UEL and SPH built the mall in 2014 (Image: The Seletar Mall)

A Singapore developer controlled by the family of Shangri-La Hotel founder Robert Kuok is in talks to acquire a shopping centre in northeastern Singapore from a joint venture between Temasek Holdings-backed Cuscaden Peak and Yanlord Land’s United Engineers Ltd (UEL) unit.

Allgreen Properties, part of the Kuok Group headed by Malaysia’s richest man, is in exclusive due diligence to purchase the 188,000 square foot (17,466 square metre) Seletar Mall in the Sengkang area, market sources told Mingtiandi this week, confirming a Business Times account which indicated a S$520 million ($387 million) price point for the discussions.

The prospective sale comes as vacancy in Singapore’s suburban malls continues to average around a third of the availability level in prime retail space in the Orchard Road area, according to Savills, with rental yields typically outperforming the office sector.

The talks are entering the final stages around 12 months after Mercatus Co-operative Ltd, then the property investment unit of NTUC Enterprise Co-operative, sold its half stake in the NEX shopping centre in Serangoon to Frasers Centrepoint Trust and Frasers Property. Just over one year ago Mercatus sold Jurong Point and Swing By @ Thomson Plaza, also suburban retail assets to Hong Kong’s Link REIT for S$2 billion.

Ringing the Register

The reported price values Seletar Mall at S$2,766 per square foot of net lettable area, and would translate to an 8.2 percent increase from the mall’s 2021 carrying value of S$480.5 million, based on Singapore Press Holdings last annual report before the media giant’s real estate business was spun off and acquired by Cuscaden Peak the next year.

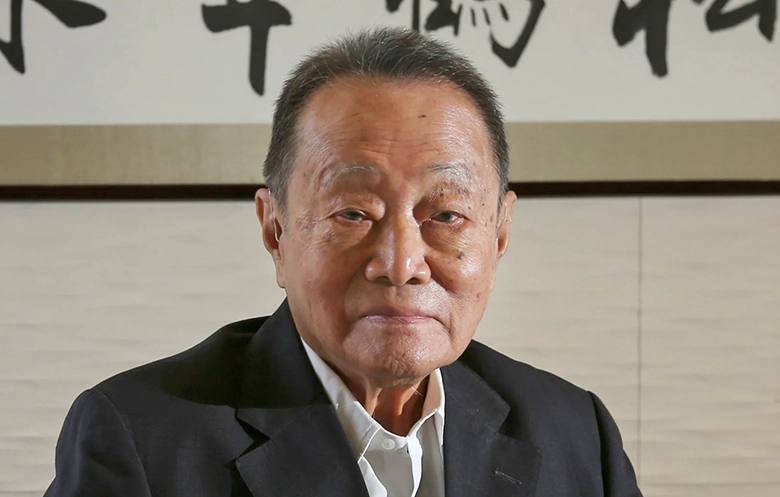

Robert Kuok and his clan are closing in on another Singapore mall

Cuscaden Peak and UEL hold the property through a 70:30 joint venture after Singapore Press Holdings had developed the mall together with UEL in 2014.

With six levels including two basement floors, major tenants in the mall include a FairPrice Finest supermarket, an NTUC Foodfare food court and a Shaw Theatres cinema, with the mix catering to families and other residents in the Fernvale residential area.

Located on the corner of Fernvale Road and Sengkang West Avenue at 33 Sengkang West Avenue, the property is directly connected to the Fernvale LRT station.

JLL and Cushman & Wakefield are understood to be assisting in the transaction, which has yet to be finalised, however, representatives of the two firms declined to comment. Cuscaden Peak also declined to comment, while UEL and Allgreen had not responded to media queries by the time of publication.

Disposing of Seletar Mall would leave Cuscaden Peak — a consortium of hotel tycoon Ong Beng Seng and his SGX-listed Hotel Properties, along with Temasek-backed CapitaLand and Mapletree — with the Woodleigh mall and residential complex as its remaining directly owned properties in Singapore.

The group also sponsors SGX-listed Paragon REIT, which owns the Paragon, Clementi Mall, Rail Mall and other retail assets.

Retail in Fashion

The move to acquire Seletar Mall would add to an Allgreen retail portfolio which includes the Great World and Tanglin Mall in the Orchard area, with the company set to open the Pasir Ris Mall in northeastern Singapore in the second quarter.

Located less than 20 minutes’ drive from Seletar Mall, Pasir Ris Mall is part of the Pasir Ris 8 integrated development project being developed by Allgreen and its Hong Kong-listed stablemate, Kerry Properties.

Singapore’s suburban retail sector continues to draw investors due to its lower risk, tight vacancy and reliable demand from local consumers, according to Alan Cheong, an executive director heading the research and consultancy team at Savills.

The latest data from the property agency shows that average vacancy for suburban Singapore malls stood at 4.2 percent in the third quarter, which was up from 4 percent in the three months prior.

Despite the uptick, shopping centres outside the city centre areas continue to report higher occupancy than those in the Orchard area, where vacancy averaged 12.1 percent in the third quarter.

Passing rents in the city-state’s suburban malls rose 0.7 percent in the third quarter from three months earlier to an average of S$14.60 per square foot, with Savills projecting a 1 to 2 percent average increase for the full-year of 2023.

Leave a Reply