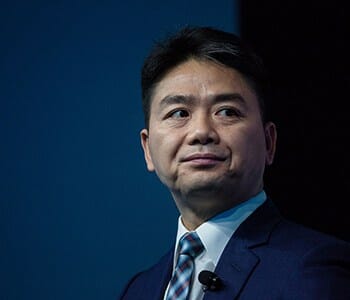

JD.com’s Richard Liu needs something to smile about after being arrested in the US last month

China’s second largest e-commerce retailer JD.com is planning to open 1,000 online to offline supermarkets in the next three to five years, stepping up its competition with Alibaba and Tencent to dominate the mainland grocery business.

Wang Xiaosong, CEO of JD.com, 7Fresh Supermarket unit declared the company’s plan to expand its app-enabled grocery showrooms at a press conference on Wednesday, doubling the goal of 500 grocery outlets set by the tech giant at the end of May this year.

7Fresh stepped up its game against Alibaba’s Hema and Tencent’s Marche joint venture with Carrefour, by announcing at the event that it had signed agreements with 16 mainland real estate developers, including China Poly Group, China Vanke, Joy City Property, Yuexiu Property, and Greenland, to secure locations for its new supermarkets.

Aiming to Cover China’s Tier Two and Three Cities

“Our goal is to expand 7Fresh supermarkets into every first and second tier city and the surrounding areas of those cities in the next three to five years,” Wang said in a statement, adding that the tech-enabled food stores combine “the best parts of fresh grocery markets and top-quality restaurants with cutting edge e-commerce technology.”

The expansion plan is scheduled to bring 7Fresh stores to Shanghai, Guangzhou, Shenzhen and Chengdu in the near future, although the company has yet to declare a time frame. JD debuted its first 7Fresh supermarket in January of this year, a 4,000 square metre store in Beijing that features “smart carts” that guide customers to their desired aisles.

The announcement of the omni-channel retail venture could produce some positive publicity for JD, after the company’s billionaire CEO was arrested on rape charges in Minnesota late last month, before hastily returning to China after being released without bail on September 1st. Authorities in Minneapolis are still deliberating whether to file charges against the online entrepreneur.

Combining Shopping and Delivery

Like Hema and Le Marche stores, 7Fresh outlets serve both as conventional supermarkets, and as showrooms for goods that can then be ordered on smartphones and delivered to shopper’s homes.

The first 7Fresh Supermarket in Beijing located near JD’s headquarters in Yizhuang district

Wang said that in addition to providing fresh food and fast delivery, 7Fresh will also use JD.com’s big data resources to construct a complete portrait of the targeted customers and offer products according to the users’ preference. The company said that it will also use its big data resources to aid in site selection for its offline locations.

Apart from visiting the stores in person, customers can also buy products via 7Fresh’s mobile app, which promises 30-minute delivery to locations within three kilometres of a physical store.

The 7Fresh stores are a culmination of a number of retail initiatives by JD in recent years, starting with the company’s RMB 4.3 billion purchase of a 10 percent stake in mainland supermarket chain Yonghui Superstores in 2015.

In March of this year, JD.com teamed up with FamilyMart to launch food delivery within 30 minutes to customers of the convenience store chain in core locations in Beijing, Shanghai, Shenzhen, and Chengdu via JD’s ecommerce platform.

Online Giants Take Aim at Offline Retail

JD, like Tencent and Alibaba, is hoping to expand its dominance of China’s ecommerce into the country’s offline retail market.

Tencent opened a smart supermarket Le Marche in Shanghai with French retail giant Carrefour this May, four months after the parent company of WeChat bought a stake in Carrefour. When shopping in Le Marche, customers are allowed to pay for their instant noodles and organic tomatoes with their WeChat accounts by scanning a QR code and enabling payment with facial recognition technology.

In April, China’s largest e-commerce giant Alibaba signed a cooperation agreement with five of China’s top 10 property developers, including China Vanke, Evergrande, Country Garden, China Overseas Land and Sunac China to expand its Hema smart supermarket chain on the mainland. Alibaba has set a target of opening 2000 Hema stores nationwide in the next three to five years.

While JD.com saw its gross merchandise value reach $200 billion in 2017, nearly double the 2016 figure, the company also reported a net loss from operations of RMB 2.2 billion in June — around eight times analysts’ expectations.

Leave a Reply