China Properties’ Concord City retail project in Shanghai

E-commerce has become a star of China’s rapidly transforming economy, but there are signs that all the attention being garnered by platforms like Alibaba’s Taobao may have generated resentment among some of the players being pushed from centre stage.

That power struggle was displayed in the New York Times last week when a Shanghai shopping mall developer bought a full-page ad urging shoppers to just “Say No to Online Shopping.”

The unusual marketing strategy comes as growth in ecommerce far outstrips the expansion of traditional retail in China, forcing many developers and offline retailers to deal with new levels of competition.

Developer Urges Shopper Boycott to Save China’s Malls

The ad on page five of the New York Times’ international edition on December 26th and 27th urged consumers to boycott online shopping because of the danger that it presents to the survival of traditional shopping centres, which the ad says face the prospect of “being abandoned by humans.”

The appeal was published by Hong Kong-listed China Properties Group, a Shanghai-based developer which owns and operates the Concord City mixed-use project on Zhenning Road near West Nanjing Road in the city, as well as the World Trade Plaza in Chongqing.

However, China Properties Group made it clear that it was not merely acting in its own self-interest, by declaring in the ad that it wishes to “represent commercial streets and physical malls worldwide in fighting against online shopping.”

Rapid Ecommerce Growth Threatening Second-Tier Malls in China

Although the approach is unusual, the ad by China Properties Group represents some of the pressures being felt by retail developers in China, as the market struggles to cope with the growth of ecommerce and a surge of new retail projects.

The growth of China’s ecommerce sector might be enough to make mall owners jealous

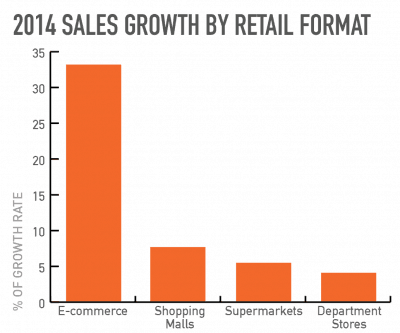

While China’s retail sales grew by more than 11 percent in 2014, the fastest rate of increase was in the online sector where turnover increased by 33 percent to RMB 12.3 trillion ($1.9 trillion) for the year. Sales in shopping malls, while still increasing, grew at a lower rate of 7.7 percent, according to data from the Ministry of Commerce.

For projects such as China Properties’ Concord City which is located away from major shopping areas and has struggled to gain traction with branded tenants since it launched 15 years ago, China’s pipeline of 40 million square metres of malls under construction makes the situation even more dire.

Although the first phase of China Properties Concord City in Shanghai was opened in 2000, the second phase, which was planned to include a retail street, five-star hotels and office tower, has not yet been completed.

For observers intrigued enough by China Properties’ marketing approach to look for the group’s advertisement online, such a search will prove futile as the ad only appeared in the newspaper’s traditional print edition.

Leave a Reply