Evergrande’s Ocean Flower project in China’s Hainan province.

Heavily indebted China Evergrande is fighting a winding-up petition filed by an investor in the developer’s Fangchebao online platform as the firm readies its restructuring plan, according to a Hong Kong stock filing on Tuesday.

“The company will oppose the petition vigorously,” Evergrande said in the filing, assuring that “the company does not expect that the petition will impact the company’s restructuring plans or timetable”.

A petition to liquidate the Chinese real estate giant was filed before the high court of Hong Kong last Friday by a company named Top Shine Global Limited, which is owned by 29-year-old investor Lin Ho Man. Top Shine had invested HK$750 million ($95 million) in the builder’s online platform unit in March 2021, according to a stock filing at the time.

The lawsuit marks the first time Evergrande has been the target of a petition for liquidation since its first technical default last December when it failed to settle $82.5 million in interest payments on two offshore bonds, in the latest sign that a cash crunch continues to haunt the world’s most indebted developer.

Repurchase Deal

Lin’s Top Shine petitioned before the high court of Hong Kong to order liquidation of Evergrande for not honouring a repurchase agreement signed more than a year ago, according to a Top Shine executive who spoke with Reuters.

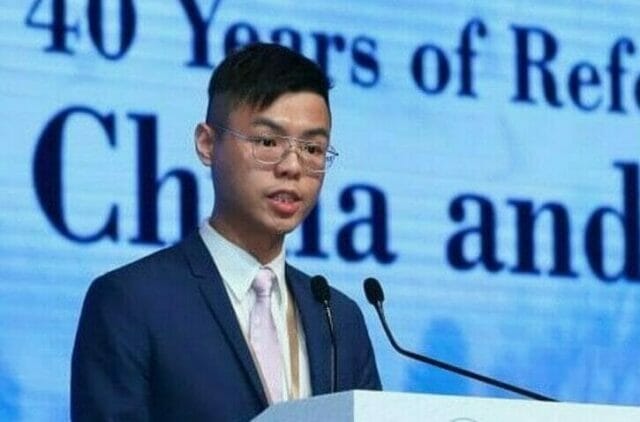

Investor Lin Ho Man is taking Evergrande to court. (source: HK01)

Top Shine was one of 17 investors that participated in a HK$16.35 billion pre-IPO fundraising undertaken by the developer in March 2021 for its online real estate and automobile marketplace, Fangchebao.

Evergrande sold 10 percent of the shares in Fangchebao, with Lin buying a 0.46 percent stake for HK$750 million and acting as the guarantor for another investor, Triumph Roc International, which invested the same amount.

Under the agreement, the developer was supposed to repurchase the shares at a 15 percent premium if the Hong Kong IPO did not materialise within the agreed one-year period. The appeal is scheduled to be heard on 31 August.

Evergrande has been actively communicating with creditors to push forward with its offshore debt restructuring plan, the company said, adding that a preliminary restructuring plan for its offshore debt would be announced before the end of July.

The petition, however, is independent from the developer’s restructuring plans, according to an anonymous source cited by media reports. Lin is the chairman of the HKEX-listed design and building service provider HKE Holdings.

“The winding-up petition has to wind through the courts, which may take some time,” Andrew Collier, managing director and founder of Orient Capital Research, told Mingtiandi on Tuesday. “It does mean Evergrande’s situation is uncertain.”

Whether or not courts have the “power or willingness to force a rapid liquidation” of a major company like Evergrande, Collier noted that compromises between the developer and its creditors still have to be reached to avoid a fire sale of assets.

For Gary Ng, economist for Asia Pacific at Natixis, the petition “may be a negotiation tool between creditors and Evergrande, but the chance of it aborting the restructuring plan solely with this move is relatively low”.

“Most of Evergrande’s assets are in China and domestic courts may not support the overseas ruling from another [jurisdiction],” Ng said.

New Bonds, Swap Possible

Saddled with $300 billion in liabilities, Evergrande has been asking for reprieves from both its local and foreign lenders, including on interest payments for its RMB 20 billion in onshore bonds, which the creditors deferred to 6 November from the initial 6 May deadline.

China Evergrande’s Xu Jiayin

A separate account by Reuters said that the company, which owes $19 billion to overseas public noteholders, is considering repaying the principal and interest through the issuance of new bonds that will be repaid in staggered payments within a seven-to-10-year period, according to unnamed sources.

Exchanging a portion of the debt for stakes in two Hong Kong-listed units — Evergrande Property Services Group and China Evergrande New Energy Vehicle Group — is another option for the builder, the report said.

Trading of shares in Evergrande, Evergrande Property Services and China Evergrande New Energy Vehicle has been suspended since March.

While the petition marks its first liquidation case, the Shenzhen-based firm has faced troubles with its assets over the past year, including a Hong Kong project that was seized by asset manager Oaktree Capital in late January following a loan default, as well as two Chengdu sites that the Chinese government repossessed in December after they were left untouched for a decade.

Authorities from Hainan province also ordered Evergrande earlier this year to demolish 39 buildings at its Ocean Flower Island resort megaproject situated on artificial islands off Hainan’s west coast near the city of Danzhou, citing regulatory violations.

Leave a Reply