The end of COVID restrictions boosted business at mainland malls (Getty Images)

Despite credit downgrades, disappearing associates and an aborted mall IPO, Dalian Wanda kept its crown as China’s biggest commercial developer last year, and the race wasn’t close.

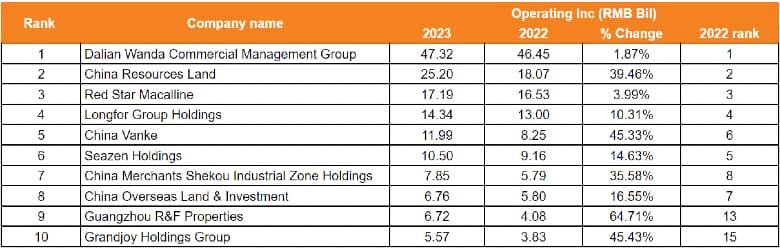

Dalian Wanda Commercial Management, the primary holding company for Wanda’s commercial and hospitality assets, achieved 2023 operating income of RMB 47.3 billion ($6.7 billion), rising 1.9 percent on the year, according to data from China Real Estate Information Corporation.

China Resources Land finished a distant second in the rankings, even as the state-owned builder’s operating income shot up 39.5 percent to reach RMB 25.2 billion. Further back at No.3 was Alibaba-backed Red Star Macalline with RMB 17.2 billion, up 4 percent.

Rounding out the top five in 2023 were Beijing-based Longfor Group with RMB 14.3 billion, up 10.3 percent, and state-controlled China Vanke with RMB 12 billion, jumping 45.3 percent.

Guangzhou R&F Surge

Shanghai-based Seazen Holdings grabbed sixth place last year with operating income of RMB 10.5 billion, up 14.6 percent, while two state-owned enterprises — China Merchants Shekou Industrial Zone Holdings and China Overseas Land & Investment — ranked seventh and eighth with RMB 7.9 billion, up 35.6 percent, and RMB 6.8 billion, up 16.6 percent.

Guangzhou R&F Properties saw the biggest improvement, with operating income surging 65.7 percent to RMB 6.7 billion, followed by Grandjoy Holdings’ 45.4 percent leap to RMB 5.6 billion, as the two developers secured the ninth and 10th rankings.

All told, operating income for the top 10 developers rose 15.2 percent to RMB 153.4 billion. It’s worth noting that the figures were shaped by a low-base effect from 2022’s COVID-19 curbs, which kept mainland shoppers at home and out of the malls for much of that year.

R&F and state-backed Grandjoy were new to the list after ranking 13th and 15th the previous year, while 2022’s ninth- and 10th-place finishers, Country Garden and Suning Real Estate, dropped out.

Mall Giant’s Tricky Year

For Dalian Wanda, led by China’s once-richest man Wang Jianlin, winning an 11-month extension on a $600 million offshore bond took some of the sting out of the developer’s failed mall IPO.

Wanda chairman Wang Jianlin is pleading for a little less drama in 2024 (Getty Images)

In November, Fitch Ratings and Moody’s Investors Service downgraded Dalian Wanda Commercial Management after the mall operator said it was seeking consent from bondholders to delay payment of the bond maturing on 29 January 2024. The company announced later in the month that it had gained early consent approval from bondholders to delay the payment until 29 December of this year.

After it became clear that Wanda’s mainland mall spin-off would not meet a year-end deadline to list on the Hong Kong stock exchange, the group struck a deal in which backers led by private equity firm PAG agreed to reinvest in Zhuhai Wanda Commercial Management.

Under the terms of the deal, Wang will see his stake in the company he built into China’s largest mall developer reduced from 78 percent to 40 percent, with the PAG-led investor consortium holding the remaining 60 percent.

Wanda’s hotel arm announced last month that it had lost contact with board member Ding Benxi, who became the third Wanda personality to go missing in 2023. Also disappearing were Qu Dejun, the vice chairman of Hong Kong-listed Seazen Group and previous holder of top management positions at Wanda; and Liu Haibo, a senior vice president and head of Wanda’s investment division.

Leave a Reply