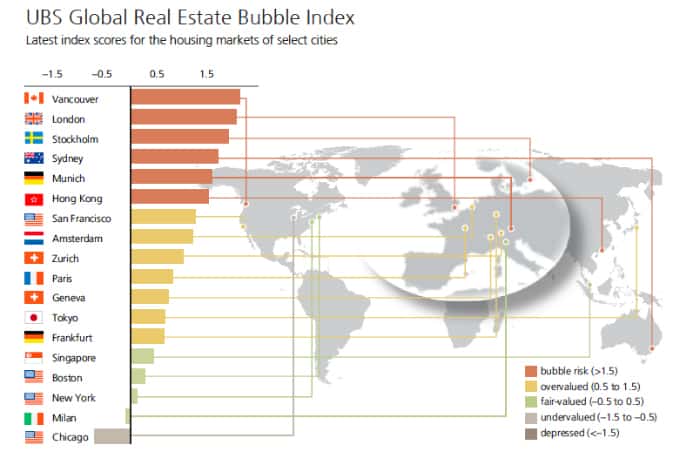

The results of the UBS Global Real Estate Bubble Index 2016

As housing markets on the mainland have started to look more dicey, Chinese home buyers have flocked to global gateway cities such as Vancouver and Sydney, driving up home prices and stunning local residents.

Analysts have cautioned that mainland capital may be exporting the nation’s famous real estate bubble, and now an annual report on real estate risk by investment bank UBS seems to confirm those fears.

The financial services firm’s annual Global Real Estate Bubble Index named favored Chinese home-buying destination Vancouver as the global city most at risk for a housing bubble, with London, Sydney and Hong Kong all landing among the top six most distorted markets in the world according to the bank’s reckoning.

The index, which tracks the risk of housing bubbles in leading cities, notes that a mix of optimistic expectations, capital inflows from abroad and loose monetary policies are some of the main causes of a housing bubble. Housing prices for the cities within UBS’ bubble risk zone have increased by nearly 50 percent on average since 2011.

While the impact of buyers from Asia is clearly noticeable places like Vancouver, Sydney and even San Francisco — which ranked seventh on the list, in London their presence may be overstated. The report noted that the overall effect of foreign buyers on the housing market is limited apart from the prime market.

A Cautionary Tale Part I

Vancouver is now the world’s most at-risk city for a housing bubble

While Vancouver had gone through a boom fuelled by Hong Kong buyers in the 1990s, nothing could have prepared local residents for the impact of mainland speculators and immigrants over the last few years.

Spearheaded by an influx of Chinese money, home prices in the city of under one million people have risen more than 25 percent since the end of 2014, according to the Global Real Estate Bubble Index, and the once-sleepy seaport town is now leads the world in risk of a property bubble.

The news of Vancouver’s unenviable status adds another wrinkle to what has been an eventful year for the city’s real estate market, including an unlicensed realtor crowdfunding an apartment purchase and a Chinese student dropping $23.5 million on mansion alongside other boom market headlines.

In the past two months, however, the local authorities have moved to calm the market, enacting a 15 percent tax on sales to foreign buyers, which helped bring home sales down by nearly 23 percent in August.

A Cautionary Tale Part II

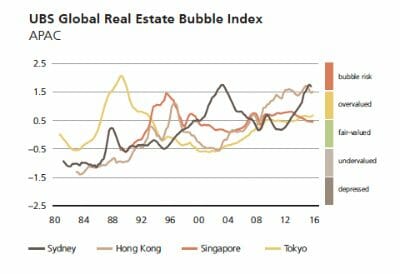

Despite being an ocean and a hemisphere apart from each other, the residents of Sydney can relate to those living in Vancouver. Home prices in the city rose to become some of the most unaffordable in the world, only trailing Hong Kong, in terms of the disparity between income and housing prices, thanks in part to a surge in Chinese purchases of Aussie homes.

UBS acknowledged in the report that the Sydney market “has been overheating since the city became a target for Chinese investors several years ago” and the country’s foreign investment regulator reported earlier this year that Chinese remain by far the biggest foreign buyers of property, paying $24.3 billion for Aussie real estate in 2014-15 – more than triple the United States the amount from US buyers, who placed second on the list.

Relief could be on the way for locals hoping to buy a home, however, with a combination of a stamp duty increase for foreign buyers in Sydney’s home state of New South Wales along with tighter controls on Chinese citizens moving cash overseas potentially ending the city’s home price boom, the UBS report noted.

Hong Kong Risks Seen Subsiding

While Hong Kong is still rated as a bubble risk by the UBS index, thanks to a 15 percent stamp duty on foreign home buyers, and the prospect of rising interest rates, home prices have corrected by almost 10 percent since the real estate market reached its peak in mid-2015.

While Hong Kong is still rated as a bubble risk by the UBS index, thanks to a 15 percent stamp duty on foreign home buyers, and the prospect of rising interest rates, home prices have corrected by almost 10 percent since the real estate market reached its peak in mid-2015.

It is not all good news for the city, however. The index pointed out that incomes in Hong Kong are stagnant meaning the affordability of housing is the lowest among the cities it ranks. The average living space per person equates to roughly 14 square metres, but affordability is expected to improve moving forward.

Leave a Reply