Survey author Alain Bertaud

Hong Kong housing has been ranked as the least affordable in the world for a ninth straight year, according to the results of a survey published today by non-profit group Demographia.

The median home price in the Asian financial capital is now a record-high 20.9 times the median annual income – up from a multiple of 19.4 times last year, and the highest multiple ever recorded in the market study.

The survey, which is in its 15th year, covers 309 metropolitan housing markets in eight countries, including Australia, Canada, China, Ireland, New Zealand, Singapore, the UK and the US, comparing them for what it terms their “median multiples,” which is the median house price divided by the median income.

Four Times Past the Severely Unaffordable Mark

The Demographia International Housing Affordability Survey: 2019 defines a median multiple of 5.1 or above as severely unaffordable, and does not attempt to compare costs per square foot, household sizes or other demographic factors. Within China, the only city covered is Hong Kong.

The authors, while noting that home prices in Hong Kong have declined since this year’s research was conducted in the third quarter of 2018, said that even in the event that the city’s housing prices declined as much as 25 percent in 2019, “Hong Kong’s housing would continue to be severely unaffordable by a large margin.’

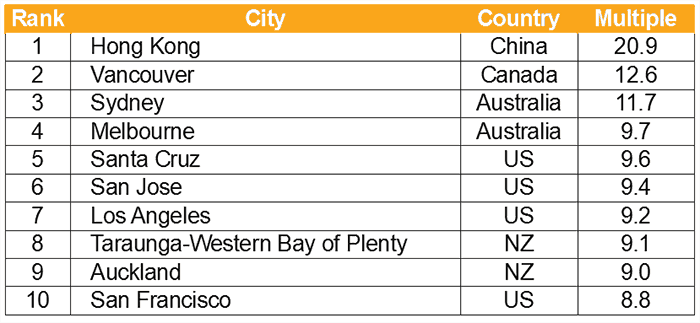

The world’s least affordable cities for housing in 2019 as measured by median home price as a multiple of median income

The study noted that Hong Kong’s housing affordability has worsened markedly over the last two decades, with figures from 2002 showing that, at the time, a 39.9 square metre (430 square foot) apartment cost the equivalent of 4.6 times the median annual income. The report’s authors cited academic research that tied the trend toward pricier housing to restrictive land-use regulations.

Vancouver, Sydney, Melbourne and Santa Cruz Fill Out Top Five

The city’s unaffordability was nearly 40 percent more than the next priciest city in the rankings, Vancouver, Canada, which had a median multiple of 12. 6, while Sydney, Australia was next on the list at 11.7 and Melbourne ranked fourth at 9.7.

The most unaffordable place in the US is Santa Cruz, California, where at least you might go surfing while paying for your home which averages 9.6 times the median income, while in famously expensive San Francisco, the median home price is still just 8.8 times the median income – only enough to rank 10th most outrageous globally.

Hong Kong’s affordability looks particularly daunting next to regional rival Singapore, where the median-priced home sells for 4.6 times the median income, according to the survey. Other urban markets given high marks for housing accessibility include Pittsburgh, Pennsylvania and Rochester, New York, both of which tied for the top affordability spot with a median multiple of 2.6, followed by Oklahoma City; Buffalo, New York, Cincinatti and Cleveland, Ohio; and St Louis, Missouri.

What’s Good for Developers May Not Be Good for the Economy

In the survey’s introduction, Alain Bertaud, a senior research scholar at the Marron Institue of Urban Management at New York University and formerly a principal urban planner at the World Bank, pointed out that while many of the world’s most prosperous cities have expensive housing markets, overinvestment in real estate can endanger economic growth.

“High housing prices misallocate resources toward real estate at the expense of the rest of the economy,” Bertaud pointed out. “This misallocation could eventually significantly slow down economic growth and causes a housing bubble to burst, freezing investments in the entire economy. Japan, has not yet completely recovered from its asset bubble created in the 1980s.”

Hong Kong’s government has approached the city’s housing crisis by forming an advisory task force which at the end of last month released a recommendation focused on large scale reclamation projects, which aims to add 3,250 hectares of new land to the city’s development pipeline, albeit without a clear time.

However, critics have pointed out that the city’s government, which in the 2017-2018 fiscal year derived 26.6 percent of its revenue from land sales, and another 15.4 percent from stamp duties on real estate sales, has a vested interest in keeping housing prices elevated.

Apart from Hong Kong and Singapore, the survey did not examine the affordability of housing in other Asian countries such as Japan, Korea or other high-priced urban centres.

Leave a Reply