WeWork’s IPO struggles have left people searching for answers

The aftermath of the decision one week ago by the We Company, the parent firm of WeWork, to postpone its initial public offering continues to be examined in the international press, in board rooms and coffee shops as markets sort out how a company that had raised over $14 billion dollars from private investors managed to stumble on its way to the opening bell.

While Adam Neumann and his crew at the shared office giant have yet to comment on a valuation for the We Company, and a timetable of sometime later this year has been suggested, in a survey conducted by Mingtiandi one day after news of the IPO delay was announced, most readers put a date for the company’s listing much further over the horizon.

From the 123 responses submitted during the first two days of the survey, Mingtiandi’s audience of investors, shared office executives and other real estate professionals made it clear that they doubt the company’s ability to quickly launch an IPO, and expect that when such an offering does occur, it is likely to be at a discount of more than 78 percent off the latest private valuation of the company from earlier this year.

Here are the survey questions, along with our reader responses.

The Importance of Profitability

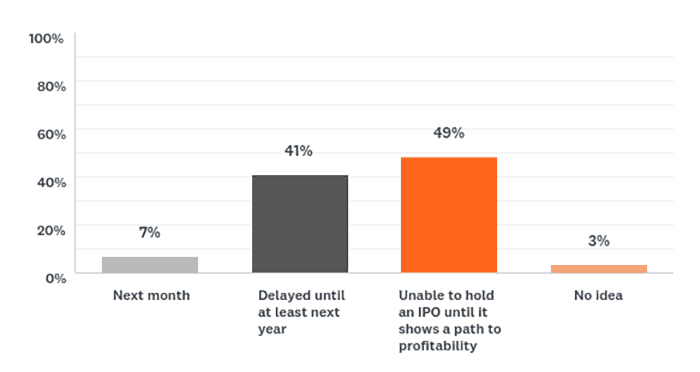

Question 1: News reports indicate that the We Company is postponing its IPO until October. Based on your judgement what do you consider to be most likely?

- The IPO will proceed next month

- The We Company’s IPO is likely to be delayed until at least next year

- The company will not be able to hold an IPO until it shows a path to profitability

- No idea

While WeWork has stated that it intends to launch its IPO this year, Mingtiandi’s respondents expect the process to take much longer. Only 7 percent believed that the offering could take place in October, while 41 percent thought the process would be delayed until at least next year.

The largest slice of respondents – 49 percent – indicated that the company, which lost $1.6 billion in the 12 months ending 30 June, won’t be able to list on a public market until it shows a path to profitability.

Among the 20 respondents who identified themselves as working in the shared office industry, the need for WeWork to show a return for investors was even more important, with 53 percent indicating that the company would not be able to achieve a listing until a path to profitability was clear.

92 Percent Say We Worth $15 or Less

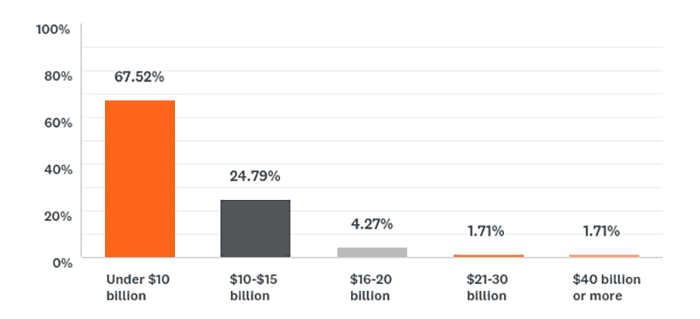

Question 2: The We Company’s most recent valuation based on a share sale is reported to be $47 billion. Reports last week had the valuation for the IPO sinking as low as $10 billion, still more than double the valuation of rival IWG, which is profitable. What valuation would you expect public markets might accept for the We Company:

- Under $10 billion

- $10-$15 billion

- $16-20 billion

- $21-30 billion

- $40 billion or more

While private investors including Japan’s Softbank and China’s Hony Capital had been convinced that WeWork should be among the world’s most valuable non-listed firms, only around 7 percent of Mingtiandi’s survey respondents thought that the parent of WeWork might achieve a valuation significantly above the $14.2 billion it had raised from those early stage investors should the company secure a public listing.

In total, more than 92 percent of those answering the survey said they believed that, in the event the We Company does list, it would be at a value of $15 billion or less, and 67.5 percent think that valuation would be under $10 billion.

Among the 58 percent of our respondents who indicate that they work in real estate investment, the belief in a slide in valuation was even stronger, with over 68 percent indicating they believe that the We Company’s eventual valuation for an IPO would be under $10 billion.

WeWork Belly Flop to Slow Funding Flow

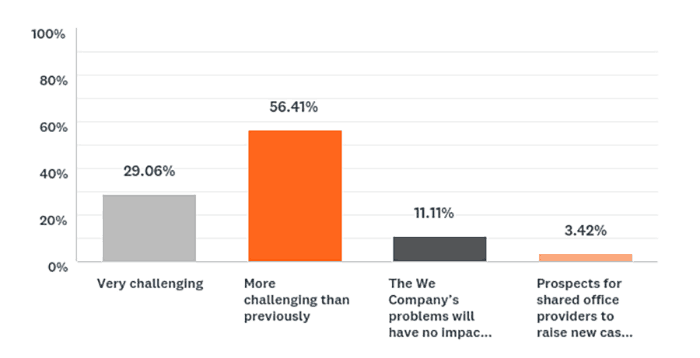

Question 3: The success of WeWork had prompted a wave of investment in competing co-working and shared office providers, most of which remain unprofitable. How challenging will it be for shared office ventures to raise money from institutional investors following the We Company’s financial struggles.

- Very challenging

- More challenging than previously

- The We Company’s problems will have no impact on investment in the broader industry

- Prospects for shared office providers to raise new cash will improve in the next 12 months

While shared office mania had attracted funding from venture capitalists, private equity investors and even the sober folks at sovereign wealth funds in recent years, an overwhelming majority of survey respondents expect the We Company’s IPO issues to slow future flows of cash into shared office ventures.

Over 29 percent of respondents indicated that it will be very challenging for shared office companies to raise funding from institutional investors following this month’s events with WeWork and another 56 percent said they thought the funding environment would become more challenging for players in the co-working space.

Why WeWork Struggled

Question 4: What do you think is the leading reason WeWork’s IPO has struggled?

In an effort seen as tied to reviving the prospects for an IPO of the We Company, investors from Softbank and other members of the startup’s board were reported this week to be exploring ways to oust CEO Adam Neumann in order to address investors concerns.

For Mingtiandi readers, however, the shenanigans of WeWork’s high-flying CEO were less of a worry than the company’s losses.

Only 4 percent of respondents mentioned Neumann specifically as a concern in their comments, compared to 45 percent which mentioned losses or other financial considerations. However, more than 35 percent referred to issues surrounding the company’s governance, conflicts of interest or management.

Just less than 22 percent pointed to issues around WeWork’s business model, while only 8 percent specifically referred to the company’s valuation.

About the Survey Responses and Respondents

Of the survey’s 123 respondents, 115 individuals provided information on their industry. with over 17 percent saying that they work in the shared office sector and just over 58 percent identifying themselves as working in real estate investment.

Just less than 13 percent described themselves as casual observers and a fun-loving 3.6 percent said that they just like to take surveys.

Methodology

The survey was made available to anyone interested in responding, with measures taken to limit responses to one per person. The survey was conducted anonymously with respondents able to submit their ideas through an online survey form embedded in a story on Mingtiandi.com, with the story promoted through Mingtiandi’s email newsletter on 18 and 19 September.

Leave a Reply