WeWork’s sleek spaces haven’t convinced investors of its valuation

Earlier this year bankers from Goldman Sachs were said to speak of WeWork as a company worth as much as $65 billion after it quietly filed for an IPO in late 2018. That valuation could still happen someday, but not this month.

The We Company, the parent firm of WeWork, has shelved its plan for an initial public offering in the US, after investors balked at buying shares in the loss-making company, according to an account by the Wall Street Journal published minutes ago.

The decision to postpone an IPO which has been in the works for at least 10 months comes after the office sharing giant had seen reports of the valuation for the company in the share offering slide to as low as $10 billion in recent days, as investors began to question the long-term prospects of the company, and its governance under CEO Adam Neumann.

Share Sale Delayed at Least One Month

The We Company, which had yet to officially declare a timetable for the IPO, has yet to comment on the offering being put off. However, reports by Reuters on Friday indicated that the We Company expected to begin its roadshow, offering shares to investment banks, during this week, with trading in company stock planned to commence during the week of 23 September.

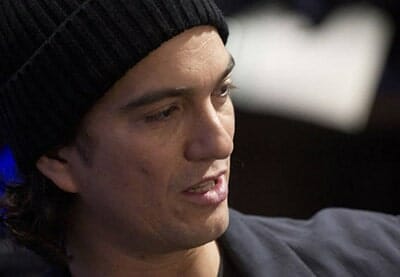

Adam Neumann’s IPO hopes are looking dimmer

The timing for the share sale was said to be set so that Neumann, who is originally from Israel, could keep with Jewish orthodoxy by refraining from use of technology during the Rosh Hashanah holiday from 29 September to 1 October.

In a statement release Tuesday morning Hong Kong time the firm’s management said, “The We Company is looking forward to our upcoming IPO, which we expect to be completed by the end of the year. We want to thank all of our employees, members and partners for their ongoing commitment.”

The company is now expected to delay the IPO by at least one month.

Last Minute Changes Fail to Win Hearts and Minds

The report of WeWork’s IPO postponement comes despite the We Company having filed a revised IPO prospectus that contained provisions that may have sweetened the terms of the share sale for skittish investors.

The revised S-1 form had reduced Neumann’s voting rights from 20 times that of a normal shareholder to just 10 times, and also took away his wife’s role in choosing a potential successor, should the company founder be unable to continue as its CEO.

The revised terms of the offering also locked Neumann into maintaining his stake in WeWork for a longer period of time, limiting potential share sales by the CEO to no more than 10 percent of his stake during the second and third year following the IPO, in addition to the previously existing stipulation that he keep his shares for at least one year following the offering.

Media reports of the We Company’s valuation over the weeks since the IPO prospectus was filed in August have indicated a rapidly falling valuation for the company, which was last valued at $47 billion in a private sale of shares to its biggest backer, Softbank, early this year.

While the We Company has yet to comment publicly on a valuation for the company in the share offering, reports earlier this month citing sources familiar with the proposed transaction had indicated that, after discussions with investors, the company might try for a discounted valuation of between $20 and $30 billion.

During last week, as the reality of a road show selling shares to banks grew closer, accounts of the We Company’s target valuation in those talks slid below $20 billion, until reaching their lowest mark of $10 billion in a Reuters report on Friday.

Debt Deal in Doubt

Should WeWork’s IPO not happen this month, it could mean the end of a $6 billion debt offering that had been planned to boost the cash reserves of the company which lost $1.67 billion for the 12 months through June 30 of this year.

As first reported early last month, The We Company, had worked out a deal with banks including JP Morgan and Goldman Sachs for a $2 billion letter of credit, alongside a $4 billion loan collateralised by cash flows from WeWork’s rental income on some of its properties.

However, those debt financing arrangements were reported to include stipulations that the We Company raise at least $3.5 billion through an IPO by 30 September. The We Company has yet to comment publicly on the terms of the proposed credit instruments.

Wedon’twork

Total con, allegedly.