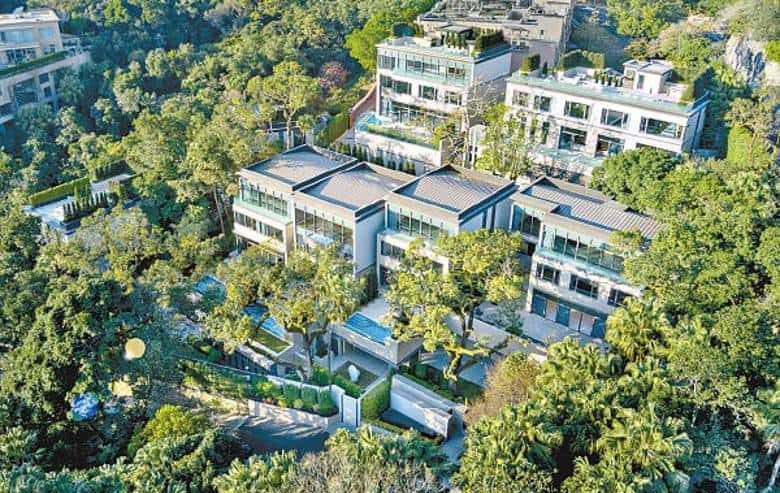

The sale of six houses at 77/79 Peak Road accounted for 17 percent of Wharf’s 2021 revenue

Wharf Holdings on Wednesday reported a 7 percent rise in its 2021 underlying net profit to HK$3.65 billion (now $470 million), but the Hong Kong developer cited lingering COVID-19 troubles and the war in Ukraine as it gave a downbeat outlook for this year.

After a rebound from the low base of pandemic-hit 2020, continued recovery in the developer’s primary territory of Greater China is at risk from new virus variants, rising inflation, geopolitical tensions and Beijing’s drive to reduce debt in the real estate industry, Wharf said in its full-year final results.

“The deleveraging campaign has dealt a massive blow to the debt-laden property sector,” Wharf warned in the filing with the Hong Kong stock exchange. “This, combined with challenges such as US-China tensions, has started ripples effects to the economy in 2022. Hence, slower growth is almost inevitable in the near term, posing downside risk to the group’s mainland businesses.”

The blue-chip builder controlled by Peter Woo’s Wheelock and Company reported full-year revenue growth of 7 percent to HK$22.38 billion, driven by the sale of six houses for a combined HK$3.9 billion at Wharf’s 77/79 Peak Road project and sales totalling HK$2.1 billion at the Mount Nicholson super-luxury development (a 50:50 joint venture with Nan Fung).

Mainland Anxiety

Wharf noted that its revenue from mainland China investment properties in 2021 rose by 28 percent to HK$5.37 billion, mainly due to the robust performance of malls at the group’s Chengdu IFS and Changsha IFS developments.

Peter Woo isn’t letting China’s debt crisis dampen his spirits

But revenue from mainland development properties fell 35 percent to HK$7.33 billion, and the company highlighted increased investment risk due to strict price controls and other regulatory policies.

“The group has become more selective with new land acquisition” in mainland China, Wharf said. “At the same time, the group’s land bank has been marked to market, which is however still undergoing correction.”

Wharf called slower growth “almost inevitable” in the near term and noted that this deceleration would pose downside risk to the group’s mainland business.

Woo’s Wealth Swells

While Wharf’s hotel revenue rose 26 percent from 2020’s low base to HK$497 million, the group’s long-established business of container-ship and air cargo terminals enjoyed a 17 percent jump to HK$3 billion as demand soared.

Also getting a boost in 2021 was former chairman Woo: the tycoon, who stepped down from the Wharf and Wheelock boards in 2015, saw his net worth rise 10 percent to $18.7 billion last year as he climbed two spots to fifth place in the Forbes list of Hong Kong’s richest.

That increase followed a leap of 47 percent in 2020 when Wheelock’s value surged after being taken private by son Douglas Woo, who now chairs Wheelock.

Last week, Wheelock-controlled Wharf REIC reported a 13 percent drop in underlying net profit to HK$6.5 billion in 2021. The retail spin-off, whose properties include the giant Harbour City mall and hotel complex, said revenue rose 3 percent from a low base but remained below pre-COVID levels “as tourist spending had been missed entirely”.

Leave a Reply