Housing sales in Shanghai jumped by 184% in March

Home sales in Shanghai nearly tripled last month – rising by 184 percent compared to March 2015, as residents of China’s commercial capital rushed to buy housing in the face of surging prices and looming cooling measures aimed at taming a property bubble.

The jump in prices in China’s big cities helped pull up the average nationwide, although many smaller cities continue to suffer from slow sale and a backlog of unsold units, according to data released on Friday by the China Index Academy.

First Tier Cities Continue to Pull Up National Average

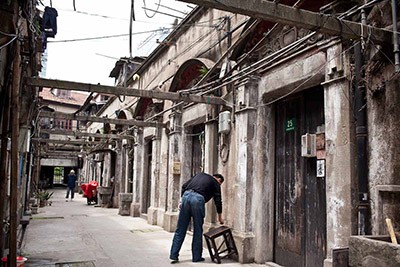

The price of your Shanghai shikumen went up by 5% from February to March

Nationwide, average home prices were up by 1.9 percent in 100 of the country’s largest cities, with Dongguan in Guangdong recording the sharpest month on month rise – with prices up by 6.9 percent compared to February. March’s price growth was markedly faster than the previous two months, with prices rising 0.6 percent in February over January, and just 0.42 percent in January compared to December of last year.

In Shanghai, home sales reached 2.21 million square meters in 31 days. The sudden demand for housing helped to send prices up by 5.1 percent compared to February to an average of RMB 39,035 per square metre, according to the Academy’s statistics.

Shenzhen prices also continued to rise, with average homes now costing RMB 48,963 per square metre – up 57 percent compared to a year ago. Compared to February, Shenzhen’s average prices were up by 3.6 percent – slowing from a 5.4 percent month on month rate of increase in February compared to January.

Beijing, where the government has kept a tighter hand on the market, saw prices rise 10 percent year-on -year in March.

New Market Restrictions Help Drive Sales

During the month of March, local governments in Shanghai, Shenzhen, Nanjing and Wuhan introduced new policies to dampen their booming housing markets, and while these measures should slow price increases in the medium to long-terms, they helped trigger panic buying as consumers rushed to get into the market before downpayments rose.

The new measures took their strongest form in Shanghai where downpayment were boosted as high as 70 percent for buyers of 2nd homes which were deemed to be luxury units. The city also put in palce curbs on on non-resident purchases and tougher transaction monitoring.

In Shenzhen, which has had China’s hottest property market since average prices began to recover last year, buyers of additional homes now need to put down 40 percent, instead of the 30 percent prevailing previously, provided that they do not have outstanding mortgages on other properties.

The Beijing and Langfang governments are also expected to issue tightening measures in the near future.

At least part of the surge in housing sales during March can be attributed to the government’s telegraphing of its intention to clamp down on housing transactions at the beginning of the month. The housing surge in Shanghai and Shenzhen became a noteworthy topic at party meetings in Beijing during the first week in March, and during those sessions top Shanghai official Han Zheng announced that steps would be taken to curb buyer enthusiasm.

While these major cities are working to tame a bubble, other areas of the country are still struggling to rekindle interest in housing purchases. Zhengzhou in Henan province, Ningbo, Zhejiang, and the entire province of Sichuan last month issued new policies to support demand.

Leave a Reply