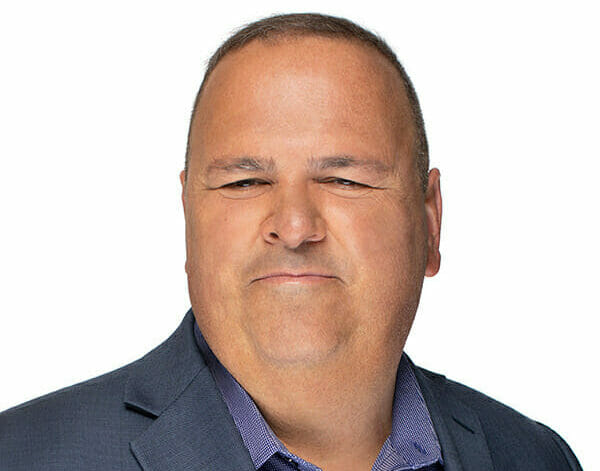

Stephen McLennan, Ontario Teachers’ Pension Plan (Image: Ontario Teachers)

Testifying last week in front of a Canadian parliamentary committee investigating the country’s relationship with China, leaders of two of Canada’s largest public pension funds said they have paused direct mainland investments as tensions rise between Beijing and Ottawa.

Stephen McLennan, who leads fund management for the Ontario Teachers’ Pension Plan, told the Committee on Canada-China relations that the C$247 billion ($183 billion) pension fund has trimmed its portfolio allocation to China to just 2.3 percent, and the parent organisation of property investment arm Cadillac Fairview has paused further mainland investment.

British Columbia Investment Management Corp (BCI), which manages C$211 billion in assets and invests in real estate through its QuadReal Property Group, has made a similar decision to pause further investments in China, the organisation’s executive vice president and global head of public markets, Daniel Garant, told the same panel.

“The reason for the pause was driven by our assessment that the risk landscape in China has substantially changed over the last two to three years,” McLennan said during the hearing. “Those all to us signalled that there was a change in risk profile… and as risk increases, we need to reevaluate how much exposure we wanted to have in China from a top down perspective.”

Attendees at the hearing also included representatives of the Canada Pension Plan Investment Board (CPPIB), Caisse de dépôt et placement du Québec (parent organisation of Ivanhoe Cambridge) and the Public Sector Pension Investment Board. The meeting on 8 May came just hours after the Canadian government declared a Chinese diplomat persona non grata for involvement in a scheme to intimidate the Hong Kong relatives of one of the committee’s vice chairs.

China Exposure Examined

McLennan pointed to the changing post-COVID economic environment, recent regulatory changes in China and the continued deterioration of the country’s relations with the US and Canada as the main factors that drove Ontario Teachers’ to rethink its strategy.

Daniel Garant of BCI and Quadreal

“We will continue to responsibly manage our existing investments in the country,” he told the lawmakers.

Ontario Teachers last year was among a group of investors that joined a $505 million fundraising round for Asia Pacific data centre platform Princeton Digital Group, with that firm listing China as among its target markets, alongside India and Singapore.

Through Cadillac Fairview, the pension fund giant in mid-2021 committed $400 million to Hines Asia Property Partners, with US developer Hines citing China as one of the top-tier markets targetted by its flagship Asia investment vehicle.

While Garant, who sits on Quadreal’s board, did not elaborate on BCI’s portfolio allocation to China, the executive was questioned by policymakers about the firm’s investment in mainland video camera maker Hikvision through an index fund, as the firm has already been accused of providing surveillance tools used for facial recognition and policy of Uyghurs and other ethnic groups in Xinjiang.

Garant responded that he could not comment specifically on BCI’s backing of Hikvision, as it is involved via a passive investment, but said that the pension fund is already working with the index provider regarding the composition of the index.

Quadreal Changes Tack

Just two years ago BCI’s Quadreal moved to expand its China investments when it set up a $1-billion partnership with Chinese logistics platform New Ease in March 2021 aiming to build a portfolio of warehouses in top-tier mainland cities.

Later that year the Vancouver-based firm exited a portion of its mainland portfolio when it sold a set of four warehouses to Singapore-listed CapitaLand China Trust for RMB 1.68 billion (then $260 million)

More recently, Quadreal has been investing in real estate ventures in other parts of Asia, including a $1 billion Korean logistics development joint venture it formed with IGIS Asia Investment Management late last year.

CPPIB Prioritises Returns

Canada’s largest pension fund manager, CPPIB has 9.8 percent of its C$500 billion in assets under management invested in Canada and told the panel it is not ready to walk back its bets on the world’s second largest economy.

Michel Leduc of CPPIB

“Exposing the fund to Chinese markets gives us access to one of the world’s largest and fastest-growing economies,” Michel Leduc, senior managing director and global head of public and corporate affairs for CPPIB told the committee.

Leduc said that real estate, particularly the multi-family sector, is one of CPPIB’s top three sectors in China after consumer discretionary and logistics.

While praising the investment benefits of the Chinese market, Leduc said CPPIB is aware of significant risks involving social issues and geopolitical concerns.

“We recognize that any investment in China needs to be handled with care, sophistication and an acute understanding of the current political and geopolitical environment,” he said, noting that there are tools and systems in place to assess and monitor both active and passive holdings of CPP Investments in China and other countries as well.

Canada’s second-largest pension fund, Caisse also pointed to the benefits of Chinese investments while vowing to manage risk.

“We see China as a market that contributes to our diversification and our depositors’ long-term performance,” Vincent Delisle, Caisse’s executive VP and head of liquid markets told the committee. “We know that the environment investors must navigate is complex because of significant geopolitical tensions, so we take a cautious and measured approach.”

With C$402 billion in assets under management, Deslisle told the committee that Caisse’s PRC exposure constituted not more than 2 percent of its global portfolio as of February.

Tensions Rising

The parliamentary hearing where the pension funds testified came amid a growing wave of reports of rising Canada-China tensions.

Canada expelled Chinese diplomat Zhao Wei on 8 May on allegations that he attempted to target the family of lawmaker Michael Chong. China responded a day later by ordering a Canadian diplomat in Shanghai to leave the country by 13 May.

Prime Minister Justin Trudeau said on 9 May that Canada will not be intimidated by China’s retaliation in the diplomatic spat, according to media reports.

Leave a Reply