TPG Angelo Gordon recently agreed to invest in Singapore’s Capri by Fraser, Changi City

TPG has closed on its eighth Asia-focused private equity fund with $5.3 billion in committed capital, as well as raising $2.5 billion for a pair of Angelo Gordon co-branded real estate vehicles targeting the region.

The campaign for TPG Asia VIII raised 14 percent more capital than its predecessor in the series, making it the firm’s largest Asia fund to date, the Texas-based private equity major said Wednesday in a release.

The two real estate funds — TPG AG Asia Realty V and TPG AG Japan Realty Value — exceeded their fundraising targets and are the first Asian strategies under the TPG Angelo Gordon banner since TPG’s $2.7 billion acquisition of the Manhattan firm in November 2023. TPG’s Asia assets under management now exceed $35 billion with the latest closings.

“Looking ahead, we expect markets across Asia to continue to experience strong economic growth,” said TPG CEO Jon Winkelried. “Our investment strategy in the region — characterised by thematic, sector-driven investing by local teams in key markets — positions us to continue to deliver excellent performance and drive further innovation and growth.”

Tapping Japanese Partners

TPG had raised a respective $2 billion and $417 million for Asia Realty V and Japan Realty Value at the end of March, according to first-quarter financial results out Wednesday.

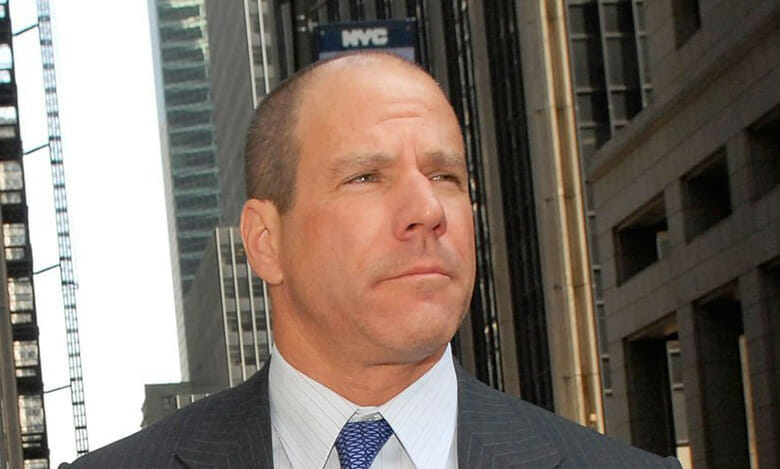

TPG CEO Jon Winkelried is eyeing more Asia opportunities (Getty Images)

Asia Realty V, which closed more than 50 percent higher than the $1.3 billion fourth fund, targets opportunistic investments with a focus on sourcing off-market transactions in Japan, South Korea, mainland China, Hong Kong and Singapore, according to TPG.

Japan Realty Value will seek value-add opportunities in Asia’s second-biggest economy, focusing on equity interests in real estate across industrial, office, residential and retail.

Wilson Leung, head of Asia real estate for TPG AG, said the firm welcomed the opportunity to deepen its partnership with Japanese institutional investors through the value-add fund.

“We continue to see a wealth of compelling investment opportunities across the region, and we are confident that our deeply experienced team and strong, established operating partner network position us well to capitalise on them and drive value for our LPs,” Leung said.

Signs of Momentum

The view continues to brighten for Asia-targeted fundraising after global levels tumbled to multi-year lows last year.

In January, KKR announced the $6.4 billion final close of its second Asia-dedicated infrastructure fund, with the US buyout giant having already deployed more than half of the vehicle’s committed capital across 10 investments. Less than two months later, Stonepeak announced the final closing of its own Asia infrastructure fund — the US firm’s first — with capital commitments of $3.3 billion, exceeding the vehicle’s hard cap of $3 billion.

In February, Dutch pension fund manager APG revealed its $400 million-plus commitment to a Korean logistics core fund set up with longtime partners ESR and the Canada Pension Plan Investment Board. That same month, Hong Kong’s Weave Living unveiled its inaugural multi-family fund dedicated to the Japan market, with an initial target of raising $500 million in equity from global institutional investors.

Leave a Reply