Xu Jiayin’s Evergrande fell from 2nd to 32nd

With private development giants like China Evergrande having been brought low by debt troubles, state-owned enterprises continued to expand their dominance of China’s real estate industry in the first half of 2022, with government-backed developers holding 13 of the top 20 spots for contracted home sales during the period.

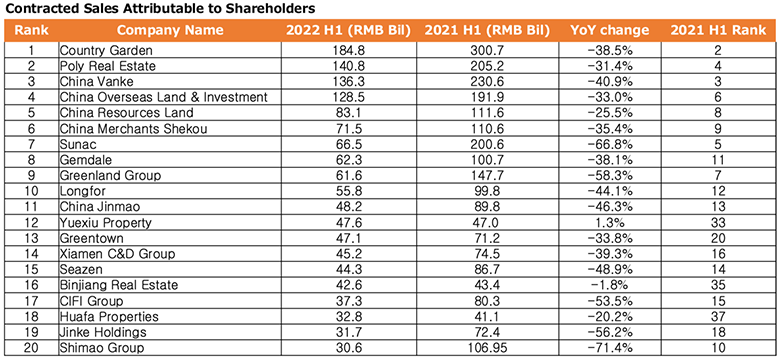

While privately-managed Country Garden Holdings held onto the top developer spot, state-owned Poly Real Estate unseated Vanke for the runner-up position, recording RMB 140.8 billion in contracted sales in the first half, according to data from China Real Estate Information Corporation (CRIC).

Vanke, which is 28 percent owned by Shenzhen’s state-owned subway operator, moved down to third place with RMB 136.3 billion in contracted sales, while Red Chip developers China Overseas Land & Investment rose to fourth place from the sixth position a year ago and China Resources Land moved up by three spots to place fifth.

As privately-run builders continue to struggle to meet their debt obligations many have been unable to compete in recent land sales, with analysts now predicting that dominance of these tenders by state-backed players will continue to cash-strapped developers to the margins of the industry.

Top 20 Reshuffled

Almost all SOEs listed among China’s top 10 developers moved up the CRIC rankings by two or three spots during the first half of 2022, compared with a year earlier except for Shanghai’s Greenland Group which fell to ninth from the seventh position last year.

Source: CRIC

Guangzhou’s Yuexiu Property and Zhuhai’s Huafa Properties, both local SOEs, also climbed the ranks to join the top 20.

While the top 20 developers on average saw their contracted sales plunge by 42 percent in the first half, state-backed Yuexiu Property managed to achieve a sales increase of 1.3 percent and raised its ranking by 21 spots compared with a year earlier.

Country Garden maintained its top slot despite a 38.5 percent sales decline, with contracted sales attributable to shareholders of RMB 184.8 billion. Longfor moved up its ranking by two positions and secured the tenth spot, with sales declining 44.1 percent to RMB 55.8 billion.

Hangzhou-based Binjiang Real Estate, with a slight sales decrease of 1.8 percent, secured 15th place, up from a 35th place in the first half of 2021.

Besides these three, all other top private sector developers fell in the rankings. China Evergrande, which reigned as China’s top developer from 2016 through 2020 but is now readying itself for restructuring, dropped to the 32nd position with a mere RMB 22.2 billion in contracted sales or approximately only one-fifteenth the figure from a year earlier.

Shimao Group moved to the 20th spot from tenth last year, and Logan fell to 27th place from 17th, with their respective contracted sales dropping to about one-third of the figure from the first half of 2021. Sunac, Seazen and CIFI Group each moved down the list by one or two spots.

Comparing the top 20 list to two years earlier, the percentage of SOEs has increased by 10 percentage points, according to CRIC data and Mingtiandi research. Several private-sector companies, namely Guangzhou R&F Properties, Zhongliang Holdings Group, and Logan, have been knocked from the top 20.

SOEs Dominate Land Market

“After the policymakers revised the rules for concentrated land parcel bidding in 22 key cities last year, land parcels have mostly been acquired by SOEs. The developments of these land parcels acquired last year are ready for pre-sale from this year, and hence SOEs have recorded more sales [than their private sector peers],” said Li Li, an editor for CRIC’s “Ding Zuyu’s Real Estate Talk” WeChat channel. Ding is chairman of CRIC parent E-House.

From February last year, China restricted land auctions in 22 key cities to three per year in a bid to cool housing bubbles and stabilize prices. An overheated first-round auction last year pushed policymakers to raise the barrier for land bidding and require verification of the source of funds.

Many private firms that had their financing capabilities restricted by Beijing’s “three red lines” deleveraging policy slowed their land acquisition amid a liquidity crunch and some acquired no land at all.

In the second half of 2021, SOEs accounted for about 65 percent of the land parcels acquired, according to CRIC. That number increased to 75 percent in the first six months of this year.

Covid Adds Challenges

While China’s real estate sector has been in a downward cycle since the end of 2018, private sector developers like Evergrande which relied on high-leverage business models have been hit the hardest after Beijing introduced the “three red lines” policy in August 2020 to restrict borrowing.

Embattled conglomerate Evergrande rattled global markets last September by warning it could default on its debts, and the crisis soon spread to other major property players such as Kaisa Group, Fantasia Holdings, Sinic Holdings, and Sunac.

“The Covid-19 outbreaks that spread from the Pearl River Delta to the Yangtze River Delta in March and April added to the difficulty faced by private-sector developers. Given that these regions are considered many private developers’ ‘bread basket’, the lockdown measures there have affected their sales. Some regions’ home sales hit a standstill,” said Jizhou Dong, head of China property research at Nomura.

Pressure Continues

Observing a month-on-month sales uptick in June, Dong expects property sales to improve in the second half but that is only “if no large-scale Covid lockdown is enforced”. “We believe the sector’s sales recovery will be slow and gradual because potential homebuyers could postpone their home purchases when there is uncertainty over how much they can earn amid slowing growth,” Dong added. “Sales will likely improve month-on-month but pressure will remain if we look at year-over-year data.”

As lockdowns were lifted in Shanghai and Beijing, the sales of China’s top 100 developers increased 61.2 percent in June compared with May, according to CRIC. The year-on-year sales decline narrowed to 43 percent in June from 59.4 percent in May.

CRIC expects China’s real estate market to benefit from a loose monetary policy and relaxed borrowing rules in the second half. “However, the transmission and implementation of the policies will take time. The challenges of financing and the high costs of financing have not been substantially improved. In the face of several bond maturity peaks in the second half, the overall debt repayment pressure of the companies is still large,” it said.

First and second tier cities such as Shanghai, Hangzhou and Hefei will likely achieve year-on-year sales growth in the second half as property supplies catch up, CRIC said.

The recovery in the Bohai Economic Circle and the Greater Bay Area will be more gradual and the central and western China markets will take even longer to recover because of large inventories accumulated over the years, according to the research provider.

Leave a Reply