Only two days after China’s government announced a new free trade zone in Guangdong province, a US real estate developer paid a record RMB 13.4 billion (US$2.21 billion) for a site in Shenzhen.

The land acquisition by Silverstein Properties, which bid jointly with Chinese partner Qianhai International Energy Financial Center, marked the first purchase of land in the Qianhai special economic zone by a foreign real estate firm.

The Qianhai zone has been promoted as a “mini-Hong Kong financial hub, however, until the new free trade zones were announced, the project had yet to catch on with foreign investors.

China Free Trade Zones Already Sparking Investor Interest

Three months ago, China announced a new free trade zone for Shanghai, with the understanding that this new economic area would allow for more liberalised economic controls, and allowing free trading of the yuan currency in the zones had been widely discussed.

On Wednesday last week, the official Xinhua news agency announced that Guangdong and Tianjin had also been approved to roll out new economic zones similar to what Shanghai has underway, and the two new projects are expected to be launched within a year.

Record RMB 28,092 Per Square Metre

The Silverstein bid set a record for the most expensive plot of land ever sold in Shenzhen, where housing prices have been rising in double-digits for much of the last year. According to a report in the South China Morning Post, the finished project will have a gross floor area of 477,000 square metres, including 303,310 square metres of office space.

The 51,416 square metre lot is approved for mixed-use development, and the price paid worked out to RMB 28,092 per square metre of GFA.

Silverstein Properties is best known for being the developer for the World Trade Center in New York, and the company also has joint ventures in Europe, Asia and the Middle East.

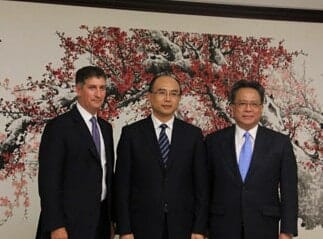

The discussions between Silverstein and the local government have been underway for some time, with the company’s CEO having met with the Shenzhen mayor in Qianhai during July last year.

Leave a Reply