Wang Jianlin enjoyed a profitable year as head of Dalian Wanda

Dalian Wanda boss Wang Jianlin has been forced to scale back his ambitions and sell off overseas and non-core assets in the past two years, but his flagship real estate operation still has more than twice the operating revenue of its closest rivals in China’s commercial real estate market, according to recently compiled statistics.

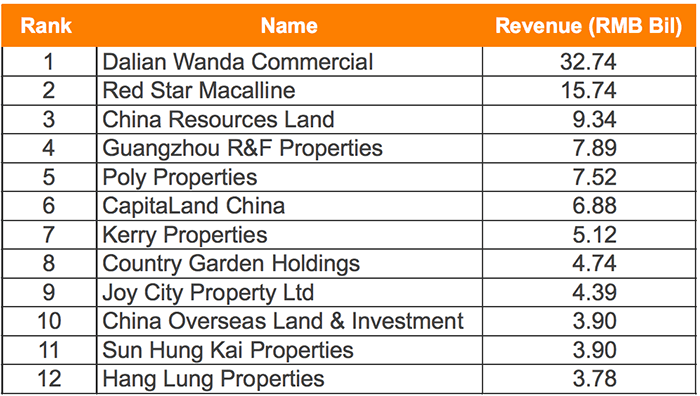

Dalian Wanda Commercial Management Group ranked first for operating revenue among developers in China last year, with Red Star Macalline Group and China Resources Land coming in second and third as they had in 2017. However, Wang’s commercial real estate business, which added another 49 Wanda Plaza shopping centres in 2018, took in more than double the operating revenue of its nearest competitor, according to data compiled by real estate information provider CRIC.

The operating revenue rankings published by CRIC, a division of real estate agency E-House, provide a look at the biggest commercials developers on the mainland, with the majority of this income derived from rent on offices and retail space, while also spotlighting the country’s biggest hotel owners and giving insight on the nascent rental housing industry.

Among the 10 biggest commercial developers by revenue in mainland China in 2018, two were foreign companies, including one each from Singapore and Hong Kong.

Wanda Shrinks Cultural Business, Grows Commercial Operation

Wanda took in RMB 32.74 billion ($4.86 billion) in revenue in 2018 from office leasing, retail operations and hotel management, according to CRIC’s figures. Second-place Red Star bagged RMB 15.74 billion, followed by China Resources Land’s RMB 9.34 billion.

While Wanda continued to sell off its cultural and technology businesses in 2018, including disposing of its tourism management business to Hong Kong-listed Sunac China Holding for RMB 6.28 billion in October last year, it still managed to grow its rental income by 28.8 percent over its 2017 levels, reaching RMB 32.88 billion, according to a statement by the company.

Wanda, which now has 282 Wanda Plazas across China, also took into revenue of RMB 1.4 billion from its hotel management business.

R&F Moves into the Top Five

The biggest gainer among China’s leading commercial developers was Guangzhou R&F, which jumped into the fourth position nationwide after buying a chunk of Wanda’s hotel assets in 2017.

R&F, which had previously focused on residential development, took in commercial operating revenue of RMB 7.89 billion in 2018 — enough to edge past state-owned Poly Properties, which ranked fifth with operating revenue of RMB 7.52 billion.

In July 2017 R&F had agreed to to purchase 77 hotels from Dalian Wanda Group for RMB 19.9 billion ($2.9 billion) after Sunac China Holdings had balked at taking on hospitality assets. Poly also saw its revenue grow significantly last year, rising 64.18 percent compared to the company’s 2017 total.

Meanwhile China Resources Land has pledged to expand its commercial operations after the developer of the MixC line of mixed-use projects earlier announced a plan to have established 48 shopping centres, totalling 6.1 million square meters by 2020, with the Shenzhen-based firm saying that it expects its commercial portfolio to generate rental income of RMB 10 billion annually by 2020.

China’s largest developers by operating revenue in 2018. Source: CRIC

Foreign Developers Shine in Commercial Sector

While China’s residential sector is dominated by local players, developers from across the border played a significant role in the commercial market. Singapore’s CapitaLand, which had 20 commercial projects in mainland China as of the end of June 2018, qualified as the largest foreign developer in the country with RMB 6.88 billion in operating revenue — enough to rank sixth nationwide.

Also in the top ten was Kerry Properties, which ranked seventh with RMB 5.12 billion in revenue. Sun Hung Kai Properties, one of Hong Kong’s biggest builders, placed 11th among commercial developers in mainland China with RMB 3.9 billion in revenue.

Residential Rents Pegged to Grow

Rental income from commercial buildings accounted for 79.6 percent of the total revenue for domestic developers and 86.8 percent for foreign developers in China, CRIC said. However, Country Garden, which ranked eighth overall by operating revenue, attributed 57 percent of its revenue to hotel management.

However, with China’s government supporting the development of a rental housing market, CRIC predicted that residential leasing will contribute more substantially to developers’ overall revenues. In the first half of 2018, Longfor (which ranked 13th for operating revenues) took in RMB 139 million in from rental housing, accounting for 7.5 percent of its total rental income and representing a 4,273 percent year-on-year increase. Longfor said it expects its rental housing income to exceed RMB 3 billion by 2020 and at which time it would account for 30 percent of its total rental income.

As credit remains tight under China’s deleveraging campaign, foreign developers became more aggressive in expanding their commercial portfolios in 2018, CRIC said. Hong Kong developer Hang Lung made its first mainland purchase in five years in May, buying a 44,827 square meter (482,514 square foot) commercial site in central Hangzhou’s Xiacheng district for RMB 10.7 billion.

CapitaLand dominated the region’s real estate headlines in November with news of its acquisition of a prime mixed-use, 4.7 hectare site in Guangzhou for RMB 882 million. The news came on the same day that the developer confirmed a joint venture with GIC for the acquisition of the Star Harbour International Centre project in Shanghai for RMB 12.8 billion.

Leave a Reply