A few years ago, the major urban initiative in Shanghai was the Hongqiao transportation hub, a new geographic nexus on the city’s western edge that brought together high speed rail, a new domestic airport, and local metro lines to form a new development centre.

Now, a recent report by the Wall Street Journal citing research by real estate consultancy Knight Frank, finds that progress on the Hongqiao development may be delayed by as much as two years, as demand for space in the area has been slow to develop, and financing becomes harder to come by.

Pushed Aside by the FTZ?

With all the love that Shanghai’s Free Trade Zone initiative has received since it was announced in August last year, it’s easy to forget that the Hongqiao transport hub was once the next big thing in China’s commercial center.

An October 2012 headline from Hong Kong’s South China Morning Post read, “Shanghai focus turns to Hongqiao CBD” and predicted that “the Hongqiao CBD will strengthen China’s ability to support its economy through domestic growth and spending. Phase 1 of the development will provide over 1.7 million square metres of new office, retail, apartment, exhibition, and hotel space over the next two to three years.”

Now the ten developers who have purchased land and made plans for the office and retail projects that are to constitute the hub are facing delays as new projects such as the free trade zone sap demand and the city officials that used to push this initiative have now turned their focus to Pudong.

These real estate development projects are intended to be the first phase of the Hongqiao Central Business District, and were supposed to be in place by the middle of next year.

Knight Frank Finds Low Demand and Disappointing Rents

However, according to a report which Knight Frank based on a survey of developers with projects in the area, final handover is likely to be delayed by as much as two years. As cited in the Journal, Knight Frank noted that, “We believe the completion timeframe, design quality and marketing strategy of the Hongqiao CBD may face challenges.”

The report went on to cite,

“Unless landlords are willing to accept a substantial reduction on rent, the assumption that tenants from competing districts will come rushing into Hongqiao CBD, may be overstated,” said Knight Frank, noting that average rents in Hongqiao CBD will likely be at CNY5.50 to CNY6.00 per square meter per day. Grade A office rents in Shanghai averaged CNY9.10 per square meter per day in 2013.

Shui On and Vantone in the Hongqiao CBD

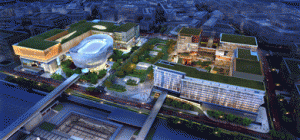

Major developments in the new Hongqiao CBD project include Shui On’s The Hub and the Hongqiao Vantone SunnyWorld Centre.

Shui On’s project is of mammoth scale for an area far from central Shanghai with the 380,000 square metre development planned to include four office buildings, a hotel, shopping centre, dining and nightlife venues, and a cultural and exhibition centre.

Meanwhile in the Shanghai Free Trade Zone at the city’s eastern edge, more than more than one thousand companies have been registered in the new economic area, which promises more relaxed business rules and the potential for free trading of currency. Rents in the free trade zone have more than doubled, and housing prices have gone up more than 30 percent since the project was announced.

Leave a Reply