Planes no longer soar over Kai Tak Airport but land prices in the area are skyrocketing

HNA Group, the operator of more than a dozen airlines including Hainan Airlines, has reached rarefied air once again after spending HK$8.8 billion ($1.13 billion) for a site near Hong Kong’s old international airport. Reuters reported that the site was tendered at HK$13,500 ($1,750) per square foot, doubling the former highest price paid for land in the area.

Hongkong Island Construction Properties Company, a relatively unknown firm backed by HNA, won the 11,300 square metre government land site in Kai Tak. A total of 19 developers, including subsidiaries of China Vanke and Sun Hung Kai Properties, submitted tenders for the plot that formally housed Kai Tak Airport’s runway.

The price per square foot paid by Hongkong Island Construction is more than double the HK$6,530 ($842) per square foot mainland developer Poly Property paid to acquire a similar site in 2014. That was the price record for a land sale in the area before HNA’s purchase. The acquisition by the mainland transportation conglomerate stunned Hong Kong market watchers who have grown accustomed to ever-rising land bids.

“I am completely shocked. The market is crazy, we have to be careful,” Joseph Tsang, managing director of JLL Hong Kong, told the South China Morning Post. “I really don’t understand why the winning buyer paid such a high price. As far as I know others submitted bids between HK$8,000 ($1031) and HK$9,000 ($1160) per square foot.”

Mainland Firms Continue To Dominate HK Land Sales

HNA’s latest win is the latest in a long line of deals completed by cashed up mainland bidders as they look to compete not only with local players but each other for land in Hong Kong.

A report from Deutsche Bank noted 24 percent of land put up for sale in Hong Kong this year in terms of gross floor area was acquired by buyers from China. The bank’s analysts pointed out that mainland developers picked up HK$9.8 billion ($1.77 billion) worth of public land sites from January through the end of September of this year.

The aggressive acquisitions by mainland developers that continue to drive up prices in Hong Kong and have been called crazy, outrageous and a number of other adjectives by analysts. However, many Chinese firms are facing skyrocketing land prices and declining profitability in their home markets and paying record prices in Hong Kong can still provide higher margins than what’s available on the mainland, according to Deutsche Bank.

No Grounding HNA’s Outbound Investments Which Surpass $18 Billion

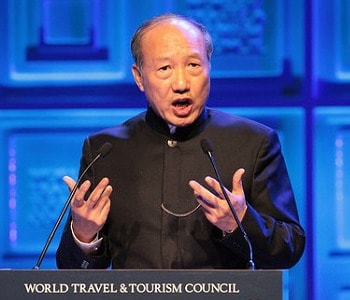

HNA Group Chairman Chen Feng has been aggressively acquiring overseas assets this year

Much like HNA’s flagship Hainan Airlines, the group’s outbound investment seems to be travelling to every corner of the globe this year. The firm has spent $18.1 billion acquiring everything from Reuters’ London HQ to US technology distributor Ingram Micro as it seeks to establish itself as one of China’s leading global investors.

Founded by “Buddhist billionaire” Chen Feng, HNA has taken a shine to hotels in particular. The conglomerate made headlines in October when it picked up a 25 percent stake in Hilton Worldwide Holdings from Blackstone for $6.5 billion. HNA also acquired Carlson Hotel Group in April, in a deal valued at over $2 billion.

The mainland firm also got into the game of golf, investing more than $137 million to acquire 10 Seattle area golf courses from local company Oki Golf last month.

Leave a Reply