Converting the Kai Tak airport site has transformed the Kowloon East area into a hotspot

China’s HNA Group continued its acquisition spree this week by returning to Hong Kong’s land market for a second record-setting site purchase in as many months.

The parent company of China’s Hainan Airlines agreed on Monday to pay HK$5.4 billion ($697 million) to acquire an 8,803 square metre residential site in Hong Kong’s Kai Tak area, that would yield a maximum 36,972 square metres of new homes, according to a statement from the city Lands Department.

HNA’s bid worked out to HK$13,600 per square foot, and surpassed bids by 20 other developers for the parcel in Kowloon East. The price paid also surpassed the Kai Tak record HK$13,500 per square foot that HNA had agreed to pay in November, when it acquired an adjacent plot.

HNA Beats Out Top Mainland and Hong Kong Developers

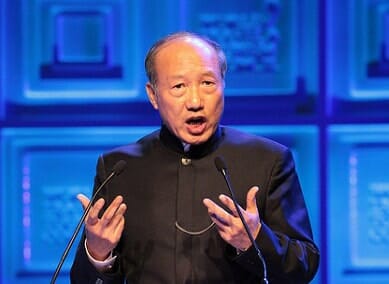

HNA chairman Chen Feng has been making some magical bids for Hong Kong sites

To win its latest land prize, HNA had to outbid a roster of competing bidders that includes many of the largest developers from Hong Kong and mainland China. From Hong Kong, heavy hitters Cheung Kong Property, Sun Hung Kai, New World Development and Wheelock all put in bids less generous than their mainland competitor.

And some of China’s most experienced developers found less to love in Kai Tak than HNA did, with China Vanke, China Resources Land, China Overseas Land & Investment and Shimao Property all submitting lesser offers.

The Kai Tak area, which formerly was home to Hong Kong’s international airport, has benefited recently from government efforts to promote the district as a second downtown. The local development authority has built a cruise terminal alongside one of the former airport runways, and promoted the conversion of many of the former industrial buildings in the area into high grade office space.

Still, HNA’s offer for the site, Kai Tak Area 1L Site 3, exceeded market expectations by 24 to 38 percent, according to an account in the South China Morning Post.

Aggressive Bidding Part of HNA’s DNA

The land parcel expenditure is dwarfed, however, by some of HNA’s other acquisitions this year, which have ranged from high tech suppliers to hotel operators.

Earlier this month the company controlled by “Buddhist billionaire” Chen Feng closed on the $6 billion acquisition of electronics distributor Ingram Micro. Also during December, the conglomerate closed on its purchase of US-based hospitality operator Carlson Hotels, giving it majority control over Rezidor Hotel Group.

The Carlson deal was one of a number of hospitality related purchases for HNA this year, including its October agreement with Blackstone to pay the US private equity firm $6.5 billion for an approximately 25 percent stake in Hilton Hotel Group. Also this year, HNA bought Blackstone’s 66 percent stake in Hong Kong-listed developer Tysan for $337 million.

Leave a Reply