Executives from Ping An, Swire Properties and JLL at the Urban Lab launch last year

Growing cooperation between real estate companies and technology firms is boosting adoption of technology in China’s property sector as demand grows for big data, cloud computing and Internet of Things solutions, according to a report published today by JLL.

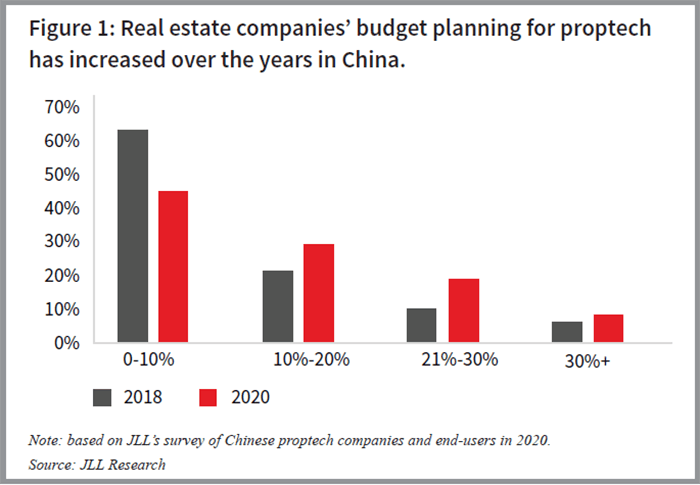

A survey of 150 proptech companies and 80 real estate firms by the property consultancy found that 47 percent of respondents are planning to increase their proptech budget by up to 30 percent in the next two years, up from just over 30 percent of respondents to a 2018 poll.

Proptech, a short name for property technology, refers to the array of digital tools and tech applications used to lower costs, increase efficiency and boost revenues in the property industry, and encompasses everything from new materials to software innovation.

“Proptech serves as the key growth engine in reimagining the future of real estate,” said JLL Greater China chief executive, KK Fung. He added that, “Cooperation among proptech companies, real estate enterprises and professional organizations will collectively drive innovation forward in the industry.”

Cloud Computing, Big Data in Demand

The survey shows marked increase in interest among real estate companies for high technology applications and services, with 70 percent of real estate companies seen as demanding big data services and cloud computing over the next two years, and another 65 percent eager to adopt AI technologies by 2022, according to the survey.

JLL Greater China CEO KK Fung

While the highest levels of demand are for big data, cloud computing and AI, the fastest rate of growth is projected for Internet of Things applications, demand for which among real estate companies is expected to more than double in China from now through 2022. Much of the IoT expansion is enabled by China’s rapid adoption of 5G mobile technology, with demand for services in this segment expected to nearly double to around 40 percent by 2022, according to the report.

“The built environment in China presents the potential to generate massive amounts of data collected from IoT sensors, which will be empowered by 5G in terms of real-time monitoring, machine learning and predictive application,” the report’s authors said, noting that market players prepared to harness these new technologies are set to reap the greatest benefits in the changing environment.

With the report terming them “frontier” technologies, blockchain and autonomous vehicles are expected to be less in demand with fewer than 7 percent of real estate companies in China expected to show interest in these applications over the next two years.

The Coronavirus Catalyst

The Covid-19 pandemic that has engulfed the world has given new impetus to digitising processes and replacing manual procedures as China has moved swiftly to reduce health risks through technical solutions.

Technology focusing on health and safety saw nearly overnight adoption in startups and conglomerates alike during the first six months of 2020 according to JLL.

Proptech innovations popularised by the pandemic include improved air purification methods and white LED light disinfection technology.

Adoption Challenges and Opportunities

Based on its survey of technology and real estate executives, JLL’s researchers found both opportunities and challenges with regard to technology adoption in China’s property industry.

The growing focus on innovation in China is seen as helping to spur tech adoption in real estate, with more than 70 percent of survey respondents learning about technology providers through peer introductions and nearly 60 percent relying on proptech forums or exhibitions.

Among the hurdles to adoption is the lack of interdisciplinary talent that can manage both real estate and technology projects, according to the survey, while challenges around interaction between tech providers and property firms mean that change has often come about through top down initiatives driven by senior decision-makers.

While nearly 70 percent of survey respondents identified a lack of standards as a hurdle to the development of proptech in China, the survey noted efforts by the government and among industries to set new benchmarks which could help to reduce this barrier over time.

China’s Digital Property Future

Although tech markets globally have been increasingly dominated by a limited number of giants, JLL’s team predicts that the proptech market will develop through partnerships between technology providers and real estate firms.

Already the report’s authors found that, “real estate leaders reshaping their businesses through proptech innovation are reaping digital dividends,” while noting that tech titans are also investing in real estate verticals to discover new business opportunities.

Commenting on JLL’s Global Real Estate Transparency Index published last month, Fung attributed the rising transparency ratings of mainland cities in part to adoption of proptech innovations.

“With a burgeoning proptech sector, Mainland China’s leading cities of Shanghai and Beijing have moved into the “Transparent” tier for the first time since the index was launched in 1999,” he said.

JLL has made proptech a focus of its operations globally and in mainland China. Last July, in a bid to encourage more innovations in the country’s proptech space, JLL, Swire Properties and a division of financial services group Ping An launched a proptech accelerator programme called Urban Lab in Shanghai last July, aiming to bring together real estate and tech firms.

“We are providing an opportunity […] to test technology solutions that can change the urban planning, real estate and infrastructure industries,” Ping An Urban Tech CTO Wei Baisong noted at the time.

Mingtiandi launched its own proptech survey earlier this month and has already received responses from top executives managing billions of dollars in real estate across the region.

Leave a Reply