HNA is now a frequent flyer in the former airport location

HNA Group has touched down at the site of Hong Kong’s former airport for the fourth time in as many months, buying its fourth plot of land in Kai Tak in as many months.

In this most recent run, the mainland conglomerate controlled by billionaire Chen Feng continued to buy its way into the city’s housing market at any price, paying HK$7.44 billion ($958 million) for its fourth Kai Tak site, according to an announcement on Wednesday by Hong Kong’s Lands Department.

The parent company of China’s Hainan Airlines beat out 15 other bids to win the 9,842 square metre (102,063 square foot) residential plot, which adjoins the three other sites which the company has acquired in the area since November.

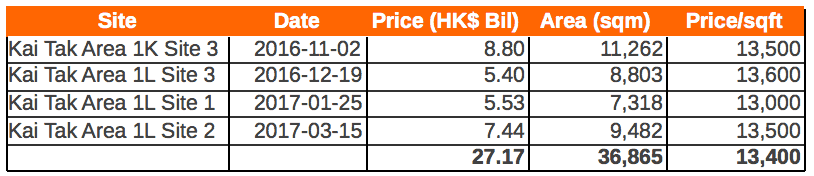

HNA, which has spent billions of dollars globally acquiring real estate, tech firms, hotel groups and other assets in recent years has now agreed to pay more than HK$27 billion ($3.5 billion) to purchase 36,865 square metres (396,811 square feet) in Kai Tak land since November, at a rate per square foot nearly double the amount paid in earlier land sales in the area.

Building a MegaSite in Kai Tak

To win this latest prize HNA overcame rival bids from Hong Kong developers including Sun Hung Kai Properties, Wheelock & Co, New World Development, Cheung Kong Properties, Far East Consortium, and K Wah International. A number of other mainland entrants also competed for the project in the former industrial location, including China Vanke, China Overseas Land and Investment, Shimao Property Holdings, Logan Property and Chinachem Group.

Source: Hong Kong Lands Dept and Mingtiandi

“We believe the bid of HNA Group for its fourth site was an aggressive bid,” research analysts from property consultancy Colliers International told Mingtiandi.

HNA had acknowledged after its earlier purchases, which averaged HK$13,367 per square foot, that it would continue to bid at a similar level for this fourth site, but other developers were still unwilling to match the conglomerate’s valuation. “This shows that either the other developers thought this given price level was not economical or that they thought the winning bid was too expensive for a residential site located in that area,” the analysts noted.

After this latest acquisition, the price for HNA’s four parcels now averages HK$13,400 per square foot, and the company is said to be planning to combine the plots into a single project.

The Hong Kong government is projecting the former industrial area in Kai Tak as a second business district for the city, as real estate prices in the traditional downtown area of Central continue to push beyond even New York and London.

Mainlanders Commanding a Bigger Slice of Hong Kong Market

HNA chairman Chen Feng’s is at the controls of a big slice of Hong Kong’s future business district

With this most recent Kai Tak acquisition, HNA has put itself at the forefront of an influx of investors from the Chinese mainland buying up land in Hong Kong.

Mainland Chinese companies bought up 29 percent of new land sold for development in the city during 2015 and 2016 according to recent data from local brokerage Midland Realty. The figures represent a sixfold increase compared to mainland buyer activity in 2013-2014.

During 2017 mainland firms have continued to bid aggressively for prime sites in Hong Kong and have already set one new price record.

Just over two weeks ago, a joint venture belonging to Hong Kong-listed mainland developers, KWG Property Holdings and Logan Property Holdings agreed to pay a record HK$16.86 billion (US$2.17 billion) for a site on Ap Lei Chau island near Hong Kong’s newly opened South Island metro line.

That purchase, which worked out to HK$22,118 ($2850) per square foot of gross floor area, was the single most expensive purchase at a government land sale in Hong Kong’s history, with the price paid said to exceed market rates by nearly 50 percent.

Less than one week after the Ap Lei Chau purchase, a branch of China’s Ping An Insurance beat out 13 other bidders to buy a site at Wong Chuk Hang in Hong Kong for an undisclosed amount estimated to be between HK$8 billion and HK$9.8 billion (US$1.26 billion).

Leave a Reply