Yang Guoqiang’s Country Garden tops China’s developer ranks for the first half of the year, with RMB 412 bil in sales

Country Garden has retained its crown as China’s top developer, measured by contracted sales, despite being one of only two of the nation’s top ten builders to see their performance drop during the first half of the year.

The Guangdong-based company chaired by rags-to-riches billionaire Yang Guoqiang reported RMB 412.48 billion ($60 billion) in sales in the first six months of the year, a 5.89 percent drop from the same period in 2018, according to data provided by China Real Estate Information Corporation.

Country Garden’s shrinking sales come as China’s top 10 developers managed average growth in contracted sales of 8.36 percent during the first half of 2019, and sales industry-wide expanded by 6.1 percent. The growth rate for the top 10 developers was less than half of the 20 percent pace that the same group recorded for the full year of 2018.

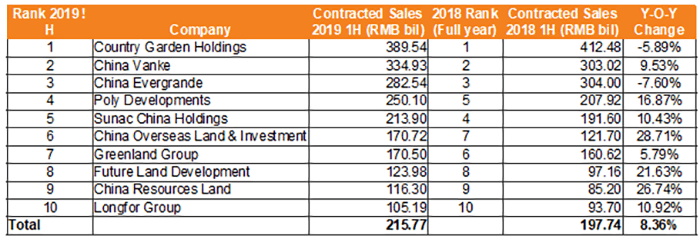

Contracted Sales for China’s Top 10 Developers in 2019 1H

Mainland China developers contracted sales for 2019 1h (Source: CRIC)

Country Garden, Evergrande Slide as Vanke Grows

The sales downtick for Country Garden comes after the company achieved RMB 728.69 billion in sales for the full year of 2018, equating to a 32.4 percent improvement on the year before.

China Vanke’s Yu Liang seems to be doing more than just surviving

Shenzhen-based China Vanke took the second-place spot during the first six months of 2019, unchanged from last year, but managed to close the gap with top player Country Garden. The Shenzhen-based firm boosted its sales by 9.53 percent over the same period last year to reach RMB 334.93 billion in signed contracts during the first half of 2019.

Vanke Chairman Yu Liang told attendees at the company’s annual general meeting on June 28 that the developer’s long-term strategy of focusing on survival has not changed and that it continues to focus on projects in the country’s first and second tier cities.

Chief executive officer of Shenzhen rival China Evergrande, Xia Haijun, who recently purchased a HK$155 million ($20 million) Hong Kong penthouse, will be pleased that his company’s performance in the first two quarters of the year mean that he can still claim to be leading China’s third-largest developer by contracted sales, despite the collection of deals signed during the first half of the year sliding by 7.6 percent compared to the same period last year, to reach a total of RMB 282.54 billion.

Poly Pushes Sunac out of Fourth Place

Guangzhou-based Poly Developments and Holdings muscled into fourth place, pushing Tianjin-headquartered Sunac China Holdings down a notch.

The division of state-run Poly Group, which teamed up with China Resources Land last week to buy the second-largest land parcel on the former Hong Kong airport for HK$12.9 billion, racked up RMB 250.1 billion in sales during the first half of 2019, a 16.87 percent improvement over this time last year.

Tianjin-headquartered Sunac China Holdings lost its fourth place spot despite seeing its sales rise by 10.43 percent to RMB 213.9 billion during the period — an increase of RMB 22.3 billion over the first six months of 2018.

Future Land Development’s 21% Sales Surge Doesn’t Erase Legal Charges

Future Land Development, which saw its share price tank this week after the arrest of chairman Wang Zhenhua, was one of three developers out of China’s top ten that benefitted from sales surges of more than twenty percent in the first half of the year.

The Shanghai-based developer recorded sales of RMB 123.98 billion for the first six months of 2019, 21 percent more than the RMB 97.16 billion recorded for the same period last year.

But booming sales were not enough to instil confidence in ratings agency Standard and Poors, which downgraded its assessment of the Hong Kong-listed company last Friday, saying that the seriousness of the child molestation allegations against former chairman Wang Zhenhua and the sudden change in leadership, with Wang’s son now leading the company, could have severe repercussions on the developer’s business.

Also growing quickly but without the scandal, were state-backed players China Overseas Land and Investment and China Resources Land.

COLI’s 28.71 percent sales growth was enough to move the company past Greenland Group for sixth place in the rankings, while China Resources Land maintained its ninth place position thanks to a 26.74 percent increase in contracted sales which brought its total to RMB 116.3 billion for the period.

Top 10 Outpace the Rest

While the top developers grew their sales by over 8 percent during the first half of the year, the industry as a whole was not far behind, with overall contracted sales by developers growing 6.1 percent to reach RMB 5.18 trillion during the first five months of the year.

That industry-wide figure shows an improvement over 2018’s full year industry growth rate of 1.3 percent, although analysts point to China’s tight credit environment during 2018 as having constrained sales opportunities during the first six months of this year.

Sales of land in terms of area grew by just over 14 percent in 2018 compared to the previous year, with the total land expenditures by developers up by 18 percent, according to the National Bureau of Statistics.

Those figures translated into a 2.2 percentage point decline in the growth of developer land expenditures, with numerous land sales being cancelled in 2018 as developers struggled to find financing.

In 2019, despite China’s financial regulators having loosened credit conditions, land sales have yet to recover nationwide, with government statistics for the first five months of the year showing that developer expenditures on land totalled RMB 226.9 billion during the period from January through May.

That amount of investment in development pipelines was down by 35.6 percent compared to the same period of last year with the rate of decline expanding by 2.1 percentage points.

Leave a Reply