These guys will need to clear some inventory in 2015

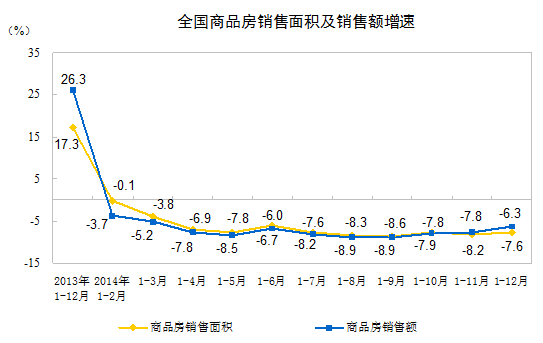

China’s new housing sales fell in value by 7.8 percent in 2014 driven by a decrease in sales and rising inventories of unsold homes.

According to a report released this week by China’s National Bureau of Statistics, sales of new homes in terms of total space sold were down still further, by 9.1 percent last year compared to 2013, totalling a still staggering 1.05 billion square metres nationwide.

The official figures did show some improvement in sales for December compared to the first 11 months of the year. However, despite the growing number of transactions, the country’s real estate developers may continue to struggle as inventories of unsold homes grew even faster, reaching a record 407 million square metres by year end.

Sales Began to Recover in December – Still Down for the Year

While the bureau does not release sales and investment figures for each month, the full year figures this week showed home sales beginning to improve in December, compared to the results for the first eleven months of the year.

| Indicator | Type | RMB Bil | % Chg/2013 |

|---|---|---|---|

| Investment in Real Estate | All | 9504 | 10.5% |

| Residential Building Investment | Residential | 6435 | 9.2% |

| Office Building Investment | Office | 564 | 21.3% |

| Retail building investment | Retail | 1435 | 20.1% |

| Sales of Buildings by Value | All | 7629 | -6.3% |

| Sales of Residential Buildings by Value | Residential | 6240 | -7.8% |

| Sales of Office Buildings by Value | Office | 294 | -21.4% |

| Sales of Retail Buildings by Value | Retail | 891 | 7.6% |

| Value of Land Transactions | 1002 | 1.0% | |

| Funding Sources for Real Estate Development Companies | 12199 | -0.1% | |

| Funding From Domestic Loans | 2124 | 8.0% | |

| Funding From Foreign Investment | 64 | 19.7% | |

| Self-Funding | 5042 | 6.3% | |

| Other Sources of Funds | 4969 | -8.8% | |

| Deposits and Advance Payments | 3024 | -12.4% | |

| Personal Mortgages | 1367 | -2.6% | |

| Source: NBS and Mingtiandi |

In terms of square metres of homes sold, sales were down by 9.1 percent for the full year, compared to 2013. However, this full year total is more encouraging for the industry than the 10.5 percent drop-off that China’s developers were looking at in November compared to the first eleven months of the previous year.

| Indicator | Type | Mil Sqm | % Chg/2013 |

|---|---|---|---|

| Floor Space Under Construction | All | 7265 | 9.2% |

| Residential Buildings Under Construction | Residential | 5151 | 5.9% |

| Office Buildings Under Construction | Office | 299 | 21.8% |

| Retail Buildings Under Construction | Retail | 943 | 17.0% |

| Floor Space of New Construction Starts | All | 1796 | -10.7% |

| Floor Space of Residential Building Starts | Residential | 1249 | -14.4% |

| Floor Space of Office Building Starts | Office | 73 | 6.7% |

| Floor Space of Retail Building Starts | Retail | 250 | -3.3% |

| Floor Space of Buildings Completed | All | 1075 | 5.9% |

| Floor Space of Residential Buildings Completed | Residential | 8087 | 2.7% |

| Floor Space of Office Buildings Completed | Office | 31 | 12.7% |

| Floor Space of Retail Buildings Completed | Retail | 121 | 11.3% |

| Floor Space of Buildings Sold | All | 1206 | -7.6% |

| Floor Space of Residential Buildings Sold | Residential | 1052 | -9.1% |

| Floor Space of Office Buildings Sold | Office | 25 | -13.4% |

| Floor Space of Retail Buildings Sold | Retail | 91 | 7.2% |

| Floor Space of New Real Estate for Sale | All | 622 | 26.1% |

| Floor Space of New Residential Buildings for Sale | Residential | 407 | 25.6% |

| Floor Space of New Office Buildings for Sale | Office | 26 | 34.4% |

| Floor Space of New Retail Buildings for Sale | Retail | 118 | 26.0% |

| Land Acquisition by Area | 334 | -14.0% | |

| Source: NBS and Mingtiandi |

Not all of the sales improvement was due to discounting last month either, although the renminbi value of housing sold was down 7.8 percent in 2014, compared to 2013, totalling RMB 6.24 trillion. December actually saw China’s developers catch a positive bounce compared to the totals for the first eleven months of the year when sales values were down 9.7 percent compared to the same period the previous year.

The growth rate in overall real estate sales by floor space (yellow) and by value (blue)

Easier Financing May Be Leading to More Sales

During late November China’s central bank cut interest rates and over the last several months the country’s financial authorities have taken steps to encourage more mortgage lending at cheaper rates. The lending incentives following months of rollbacks in housing prices restrictions in earlier in the year.

The recovery in sales volumes and values correlate with the bureau’s figures on average housing prices released on Sunday which saw the month to month drop in average housing prices continue to taper last month. Including subsidised housing, average home prices fell by 0.4 percent in December, slowing down from a 0.57 percent drop. December was the eighth straight month of falling housing prices according to the bureau’s statistics.

Inventories Build to 40 Million Square Metres

Despite the December recovery in sales, China’s developers still face a major challenge as unsold inventories of new housing continued to grow to 40.68 million square metres by the end of the year. On a year to year basis, the supply of unsold homes grew more than 25 percent.

Nationwide the country added 1.35 million square metres of unsold homes last month, despite reducing the amount of new projects launched onto the market in December.

There continued to be a disconnect between housing in the pipeline and housing sales as well, with developers adding 5.9 percent more homes in progress nationwide by the end of the year, reaching 515 million square metres of homes under construction.

Land Sales Down by 14 Percent

Within this growing pipeline of housing, however, there are signs that real estate companies are becoming more selective about their projects, with less land being sold, but for higher values.

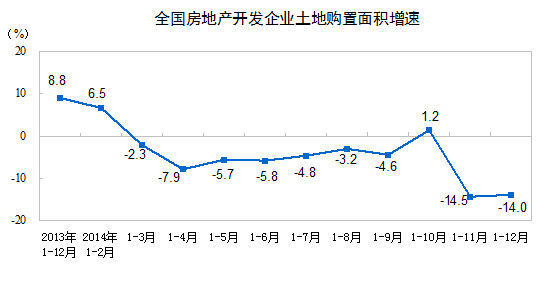

China land sales growth rate in 2014 (by area sold)

In terms of area, land sales were down by 14 percent to 33 million square metres in 2014, however, the amount paid for these sites rose by one percent to RMB 1 trillion.

The shift toward purchases of less land for more money corresponds with a movement by many developers away from China’s oversupplied smaller cities, toward first-tier cities where the housing markets are seen as more reliable.

Investment in Housing Still Grew 9.2%

Despite the lack of good news for China’s real estate developers, the property companies continued to invest in new projects, with overall investment in the industry up 10.5 percent to RMB 9.5 trillion. For the residential sector, growth was slightly slower at 9.2 percent, although it still totalled RMB 6.4 trillion for the year.

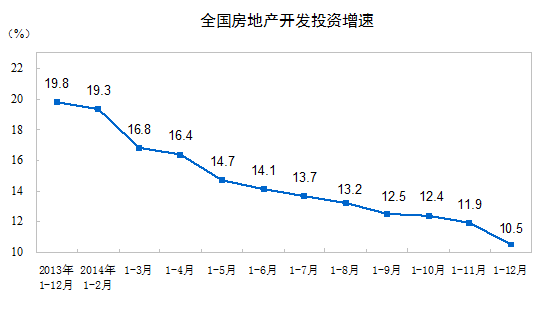

Cumulative month by month breakdown of China real estate investment growth rate in 2014

However, the residential sector appears to be losing favor rapidly in recent months as the growth rate has been tapering sharply following the first quarter.

At the end of February, China’s year to date growth rate for real estate investment still stood at 19.3 percent. By the end of November it had slowed down to 11.9 percent, and by year end, the growth rate for real estate investment last year had slowed down to just 10.5 percent over 2013.

The year-end figures show an industry still searching for a path to growth, with the current slump not likely to be resolved until housing inventories begin to shrink.

In the meantime, there are likely to be far few new project starts in emerging cities, while competition for prime sites in China’s largest urban areas continues to grow.

Leave a Reply