Source: ANREV 2024 Investor Intentions Survey

Investors in Asia Pacific are more likely to boost their real estate exposure over the next two years than investors in other regions, with industrial and residential assets in Japan and Australia among their top targets, according to the results of a survey published on Wednesday.

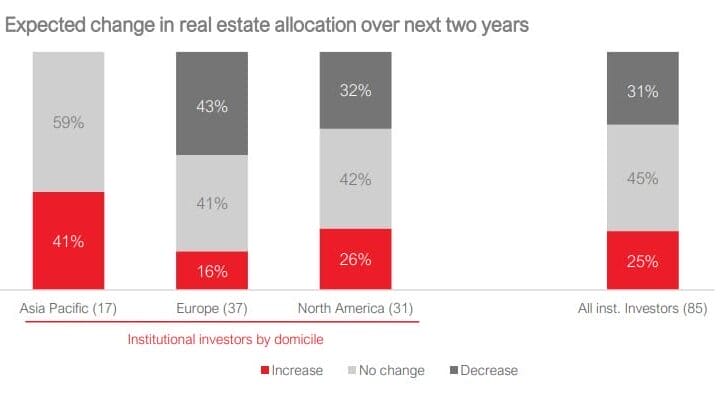

Some 41 percent of Asia Pacific investors expect to increase their allocations to real estate between 2024 and 2026, compared with 26 percent and 16 percent for their North American and European counterparts, according to the 2024 Investment Intentions Survey published Wednesday by the Asian Association for Investors in Non-Listed Real Estate Vehicles (ANREV).

Japan and Australia topped the list of preferred investment locations in Asia Pacific among institutional investors polled by the Hong Kong-based non-profit organisation, while industrial and residential were the top sectors. On a combined city and sector basis, Tokyo industrial and Sydney residential tied for the top spots with 59 percent of investors favouring those strategies.

Asia Pacific investors also stood out as having the most risk appetite globally, with 63 percent of investors opting for value-added strategies in 2024 — the highest level since 2014.

“The 2024 Investment Intentions Survey is reflecting institutional investors’ penchant for high returns as we look past a challenging 2023,” said Amelie Delaunay, ANREV’s director of research and professional standards. “Notably, institutional investors are shifting their investment preference towards value added style in Asia Pacific, while it is unsurprising to observe the Japan market being favoured by investors as an institutional safe haven amid a high interest rate environment.”

The annual survey is a collaboration between ANREV, its European counterpart INREV and US-based pension fund trade group Pension Real Estate Association (PREA), which together serve the property investor community.

Beds and Sheds

This year’s survey garnered responses from 90 participants across 19 countries, of which 85 were institutional investors and five were funds of funds managers. Of the 90 respondents, who manage a combined $897.7 billion in real estate assets, 17 were based in Asia Pacific.

Amelie Delaunay, ANREV’s director of research and professional standards

The poll showed investors gravitating toward Japan and Australia, with Tokyo and Osaka as the most favoured investment destinations, with 85 percent and 70 percent of respondents respectively preferring those locations. Sydney tied with Osaka for second place, followed by Melbourne with 67 percent.

Seoul rounded out the top five locations with 59 percent choosing the Korean capital, while Singapore notched 33 percent. Tier-one cities in mainland China garnered 19 percent, while Hong Kong and India each attracted 11 percent of respondents.

By sector, industrial and residential were preferred by 93 percent and 85 percent of investors respectively. Office was the third most-favoured sector, but did not rank in the top 10 on a combined city and sector basis.

Growing Risk Appetite

The survey showed Asia Pacific as the only region with no investors planning to decrease real estate allocations over the next two years. This contrasts with a respective 32 percent and 43 percent of investors in North America and Europe expecting to trim their property exposure.

Asia Pacific investors are increasingly embracing higher risk strategies, with 21 percent liking opportunistic investments in addition to the 63 percent opting for value-added. Just 16 percent of respondents preferred a core strategy in the region.

Non-listed real estate funds and private REITs ranked as the top vehicle of choice for investors increasing their allocation to the Asia Pacific region, followed by joint ventures and club deals. Non-listed debt assets also grew in attractiveness, rounding out the top three investment avenues for the first time.

On a global level, diversification was ranked as the most important rationale for real estate investment within a multi-asset portfolio, while interest rate policy, inflation and geopolitical risk are the top factors potentially affecting property investment decisions this year.

The survey also showed that real estate investors are increasingly considering ESG factors when making investment decisions, with 79 percent of respondents opting to assess ESG characteristics before investing in non-listed real estate funds.

Leave a Reply