Housing sales in China dropped 10.5 percent during the period from January to July this year as buyers continue to wait for further price decreases and banks appear to be pulling back sharply on credit.

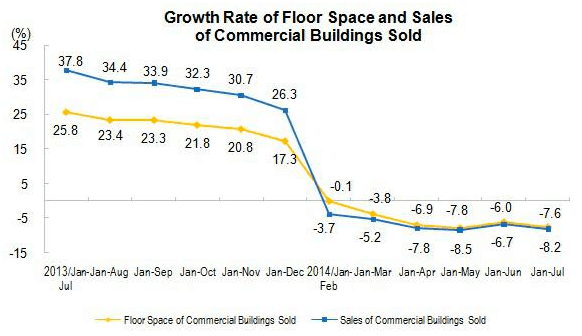

According to figures released by the National Bureau of Statistics this week, sales of new homes fell to RMB 2.98 trillion ($484 billion) during the first seven months of the year, and the quantity of real estate sold in terms of area fell 7.6 percent year on year to 564.80 million square meters. The figures exclude data for low-cost or subsidised housing projects.

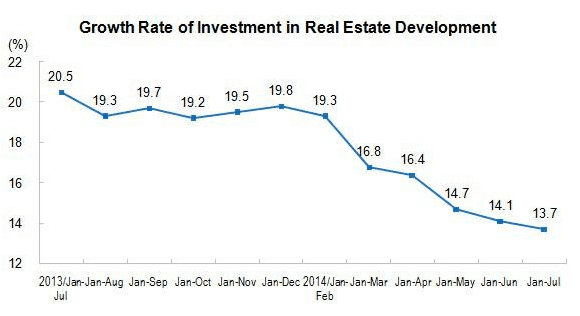

China’s real estate developers, once famous for their confidence, have also become more cautious, with the growth of real estate investment for the first seven months of 2014 slowing to 13.7 percent year on year, compared to a growth rate of 14.1 percent during the period through June.

Total investment in real estate over the period through the end of July came to RMB 5.04 billion of which RMB 3.44 billion was invested in housing projects. Investment in residential buildings was up by 13.3 percent during the period, down from a 13.7 percent year on year growth rate during the first six months.

Home prices have been headed down across China for the last few months, and according to a survey of 288 cities by E-House’s China Index Academy, home prices fell 0.13 percent on average during July to RMB 10,835 ($1753) per square metre.

Policy Changes Not Yet Having an Impact

So far during 2014 more than 30 cities in China have lifted or loosened the home purchase restrictions put in place during 2011 and 2012, but so far these policy changes have not brought a rebound in sales.

Some analysts speculate that the lifting of the home purchase restrictions may have helped to slow the fall in housing prices by luring more buyers back into the market, but for now many potential new homeowners seem content to wait and see if prices fall still further this year.

Slowing Credit a Growing Issue

Despite some recent moves by the government to encourage mortgage financing for first time home buyers, the People’s Bank of China revealed yesterday that lending slipped sharply in July to RMB 385 billion yuan ($62.58 billion), down approximately 65 percent compared to June.

Although July is traditionally a slower month than June, the broader liquidity measure of aggregate financing also slid sharply last month, down reached 273.1 billion yuan, down 87 percent from June’s level of RMB 1.21 trillion, and the lowest level since 2009.

A People’s Bank official was cited by the AFP as attributing the drop in lending to the real estate market “undergoing some adjustments” and “downward pressure in the domestic economy.”

In a recent survey of Chinese real estate developers by Standard Chartered, the vast majority of respondents said that it was more difficult to borrow money from banks now than it was three months ago, and trust financing was also seen as more challenging to obtain.

Leave a Reply