SOEs accounted for more than three-quarters of sales among China’s top 10 property giants in 2022

State-owned enterprises dominated the ranks of China’s biggest developers by sales in 2022, with SOEs accounting for eight of the top 10 mainland builders, as Beijing’s deleveraging policy battered the country’s private real estate firms.

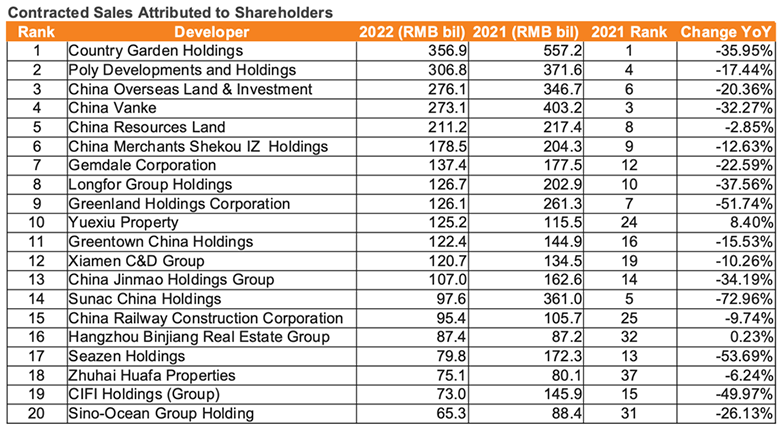

Country Garden Holdings and Longfor Group Holdings were the only private-sector developers that earned a top spot in the semi-annual ranking published by China Real Estate Information Corporation, with Country Garden once again leading the way in annual contracted sales attributed to shareholders.

An octet of SOEs including China Vanke and Poly Developments and Holdings claimed the rest of the top 10 list, chalking up a combined RMB 1.6 trillion ($237 billion) in contracted sales during the year. That figure accounted for 77 percent of total contracted sales among the top 10 property giants.

By contrast, six SOEs ranked among the top 10 in 2021, with a combined RMB 1.8 trillion in sales, or 54 percent of the total. State-backed players expanded their dominance in 2022, as financing struggles continued to hobble private developers during a historic housing market slump.

Top 20 See 38% Slide

CRIC, a division of mainland real estate agency e-House, found that the cumulative sales volume of China’s top 100 real estate enterprises fell 41.6 percent year-over-year to RMB 6.4 trillion in 2022, as mainland new-home sales plunged more than 28 percent compared to 2021.

Source: CRIC

The top 20 developers by contracted sales attributed to shareholders saw their combined sales fall to RMB 3 trillion in 2022, down 37.6 percent from the previous year’s total of RMB 4.9 trillion. Private development giants Country Garden and Longfor reported sales declines of nearly 36 percent and 38 percent, respectively.

Those two firms managed to stay high in the rankings, however, while debt-strapped private behemoths China Evergrande and Shimao Property Holdings slid off the top-20 list in 2022. SOEs Poly Developments and Holdings and China Overseas Land & Investment climbed to second and third place despite seeing substantial sales drops.

Their state-owned peers China Resources Land, China Merchants Shekou Industrial Zone Holdings, and Gemdale Corporation also ascended in the ranking amid declining sales. China Vanke, which counts state-owned Shenzhen Metro Group as its largest shareholder, slipped from third to fourth place last year as its sales dropped more than 32 percent.

Zhuhai Huafa Property Development, which recently agreed to buy a majority stake in an indoor ski resort project from struggling developer Sunac China Holdings, was among the government-backed builders that landed on the top-20 list in 2022 after being absent the previous year.

State-owned Yuexiu Property, China Railway Construction Corporation, and Hangzhou Binjiang Real Estate Group also debuted on the reshuffled top-20 list alongside Zhuhai Huafa.

Curbs hit hard

The increasing clout of SOEs continues a trend that had already emerged in CRIC’s previous ranking, where state-owned developers held 13 of the 20 top spots for the first half of 2022 – a number that has since risen to 14 for the full year.

Liu Ping, chairman of Poly Developments and Holdings Group

At the time, CRIC noted that most land parcels had been acquired by SOEs after China imposed restrictions on land auctions in 22 key cities in early 2021. Projects developed from parcels acquired in 2021 were ready for pre-sale the following year, causing SOEs to record more home sales than their private-sector peers.

China’s two-year crackdown on excessive leverage in the real estate sector has triggered a wave of developer defaults, with property firms missing payments on a combined $50 billion in onshore and offshore debt in 2022, according to Bloomberg calculations, while Covid-19 lockdowns contributed to a major housing market meltdown.

The central government has introduced a raft of measures in recent months to bolster the real estate industry, including easing the lending limits that were introduced in 2020, as the debt crisis that has engulfed private developers like China Evergrande Group and Kaisa Group Holdings is seen to generate systemic risks to the world’s second-largest economy.

Leave a Reply