As China’s housing boom fades the country’s real estate investors appear to be shifting to tourism, as “destination” provinces now lead the nation for property investment’s contribution to their economies.

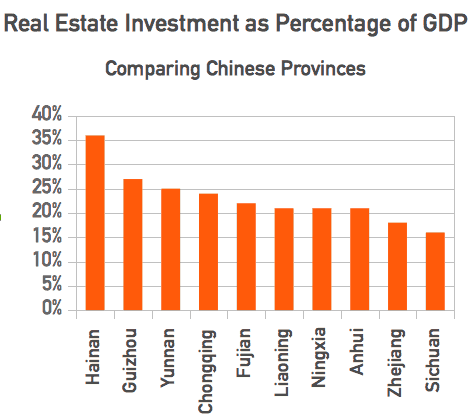

In Hainan, which is the only tropical island province in the nation, 36 percent of the province’s GDP is devoted to real estate investment, while in Yunnan, which is home to Lijiang, Shangrila and other mountain resort sites, 25 percent of GDP centres on the property sector, according to reports in local media.

Also leading the list were the mountainous province of Guizhou in southern China with 27 percent of GDP coming from real estate investment, the municipality of Chongqing in western China with 25 percent, and Fujian with 22 percent.

The more developed areas such as Shanghai, Beijing, and Guangdong province, while having more investment in real estate by value, owed a comparatively smaller piece of their economic pies to the property sector, thanks to having more diversified economies.

Investors Pick Tourism as China’s Wealthy Classes Look for Fun

During recent years real estate developers in China have turned to tourism developments as a way to profit from China’s shift to a consumption-driven economy and to find higher value-added investments as the mainstay housing sector slows down.

Investment conglomerate Fosun last year announced plans for a RMB 10 billion 7-star resort in Hainan, as part of a RMB 100 billion set of domestic tourism investments planned for the coming years.

China’s wealthiest man, Wang Jianlin, is also putting his money into tourism projects, with plans for ten “cultural cities” aimed at surpassing Shanghai’s Disneyland resort which is scheduled to open in 2015. One of the resorts planned by the tycoon’s Dalian Wanda is planned for the city of Xishuangbanna in southern Yunnan province.

Hainan Ranks with the Heavyweights for Real Estate Investment

Even when looking at real estate as a percentage of fixed asset investment, regardless of GDP size, Hainan ranks right behind the country’s two biggest cities with 46 percent of fixed asset investment going into real estate. Shanghai was first in the country with 55 percent of fixed asset investment devoted to the property sector, while Beijing was second with 52 percent. Yunnan, which has comparatively lower land prices, sank only 26 percent of fixed asset investment into real estate.

Economists noted that, while Shanghai and Beijing are treated as provincial-level units under China’s administrative system, they are entirely urban areas that are much more developed than Hainan, Guizhou or Yunnan, and are better able to attract investment in other industries.

Leave a Reply