China’s real estate developers will struggle to maintain growth over the next few years as many of them run out of available stock to sell and competition for new sites erodes margins and limits opportunities for expansion according to a recent report from a major investment bank.

The most recent Sector Report on China Real Estate published by BNP Paribas Securities on December 6th, predicts that real estate developers working on China’s mainland are not likely to repeat the 30-percent or greater growth rates that many of them enjoyed in 2014, and investors should be prepared for a more leisurely pace of expansion in China’s property industry.

Because of these market challenges the report, authored by Wee Liat Lee, Regional Head of Property Research at the bank, downgraded the overall industry for 2014 from “Improving” to “Stable.”

Landbank Shortages Limiting Growth

The major constraint on continuing growth, according to the analysis in the report, is their ability to maintain the supply of land necessary to continue launching new projects. This finding was based in part on analysis of the recent landbank replenishment behaviour for 13 listed developers and projected proportions of land available for development (or landbank) to contracted sales growth.

Also, as many developers have been relying on overseas bond sales to raise the funds necessary to purchase new land, the prospect of an end to quantitative easing in the US during 2014, and the higher borrowing prices that this will entail, means further pressure on the ability of developers to secure new sites affordably.

Prices for Land Rising Faster Than Prices for Real Estate

While developers have been setting new records for the price of land this year as competition for new sites increases, so far they have not been able to pass all of these additional costs along to the public.

While developers have been setting new records for the price of land this year as competition for new sites increases, so far they have not been able to pass all of these additional costs along to the public.

Through the end of September, land prices in China’s first-tier cities – Shanghai, Beijing, Shenzhen and Guangzhou – had increased by 135 per cent year over the same period a year earlier. However, according to the report, the average increase in housing prices had only risen by 15 percent in those same cities.

For one new site in Beijing this year, the developer Sunac paid RMB 4.3 billion for a project with a planned floor area of 59,152 square metres, which means that the cost per square metre of built space for the developer will be RMB 73,000 by the time the project is complete.

In the smaller communities that make up China’s second-tier cities, land prices had risen more slowly, at only 43 percent, however, the price of homes had only gone up by four percent during the period.

The author attributes this disconnect between land costs and housing prices as being “due to the ‘herd mentality’ of developers in making acquisitions.”

Lack of Available Stock Becoming an Issue

A shorter term problem that will adversely affect developers’ sales in 2014 will be the lack of available stock for sale. Over the last 12 months, the contracted sales growth for most developers has outpaced construction of new homes. The report points to Country Garden, China Overseas Land and Shimao as being developers with the most acute shortage of housing in the pipeline.

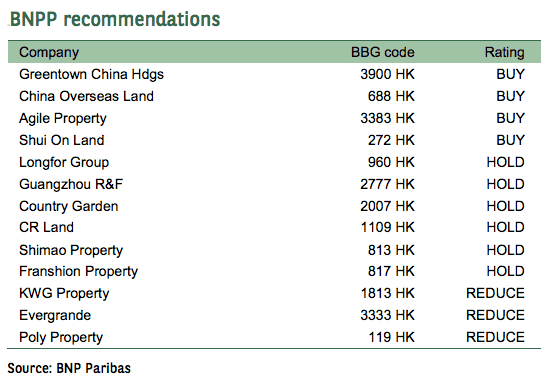

While the sector overall was downgraded to stable, particular developers were singled out for downgrading for various reasons. KWG Property of Guangzhou was downgraded to “reduce” from “hold,” China Resources Land, Longfor Properties, Guangzhou R&F and Franshion Properties were all downgraded from “buy” to “hold.”

Leave a Reply