Country Garden boss Yang Guoqiang seems pleased to be treading water this year

A second-half plunge knocked China Evergrande from its perch as China’s top developer by contracted sales in 2021, enabling rival Country Garden Holdings to seize the No.1 spot despite a lacklustre performance.

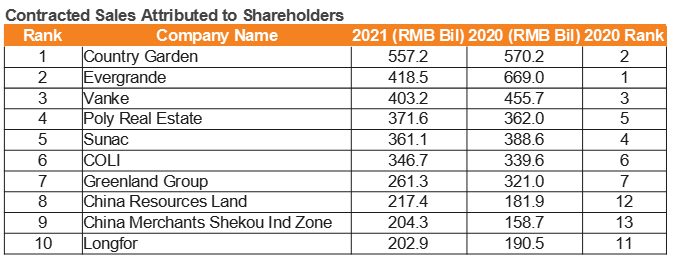

Shenzhen-based Evergrande, the world’s most indebted developer, had to settle for second place last year with contracted sales attributable to shareholders totalling RMB 418.5 billion ($65.6 billion), which was down 37.5 percent from 2020’s RMB 669 billion and a far cry even from 2019’s RMB 578 billion, according to data provided by China Real Estate Information Corporation.

Country Garden, meanwhile, saw a more modest year-on-year decline of 2.3 percent, with the Guangdong-based builder recording more than RMB 557 billion in 2021 contracted sales.

Rounding out the top five were China Vanke (RMB 403 billion), which maintained its third-place position from 2020; and Poly Real Estate (RMB 371.6 billion) and Sunac China Holdings (RMB 361 billion), which swapped places in the fourth and fifth spots.

Disappearing Sales

Based on its interim report released in August, Evergrande had looked set to continue its market dominance after posting first-half contracted sales of RMB 356.8 billion, up 2.3 percent from the same six-month period of 2020.

Source: CRIC

But a downward trend emerged as the developer chaired by Xu Jiayin recorded sales in June, July and August of RMB 71.6 billion, RMB 43.8 billion and RMB 38.1 billion and issued a warning that sales in September — normally a strong month for real estate firms in China — would experience a “significant continuing decline” owing to “negative media reports” about the cash-strapped group.

Evergrande’s regular information updates grew sporadic in the second half, and sales seemed to all but evaporate as the developer reported a mere RMB 3.65 billion in contracted sales for the period including September and the first 20 days of October, bringing year-to-date sales to RMB 442.3 billion, per the group’s accounting.

By the end of 2021, full-year contracted sales had inched up to just RMB 443.02 billion, according to an Evergrande announcement this week, putting the figure higher than CRIC’s assessment but still down roughly 34 percent year-on-year.

The developer’s woes are unlikely to fade in the new year: Evergrande is staring at an offshore debt pile of close to $20 billion, including coupon payments of $487.7 million due this month, as China’s developers confront $197 billion in liabilities coming due in January alone, according to Bloomberg.

Top 10 Reshuffled

Protests may have put a dent in Evergrande sales this year

As the liquidity crisis roiled mainland property firms, some lower-volume developers nonetheless enjoyed sales growth and cracked the top 10 in 2021.

State run developers China Resources Land and China Merchants Shekou Industrial Zone Holdings both saw sales rise last year with the development arm of China Resources group boosting its new contracts by 19.5 percent to RMB 217 billion. Fellow Shenzhen-based SOE China Merchants Shekou achieved still stronger results with sales climbing 29 percent to RMB 204 billion.

Privately controlled Longfor Group also managed to increase its sales by 6.5 percent to RMB 203 billion in 2020 to take the 10th spot on the list, behind China Resources Land in eight place and China Merchants Shekou in ninth. The strong performances by the rising trio helped to push Shimao Property, China Merchants Land and Future Land Development from the top decile of the league table.

Maintaining their spots in sixth and seventh place were state-owned enterprises China Overseas Land & Investment with RMB 346.7 billion in sales and Shanghai Greenland Group with notched RMB 261 billion in contracts.

Leading Players Under Pressure

In the broader market, China’s top 100 developers recorded contracted sales attributable to shareholders of RMB 88.8 trillion in 2021, down 6 percent from the year before, according to CRIC.

Operating sales for the top 100 totalled RMB 11.1 trillion in 2021, down 3.5 percent from a year earlier but up nearly 10 percent from pre-COVID 2019. In common with Evergrande, the top 100 on average experienced surging sales in 2021’s first half relative to the pandemic-struck year-earlier period, followed by a sharp downturn in the year’s final months as the scale of the crisis in China’s real estate market came into full view.

For the first time, the pressures of China’s slowing housing market hit home for even the largest players in 2021, with sales by the top 10 developers totalling RMB 3.34 trillion for the year, which was down 10.3 percent from a year earlier. In 2020 the top 10 developers had signed contracts for RMB 3.70 trillion in homes, which represented a 12.8 percent increase over the 2019 figure.

Leave a Reply