K Wah boss Lui Che-Woo has seen his firm lose all 16 of the land auctions it entered this year

Maybe billionaire Hong Kong developer Lui Che-Woo wasn’t being a sore loser when he bemoaned the fact that his K Wah International seemed unable to win a land sale in its home market this year.

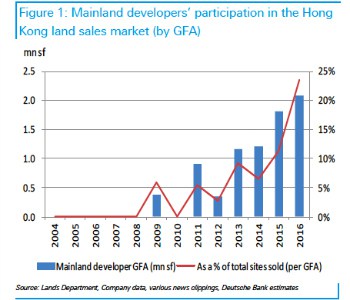

In their continued search for higher margins, mainland buyers have acquired nearly 24 percent of land put up for sale in Hong Kong this year in terms of gross floor area, a recent report from Deutsche Bank has revealed. The bank’s analysts pointed out that mainland developers gobbled up HK$9.8 billion ($1.77 billion) worth of public land sites from January through the end of September of this year.

The emergence of mainland developers in Hong Kong land sales has been swift. In 2010, no Chinese developer purchased land in Hong Kong and by 2012 they accounted for less than five percent of acquisitions in terms of gross floor area. Since 2013, however, homebuilders from across the city’s northern border have scooped up HK$33 billion ($4.2 billion) at Hong Kong land auctions.

Lower Taxes and Rising Mainland Site Costs Add to HK Appeal

Mainland developers continue to buy land at record rates in Hong Kong

And some of the land buys have been shocking, even to local analysts accustomed to Hong Kong’s world-leading property prices.

In August, Minmetals Land paid HK$4 billion ($515 million) for a residential site in Yau Tong that was formerly part of an industrial complex. Thomas Lam, Knight Frank’s head of valuation and consultancy, told the South China Morning Post at the time that the bid was “outrageous.” However, the aggressive acquisitions may not be so crazy for mainland developers facing skyrocketing land prices and declining profitability in their home markets.

Increasing land prices along with higher taxes have strained the profitability of mainland developers since 2010. Gross margins have contracted nine percent and net margins are down five percent since the start of the decade, according to the Deutsche Bank report.

Developers spent RMB 50.6 billion ($7.5 billion) in the first six months for land in Shanghai, including Cinda Real Estate’s RMB 5.8 billion ($870 million) acquisition of a plot in the Baoshan district. The trend of rising land prices is now spreading to China’s second tier cities. In Nanjing, Greenland purchased a land plot for RMB 8.06 billion ($1.19 billion) and Yanlord Group bought two plots in Suzhou for RMB 3.7 billion ($753.7 million) at a recent auction.

In addition to the mainland’s rising land prices, developers there also face steeper tax barriers. A project carrying a gross margin of 28 percent would be subject to an effective tax rate of 16.13 percent in mainland China, but only 4.13 percent in Hong Kong, the bank’s research noted.

For Hong Kong, it means that despite growing uncertainty over home prices, developers are continuing to pay higher prices for new sites, as cashed up mainland bidders compete with local players for projects. On Wednesday of this week Hong Kong-based Kerry Properties agreed to pay HK$7.3 billion ($940 million) for site in Kowloon’s Beacon Hill neighborhood. The price for the 50-year lease-hold was the most paid for a site since 2013, and Kerry needed to best nine other developers to take home the prized project.

Leave a Reply