Sales of homes in sunny Sanya rose 3.7% last month

Average prices for new homes in China rose 1.2 percent in July, defying government efforts to ensure housing affordability and to clamp down on property speculation. It was the largest month-over-month increase in two years, as 67 out of 70 cities surveyed saw higher new home prices last month, according to data from the country’s National Bureau of Statistics.

Among China’s first-tier cities, Shanghai was the only city to see a dip with a 0.1 percent decline in new home prices. It saw the same decline in prices for second-hand homes, but this may only signify changes in the types of homes people bought in July.

“Key cities such as Shanghai are still highly sought after, though restrictions in buying and availability of credit has softened the effective demand for the time being,” said James Shepherd, head of research for Greater China at property consultancy Cushman and Wakefield. The dip in average home prices in the city was more likely the result of changes in the types of transactions, such as the sale of a large number of lower-priced homes, he said.

Buyers and Builders Flock to Mid-Sized Cities

The lull might be temporary, but efforts from the Ministry of Housing and Urban-Rural Development (MOHURD) to crack down on “chaos in the real estate market” in 30 cities since June 28 have been felt most keenly in China’s largest cities. Banks in these cities have raised mortgage rates and taken other steps to reduce the flow of credit to the real estate sector.

New home prices in the tier one cities of Beijing, Shanghai, Guangzhou and Shenzhen, as well as in another 15 urban hubs crowned last year as “New Tier One Cities”, rose by less than a percent from the end of June.

In tier two and tier three cities, new home prices rose 1.4 and 1.5 percent respectively during July. Only for homes in the fourth tier cities included in the survey did average prices increase more slowly over the last month than those in tier one cities.

Policy Changes Drive Sales Away From Mega-Centres

Cushman & Wakefield’s Shepherd sees policy changes driving sales from mega-cities

“This is due in part to the tighter policy enforcement in major cities as some capital flows to nearby cities,” Shepherd said. “Another important driving force is ongoing urban renewal where relocated residents look to reinvest compensation they have received.”

Six weeks after the original MOHURD notice, 14 cities had reportedly already taken action with rest expected to soon follow suit. Of those 14, nine are first tier cities.

One national program that allowed local governments to borrow money to tear down older homes and offer subsidies to families buying new ones favored smaller cities where this activity was more common. However, that shanty town redevelopment support might soon be coming to an end.

Now that support for governments to compensate residents displaced by new projects appears to be ending, which could have an impact on the market, according to Shepherd. “With further policy on the horizon, rapidly rising home prices should be controlled,” he said.

Hainan Attracts Developers as Home Prices Leap

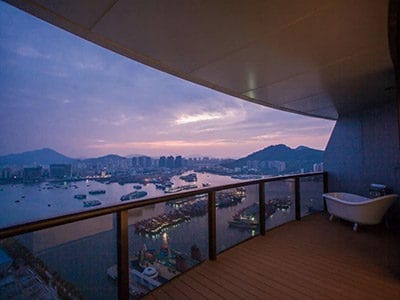

The city with the largest gain in July, at 3.7 percent, was Sanya on the tropical island of Hainan. The other urban centre on the island province often referred to as “China’s Hawaii”, Haikou, saw an above-average 2.3 percent gain.

A recent government decision to turn Hainan into China’s largest free-trade zone and attract more foreign tourists have driven demand for projects on the island, where real estate development accounts for 36 percent of the province’s GDP.

Haikou is among the 14 cities already reported to have started taking action on the MOHURD dictate. The Hainan Provincial Housing and Construction Department is also seeking to combat high housing prices.

The province has proposed building public rental housing and restricting the sale of commercial housing, shared housing and rental housing. The proposal includes renovating property in poorer areas, as well.

Leave a Reply