WeWork’s IPO hopes flew away faster than Neumann’s Gulfstream

WeWork’s planned IPO won’t work, appears to be the decision of the shared office giant’s new leadership, which announced late Monday that the We Company was withdrawing its application for an initial public offering.

“We have decided to postpone our IPO to focus on our core business, the fundamentals of which remain strong,” the We Company’s Co-CEOs Artie Minson and Sebastian Gunningham said in a public statement.

The leadership duo, who were appointed last week in the wake of founder Adam Neumann being pushed out added that, “We are as committed as ever to serving our members, enterprise customers, landlord partners, employees and shareholders. We have every intention to operate WeWork as a public company and look forward to revisiting the public equity markets in the future.”

Neumann was quickly persuaded to leave the We Company by investors including Japan’s Softbank just one week after what had been expected to be one of 2019’s largest market debuts was rejected by the public markets.

Since the IPO flop the We Company has begun forcing out Neumann loyalists and cutting the former leader’s extravagances, including a $60 million corporate jet.

Those initial moves are expected to be followed by a round of cost cuts and restructuring as the co-working operator faces the possibility of running of cash before the middle of 2020.

WeWork Restructuring Continues

The formal cancellation of the planned share offering included the We Company indicating that it would file a request with the Securities and Exchange Commission (SEC) in the US to withdraw its S-1 registration form for the IPO.

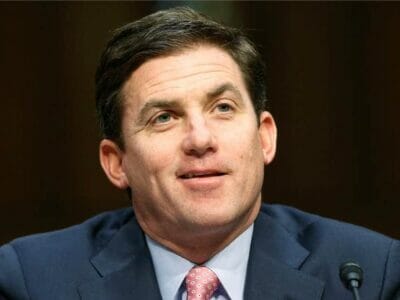

We Company Co-CEO Artie Minson is expected to announce layoffs

The We Company’s formal retreat from the share offering debacle closes down a weeks-long drama that included the shared office player’s expected valuation dropping from over $50 billion to as low as $10 billion before the company on 17 September announced a delay in the IPO until later this year.

Now, even with Neumann’s ouster removing some governance concerns, The We Company continues to face questions over spending levels that led the firm to lose close to $2 billion in 2018.

In a poll conducted by Mingtiandi last month nearly half of the executives working in real estate investment and within the shared office industry surveyed predicted that the We Company would not be able to list on a public exchange until it shows a path to profitability.

Cost Cuts Already Taking Hold

The We Company had been planning on its IPO to bring in between $3 billion to $4 billion from sales of equity, with an additional debt package set up to provide it with another $6 billion in cash. With that funding no longer available, the New York-based firm has to rely on the $2.5 billion of cash that it had on hand at the end of June, or come up with new financial resources.

The co-working giant is currently burning through $700 million per quarter, according to an analysis last month by New York research firm Sanford C Bernstein and Company. At that rate of financial consumption the We Company would be out of cash sometime in the second quarter, unless changes are made.

While Softbank is due to invest another $1.5 billion into the firm next year, WeWork’s new management has already started cutting costs, with the Wall Street Journal reporting that thousands of layoffs are potentially on the way at the company which employed 12,000 staff at the end of June.

Also being dispatched is the $60 million Gulfstream G650ER which WeWork purchased last year and which had become known as Neumann’s personal shuttle craft to carry him between the five homes the entrepreneur is reported to have purchased.

Many of the former We CEO’s top lieutenants are also leaving the company, with Vice-Chairman Michael Gross reported to have resigned, and Neumann’s wife Rebekah, who had held the title of chief brand and impact officer, also said to have left the firm.

Other executive departures since the IPO flop include Neumann’s brother-in-law, Chris Hill, who served as the company’s chief product officer and CEO of WeWork Japan. Granit Gjonbalaj, the We Company’s chief real estate development officer is also said to have resigned from the firm last week.

Despite the leadership shake-up the We Company’s bonds fell to 85 cents on the dollar on Monday – down from 105 cents when the IPO was announced last month.

Leave a Reply