The Wanda Plaza in Jiangmen’s Taishan county officially opened on 29 August

Dalian Wanda Group last week said that it is sticking to its plan to open 40 to 50 new plazas each year despite steep declines in revenue and profit at the conglomerate’s real estate and hospitality businesses during the first half of 2020.

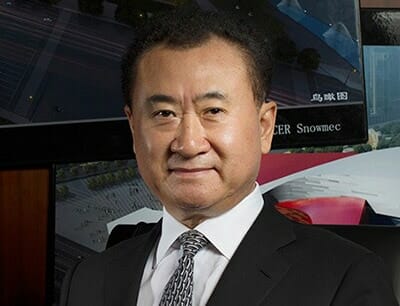

Dalian Wanda Commercial Management Group, the real estate development unit of billionaire Wang Jianlin’s Beijing-based giant, saw its revenue nearly halve in the first six months of this year, compared to the same period of 2019, according to the group’s half-yearly report.

The disappointing results for China’s largest commercial developer came just two weeks after the group’s hotel division posted a loss attributable to shareholders of HK$33.5 million ($4.3 million) after its revenue fell by more than 47 percent during the first six months of 2020.

Revenue Nearly Halves

Wanda Commercial Management, which has been shifting toward joint ventures with financial backers in recent years to reduce its debt load limit risk saw its operating income from property sales decrease by 100 percent year-on-year due to a lack of new projects during the first six months of 2020.

Wanda’s Wang Jianlin is keeping up his mall building program

With no operating income from property sales from January through June China’s largest commercial developer sees the strata sales approach it took on many of its early mall projects reduced by a change in strategy and the coronavirus pandemic.

During the first half of 2020 took in total revenue of RMB 17.3 billion ($2.5 billion), a year-on-year decrease of 47.7 percent as its net profit slid to RMB 6.4 billion — down 36.22 percent from the RMB 10 billion that it recorded during the same period last year.

Property Sales Drop to Zero

Wanda Commercial’s most recent report shows the ongoing evolution of the mall developer as a shift to asset light projects and a challenging investment environment grounded a property sales business which brought in more than 70 percent of its operating revenue just three years ago.

Since that time Wanda has shifted to what the company calls its “asset light” model, under which it has selling properties or developing under joint ventures with insurers and other backers in a bid to reduce risk after being targetted in a government drive to rein in indebted property developers.

As of the end of March last year, the group had dumped more than RMB 170 billion of assets from end 2016, shrinking its balance sheet by 20 percent.

With financial partners now buying into Wanda projects for their rental income earnings and individual investors staying on the sidelines during the early months of 2020, the commercial developer recorded no property sales revenue during the first six months of the year.

However, despite the numerous properties Wanda has offloaded over the past few years, the company’s interest-bearing debt remains high with total liabilities at RMB 283 billion at the end of the first half.

That sum marks a decrease of just 4.87 percent from the same interval last year while the company’s asset to liability ratio dropped by only 1.6 percent to 51 percent.

40 to 50 Plazas Expected to Open Every Year

Despite its ongoing financial challenges Wanda Commercial continues to show confidence in its mall building program with the company opening a new Wanda Plaza in Guangdong’s Taishan county on 29 August.

That 210,000 square metre (2.3 million square foot) project brings the group’s total number of Wanda Plazas to 331 malls nationwide.

The company expects to open a total of 45 new Wanda Plazas this year, according to its half-yearly report. “Among these plazas, we will focus mainly on asset-light projects while proportioning self-holding projects according to our cash flow,” Wanda Commercial stated.

In 2019, the company opened 43 new malls across 39 cities in China with Wang having set a goal of opening 40 to 50 Wanda Plazas each year.

Such an Insightful message shared. thanks. Would like to read some follow-up coverage on this commercial property giant’s strategy as we stepping into the year 2021.