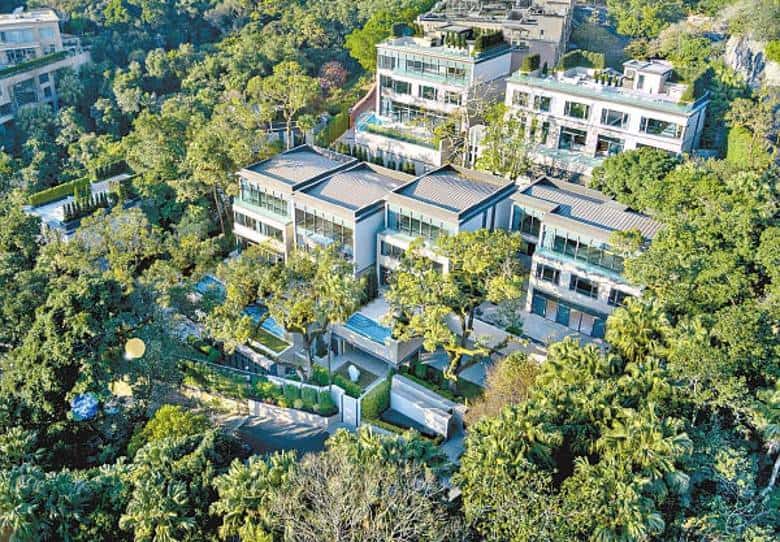

Wharf sold 5 houses at its 77/79 Peak Road project during March

Sales in Hong Kong’s luxury residential market nearly tripled in the 12 months that ended 30 June, driven by wealthy locals who resumed home-buying activities and a surge of initial public offerings on the Hong Kong and Shenzhen stock exchanges.

Despite border closures, mainlanders’ appetites for luxury continued to grow. From July 2020 to June 2021, the city’s luxury home sales picked up in its two poshest locations, with the Peak and Southern district combining for 50 transactions of HK$100 million ($12.8 million) or more, which was up from 18 such deals in the preceding 12-month period, Colliers International said in a report.

“We have seen more transactions in the second half of 2020 and the first half of 2021 despite the pandemic,” said Hannah Jeong, Colliers’ head of valuation and advisory services in Hong Kong. Jeong also noted that property prices have gone down, ranging from HK$80,000 to HK$100,000 ($10,267.5 and $12,834.4) per square foot.

“We forecast a gradual price growth of 3 percent for the second half of 2021,” she added.

IPOs Boost Home Sales

With the count of high-end deals having risen 178 percent over the past year, demand for luxury homes is expected to “remain healthy” through the second half of the year, driven by new listings in Hong Kong and Shenzhen that have minted a set of wealthy buyers looking to settle in the city, said Colliers.

Colliers’ Hannah Jeong

From the beginning of 2020 to June 2021, 180 companies completed initial public offerings on the Hong Kong exchange, which created a fresh crop of corporate millionaires and billionaires able to afford luxury homes in the world’s most expensive property market.

Just north of the border, the Shenzhen stock exchange recorded 266 new listings since 2020, of which 25.6 percent were companies based in Guangdong province, said Rachel Chin, associate director of valuation and advisory services at Colliers Hong Kong. The city’s proximity to Hong Kong makes these new tycoons “prime candidates” for luxury home purchases.

Of the 2,755 billionaires who made Forbes’ list this year, 25.3 percent were from mainland China and Hong Kong. The Colliers report also noted that among the 493 new billionaires added to the most recent list, 41.6 percent were from mainland China, and another 1 percent were from Hong Kong.

Focus on the Posh Zone

This cohort of newly wealthy Chinese are rekindling sales of luxury homes on Victoria Peak and in Hong Kong’s Southern district, according to developer statements and agency data.

In the period between July 2020 and June 2021, 50 sales of luxury homes worth HK$100 million or more were recorded in Hong Kong, including 30 transactions from Southern District, and the remaining 20 deals were for properties on the Peak.

For the first half of 2021, sales of luxury homes in the Peak and Southern District averaged HK$72,000 per square foot and HK$75,000 per square foot in price respectively, said Colliers’ Jeong. These rates were more than double those found in the mass residential market, where prices ranged between HK$28,000 and HK$34,000 per square foot.

Developers Move Mansions

In March this year, Wharf Holdings Limited put six houses at its 77/79 Peak Road ultra-luxury project with five of those selling within the month, including two purchased by mainland buyers. A notable transaction involved a former Tencent executive Li Haixiang purchasing 77A Peak Road, with Colliers indicating that the mainland tech tycoon paid HK$598 million, or HK$80,942 per square foot for his 7,388 square foot piece of the Peak.

Last month, two houses, both part of SEA Holdings’ Shouson Peak project at No.1 Shouson Hill Road East on Shouson Hill, were sold in separate deals, according to filings by the developer to the Hong Kong Stock Exchange. This included the sale of a 2,840 square foot house to an unnamed “Hong Kong resident” for HK$260 million. Just four days later, a 2,657 square foot house was purchased by Vibrant Colour Holdings Limited, a subsidiary of Hong Kong-listed investment firm Rykadan Capital Limited, for HK$210 million.

Shouson Hill, which is home to billionaires including CK Asset’s Li Ka-Shing and Alibaba’s Joe Tsai, has seen more mega-sales this month, including Hong Kong’s largest international school association selling a duplex in the neighbourhood for HK$76.5 million.

Property and investment group Orion Land aims to bring more supply to the luxury housing market by September with its launch of Nantiandi, three luxury houses located on 11A Shouson Hill Road West. The largest house available for sale will have a maximum area of 5,144 square feet.

Leave a Reply