Source: RCA

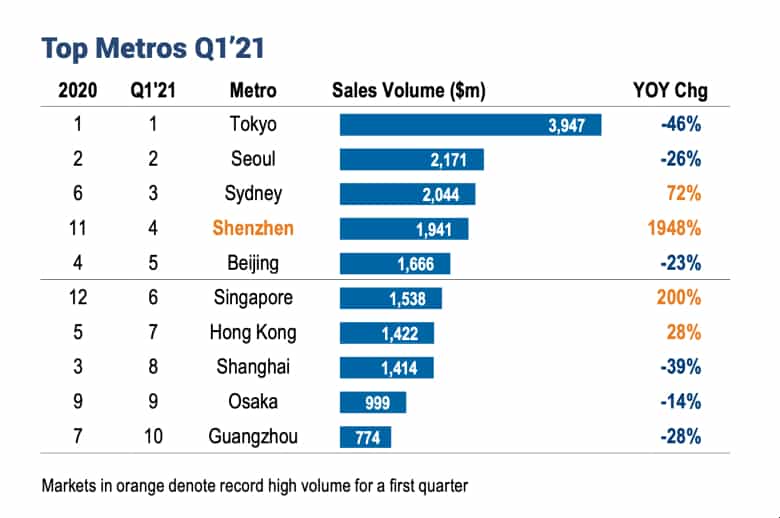

Shenzhen leapt into the top five APAC metro areas for commercial real estate sales in 2020’s first quarter as China overtook Japan to emerge as the region’s biggest market during the COVID-19 era, according to research by Real Capital Analytics.

Commercial sales volume in Shenzhen during the first three months amounted to $1.9 billion, which was more than 20 times the year-ago figure and the city’s highest-ever total for a first quarter.

Southern China’s tech hub placed fourth among the region’s key metros, trailing only Tokyo ($3.9 billion), Seoul ($2.2 billion) and Sydney ($2 billion), RCA said in its latest Asia Pacific Capital Trends report. Beijing ($1.7 billion) rounded out the top five.

“Commercial property sales in the first quarter are evidence of a recovery gaining ground across the Asia Pacific region,” said David Green-Morgan, RCA’s managing director for Asia Pacific. “China emerged as the most active market, while momentum rebuilds in Hong Kong, Taiwan and Singapore. While Japan was the weakest link, this masks the resilient performance in Tokyo, which saw robust cross-border investor appetite.”

Drilling Down

With first-quarter commercial volume declining 46 percent year-on-year in both Tokyo and Japan as a whole, deal activity appeared to have fallen significantly. But RCA put it down to last year’s first-quarter tally being relatively unaffected by the pandemic at the time, as well as the tendency for deal information to take longer to emerge in the world’s third-biggest economy.

David Green-Morgan, RCA’s managing director for Asia Pacific

Japan’s $6.9 billion in first-quarter volume was topped by China’s $8 billion, which was up 4 percent year-on-year. China also led Japan by volume in the past 12 months, with $41.3 billion versus $35.8 billion.

RCA identified Beijing as the only notable metro area where liquidity grew throughout the pandemic. China over the past year has drawn heavily on domestic investment, which accounted for about three-quarters of the Asian superpower’s volume.

South Korea ranked third among APAC markets in the first quarter as deal volume fell 13 percent year-on-year to $4.8 billion, a still-respectable showing after a banner 2020.

“It was always going to be difficult for South Korea to match last year’s record levels of activity,” said Benjamin Chow, RCA’s head of analytics for Asia. “But the pullback in sales was relatively modest considering commercial property prices have continued to climb over the past year.”

Big-Ticket Boost

In Singapore, first-quarter volume rose 200 percent year-on-year to $1.5 billion, aided by the sale of a half-stake in OUE Bayfront to Allianz and South Korea’s National Pension Service for $477 million. The city-state ranked sixth among metro areas and fifth among broader markets during the period.

Volume in Hong Kong recovered for a third consecutive quarter, climbing 28 percent year-on-year to $1.4 billion. Deal activity has been largely confined to the northern regions of Kowloon and New Territories as Hong Kong Island remains in the doldrums, RCA said.

Commercial sales volume in Asia Pacific as a whole fell 12 percent year-on-year in the first quarter to $29.6 billion, though more than half of the top 10 markets in the region enjoyed an uptick in investment activity.

The quarter’s biggest transaction was the closing of fund manager BentallGreenOak’s $675 million acquisition of the Avex Group headquarters in Tokyo. Avex, a one-time powerhouse in J-pop music, had announced the sale in December.

Other large deals included Macquarie’s $618 million sale of Martin Metro Place South Tower in Sydney to a joint venture of Australia-based Investa Commercial Property Fund and Canadian financial services firm Manulife, as well as Singaporean property giant GLP’s $522 million purchase of the ZT International Center in Beijing from local real estate firm Zhaotai Group.

Shenzhen was propelled from 12th among metro areas to the top five on the sale of Ocean Seafront Towers T1 for $433 million and Prince Bay Commercial Plaza T5 for $345 million.

Leave a Reply