Adam Neumann went from asset to liability when the IPO sank

“Never settle,” is reportedly the first inspiring slogan to adorn the walls at WeWork, a company which CEO Adam Neumann, built into an empire spanning 111 cities.

Now the entrepreneur hailed as a visionary as the We Company prepared for what it hoped would be one of 2019’s biggest IPOs just weeks ago will need to settle for being a shareholder in the company he built, after being forced out in a boardroom coup this week.

In a statement released yesterday by the We Company, Neumann thanked his employees, partners and investors as he turned over the task of carrying the office sharing phenomenon to a public listing to its new leadership.

“While our business has never been stronger, in recent weeks, the scrutiny directed toward me has become a significant distraction, and I have decided that it is in the best interest of the company to step down as chief executive,” Neumann said in the statement.

Two-Headed CEO to Take Over

The company founder’s position was taken over, effective yesterday, by a pair of current We Company executives, former co-president and chief financial officer, and former vice chairman Sebastian Gunningham who have been named co-CEO. Neumann will continue to be involved in the nine-year-old firm as non-executive chairman.

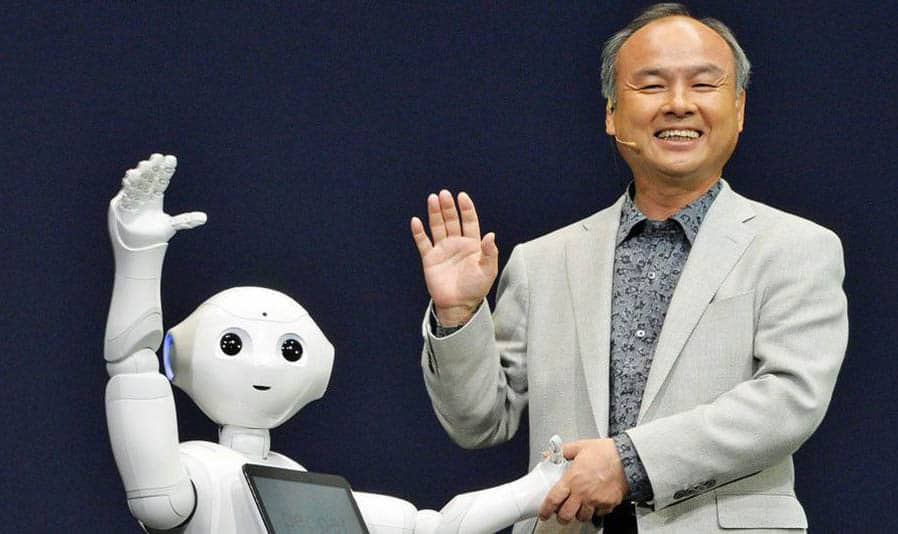

Softbank’s Masa Son has already found new leadership for WeWork

With the We Company’s shareholders and IPO underwriters including JP Morgan scrambling to make the co-working giant’s shares palatable to public markets, Neumann has also agreed to reduce the voting rights associated with his shares in the company, which are said to total up to 29 percent once fully vested, from 10 times that of common stock to a multiple of three times ordinary shares, according to an account in the Wall Street Journal.

WeWork, which operated 562 locations in 29 countries at the end of 2018, is now expected to announce a round of cost-cutting measures as it scrambles to improve its finances in the next phase of a campaign to convince investors in the value of the company’s shares.

“Be Bold, But Don’t Lose Investor Cash” Could Debut as New We Slogan

Neumann’s ouster came during a week when the We Company and its investors had earlier expected to be selling shares at a valuation of $50 billion or more in an IPO which had been planned since late last year. As discussions around that offering saw the valuation slide to as low as $10 billion before the share sale was eventually shelved early last week, the 40-year-old former model went from asset to liability in the books of Softbank, Benchmark Capital and other investors in the startup.

The fate of the We Company CEO appears to have been sealed over the weekend, with reports emerging in New York on Sunday that Softbank, which holds around one third of the startup’s stock, had joined a movement to remove Neumann from the management team.

Softbank did not comment on the change in leadership at the We Company, however, Bruce Dunlevie, a partner at Benchmark, which played a key role in Travis Kalanick’s ouster at Uber, was quick to wish Neumann well and welcome the new management team.

“Adam has overseen the creation of a global platform that supports its members daily, and has grown to more than $4 billion in run-rate revenue in less than ten years,” Dunlevie said, adding that, “I am excited about the future of WeWork and thrilled to have Artie and Sebastian take the baton from Adam to lead the next phase of growth.” The Silicon Valley investor is said to have met with Neumann in person on Sunday before the We Company announced its leadership change on Tuesday.

Softbank Faces Questions as Unicorns Fail to Fly

Neumann’s standing at the company which made shared offices cool suffered a flurry of blows last week as the Wall Street Journal reported that the long-haired billionaire had been left stranded in Israel last year after the owner of a private jet that Neumann had chartered to fly friends across the Atlantic had abruptly recalled the Gulfstream. Neuman and friends were said to be left to find their own transport home after the plane’s crew had discovered a cereal box stuffed with the remains of a marijuana stash that the WeWork CEO and his friends had left on board, apparently for the return flight.

While Neumann’s voting rights would have allowed him to resist the leadership coup, the We Company’s ongoing need for cash may have forced the company founder to bend to investor wishes. The IPO had been planned to raise at least $3.5 billion in equity for the company as well as unlocking a $6 billion debt funding package that the loss-making company needs to fuel its expansion.

Softbank, which invested over $10 billion of the more than $14 billion that the We Company raised will be now be under pressure to salvage an exit from the office sharing startup which lost around $2 billion last year. The Japanese investment firm is currently raising money for a second Vision fund and the We Company fiasco adds to challenges posed by the ongoing slide in value of Uber, where Softbank also was a lead investor.

With Uber having lost nearly 25 percent of its value on the New York stock exchange since its debut in May, and investors continuing to raise questions about the disparity between the We Company’s valuation and the company’s ongoing losses, Neumann’s departure is likely to just one in series of moves to solidify the co-working pioneer’s appeal to investors.

Leave a Reply