New World Development agreed to pay RMB 4.1 bil for a Shanghai site last month

After a gruesome start to the year, home sales in China continued to climb in August, and the country’s developers are responding by pouring more money into the sector, according to official data published this week.

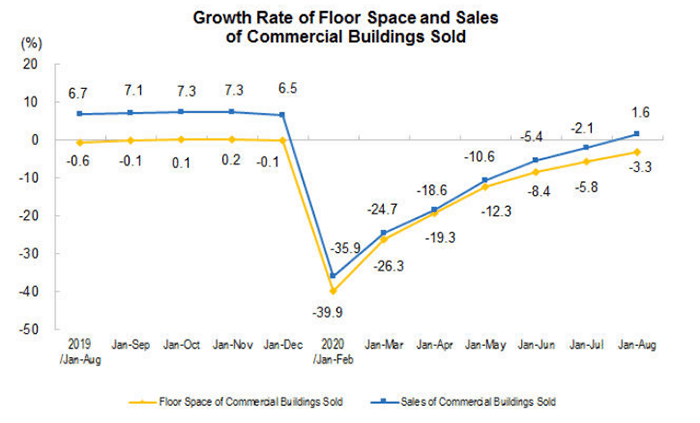

Sales of new real estate on the mainland, primarily housing, grew by 1.6 percent in August compared to the same month last year, with the value of new homes sold during 2020 reaching nearly RMB 9.7 billion, according to the National Bureau of Statistics. August brought the sixth straight month of growth in the home business after the market came to a near halt in January and February during the coronavirus pandemic.

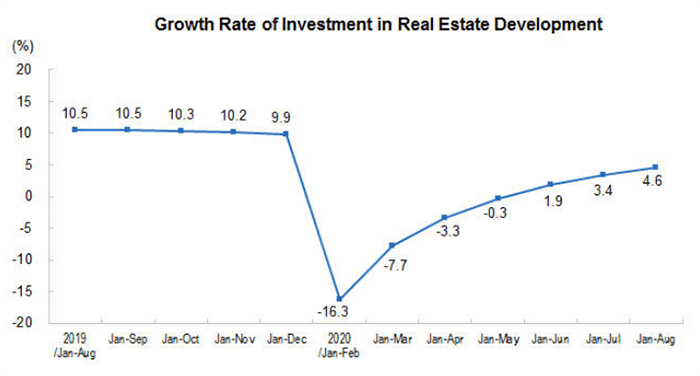

The nation’s builders reacted to the upswing in housing demand by investing RMB 8.84 trillion ($1.3 trillion) into real estate development across the country during the first eight months of this year, according to the government data. That amount was 11.8 percent more than the investment level in August 2019, and the quickest rate shown in the official data in 16 months.

Despite the upturn in the residential sector, however, both investment and sales were down in the commercial segment, with developers remaining wary of new office and retail projects.

Home Prices Rise 0.6%

Home buyers in China scooped up RMB 1.55 trillion in new housing during August, according to Mingtiandi calculations based on government data, with that amount up by 6.4 percent compared to the RMB 1.45 trillion sold one month prior.

Source: National Bureau of Statistics

That increase in sales only nudged housing costs up fractionally, however, with the average cost of homes across 70 cities tracked by the Statistics Bureau up by 0.6 percent compared to July. That rate was up by 4.8 percent compared to August 2019, the data showed.

Markets have been trending steadily northward since April, thanks in part to more accommodating monetary policy and relaxation of home purchase restrictions earlier in the year, as local governments and central authorities moved to ensure ongoing economic activity in the wake of the COVID-19 crisis.

Developers have also been taking steps to lure buyers into the market, with China Evergrande this month offering 30 percent discounts on new homes nationwide — the biggest sales incentive program ever by one of the country’s top builders.

Govt Clamps Down

The rebound in China’s property market already seems to be a concern for the government with the People’s Bank of China, together with the country’s primary regulator of the real estate market, last month rolling out new rules designed to restrict access to credit and reduce risks of default.

Source: National Bureau of Statistics

In a set of measures still being formalised, China’s central bank, together with the Ministry of Housing and Urban-Rural Development (MOHURD), aim to cap lending to overleveraged developers as competition at land sales has heated up since April of this year.

Executives from key developers have been called in for meetings with local authorities, with officials advising builders of the need to keep debt under control.

The government statistics released this week showed that developers raised RMB 11.7 trillion in new funding from January through August, an increase of 3 percent over the same period in 2019. Of that funding, domestic loans grew by 4.0 percent, while overseas borrowing jumped by 24.5 percent to reach RMB 10.1 billion over the period.

Commercial Suffers from Oversupply

While builders have been rushing into residential projects, enthusiasm for commercial developments has been dimmer, with RMB 3.82 trillion invested in office developments in the period from January through August. That amount was down by 1.0 percent compared to the same period in 2019.

JLL China capital markets chief Jim Yip says investors are still cautious on commercial projects

“China’s major cities are facing a strong supply cycle in the office sector, and with the impact of the epidemic on China superimposed, investors are relatively cautious in their investment sentiment,” said Jim Yip, head of capital markets for JLL China.

On the retail side, investors have been still more reluctant to commit their cash, with total investment through August of this year reaching RMB 8.21 trillion — down by 2.9 percent compared to the first eight months of 2019.

Not all developers have been staying on the sidelines, however, as Hong Kong’s New World Development last month agreed to spend RMB 4.1 billion to acquire a commercial project on Shanghai’s Huaihai Road, with a plan to develop a mixed office and retail project on the site near Xintiandi.

Just today, Shenzhen-based China Evergrande adding one more project to Shanghai’s tally for the year, when it agreed to pay RMB 2.3 billion to acquire a site for a mixed-use project in the city’s Hongkou district.

Leave a Reply