Not satisfied with sales of RMB 35 billion ($5.75 billion) over his e-commerce sites on a single day, Internet billionaire Jack Ma has decided to take on China’s real estate industry. For the good of the people, of course.

Turning a Celebration into an Online Manifesto

Appearing on television to spotlight the sales success of Taobao.com and its up-market T-Mall twin on China’s unofficial ecommerce day this November 11th, the Chairman of Alibaba Group indicated that the new sales records set by the group’s online shopping sites during the event were only the beginning.

And, as his company gears up for a 2014 IPO that some analysts expect to be bigger than Twitter’s, Ma made it clear that China’s real estate market is his next target.

Commenting on the day’s revenues, which exceeded the mark set the previous year by 80 percent, Ma said, “Today, whether we sell 30 billion or 35 billion (Renminbi), I just want to feel that we shocked the real estate industry.

Ma explained that the development of online shopping should bring down the price of commercial real estate by weakening the location advantage of retail developers.

He went on to add that, “If in 2020, the real estate industry still accounts for more than half of China’s economy, then our efforts at progress will have failed, and this means that society as a whole will have lost.”

Zhang Jiwen, executive vice-president at property developer China Vanke, retorted on Weibo that “People … say all sorts of things when they are delirious.”

Jack Ma’s Bet with Dalian Wanda’s Wang Jianlin

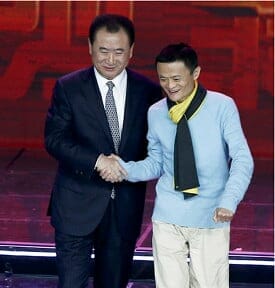

And Ma’s jousts with the real estate industry are nothing new. During December last year, China’s feistiest ecommerce guru had already wagered a hundred to one with one of China’s biggest mall developers, Wang Jianlin of Dalian Wanda, that online shopping would soon account for half of China’s retail sales.

Appearing jointly on Chinese television the two billionaires bet that if ecommerce could account for 50 percent of China’s retail market that Wang would pay Ma RMB 1 million. But if not, Ma would need to pay Wang Jianlin RMB 100 million.

The always outspoken Ma noted at the time that “If Wang Jianlin wins, China loses.”

So far, Wang, who was crowned China’s richest man by Forbes this year, seems to be on a bit of a winning streak. This year Dalian Wanda has been able to use the proceeds from its chain of malls and other commercial property in China to develop billion dollar hotels in London and New York, take over a British yacht maker, and to buy a $28 million Picasso on auction at Christie’s in Manhattan.

Ecommerce to Devalue China’s Commercial Real Estate

Ma and Alibaba seem to be making a dent in Wang’s empire, however, as a Jones Lang LaSalle report on the impact of ecommerce on China’s mall industry released in July, pointed out that online shopping sites such as Taobao are already having an impact on China’s retail real estate industry.

The report noted that “there are real risks for some segments of the (shopping mall) market.” In particular the report singled out low and mid-range malls (which would include Wang’s mass-market Wanda Plaza chain of shopping centers) as likely to feel pressure from more price competitive online marketplaces.

Eugene Tang, Head of Retail Greater China at Jones Lang LaSalle pointed out that, “This brewing competition means that the archetypical strata-titled shopping mall could be the first to see a substantial portion of its tenant base become obsolete.”

Salesmanship Packaged as Social Advocacy

While Ma’s online remarks exhibited concern for bringing down prices, the subtext is the direct competition between companies like Alibaba and Wanda to sell real estate. Whether a mall is a physical location such as a Wanda Plaza, or a virtual marketplace such as T-Mall, both Ma and Wang are in the business of selling space to vendors, and as such are direct competitors.

While it’s easy for Jack Ma to grandstand about real estate prices on TV, for most people in China – who are only concerned about saving enough money to buy a home – his talk about using ecommerce to bring down real estate prices is not relevant to their plight.

And as for using Taobao and T-Mall to bring down the prices of space in malls such as Wanda Plaza, the retail rents in the malls are only one factor in the price of what people buy there.

So perhaps Ma’s concern is not so much with modernising the retail industry as it is with convincing vendors to buy more space in his virtual malls. And maybe perhaps to help boost the value of the Alibaba Group before its expected 2014 IPO.

Leave a Reply