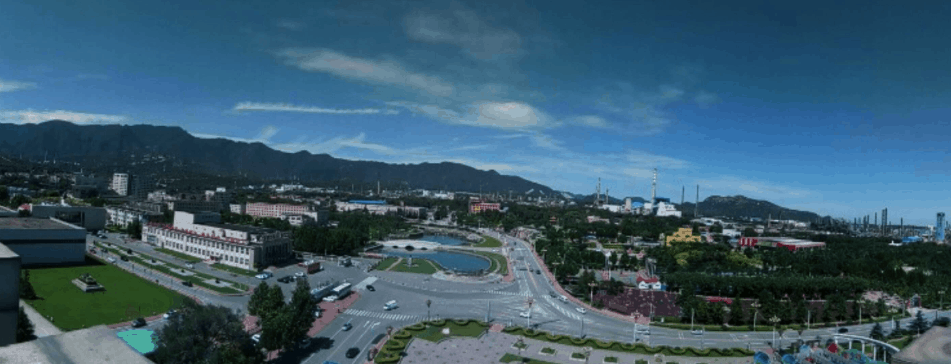

Bejing’s Fangshan district is becoming a residential development hotspot

Shimao Properties, mainland China’s eleventh largest developer by contracted sales, has agreed to pay RMB 850 million ($115 million) for a residential site in Beijing, according to the city’s Land Bureau.

The Hong Kong-listed developer controlled by tycoon Hui Wing Mau won the 57,400 square metre (617,848 square foot) site in southwest Beijing’s Fangshan district after agreeing to tender conditions that require housing developed on the property to be offered for sale on shared ownership basis as mainland authories continue to push for housing affordability in China’s major cities.

Shimao’s winning bid edged out a competing offer from local government firm Fangshan New Town Investment Ltd and came at a premium of 10.4 percent over the auction reserve price after 15 rounds of bidding between the two companies.

Capping Prices to Take the Heat out of the Market

With up to 35,800 square metres of the site eligible for construction, the development, which has a plot ratio of 2.15 can yield up to 68,400 square metres of housing, making Shimao’s purchase price equivalent to RMB 12,392 per square metre of saleable homes.

Shimao president Jason Hui is targeting the Beijing suburbs with a shared ownership venture

As a condition of the tender, the Shanghai-based developer is also required to build a nine-room kindergarten, which is to be handed over to the local education authority free of charge upon completion, and which will bring the total built area of the project to 71,600 square metres.

The development, which is capped at a height of 30 metres, must also retain 30 percent of the site area for greenery.

Units in the project are to be sold under China’s shared ownership housing model, where qualified homebuyers choose to pay between 50 percent and 95 percent of the property value, with the government retaining the remaining equity.

In line with Beijing’s prevailing practice of capping home prices, the terms of the land tender also set the tariffs on sales of the furnished units at RMB 29,000 per square metre, with the developer allowed to adjust that rate by five percent up or down depending upon the home’s position within the project.

Targeting the Suburbs

Shimao’s new plot neighbours the Liangxiang Campus of the Beijing Institute of Technology and is about two kilometres from both the Guangyang City and Liangxiang University City metro stations.

In purchasing the site 30 kilometres southwest of Tiananmen Square, Shimao has targeted a suburban area which has recently welcomed a number of new housing projects as China’s capital continues to sprawl outwards.

Among these new developments in Fangshan – which is well known as the site of the Peking Man archaeological discoveries – is Beijing-based Hanjian Group’s Mountain View and Shimao’s own La Villa, where second-hand units are currently available for between RMB 36,000 to RMB 45,000 per square metre.

Shimao Adds to Land Bank as Smaller Developers Struggle

With a land bank totalling 64 million square metres in mainland China, Shimao added 14 million square metres of that pipeline within the first six months of this year.

In addition to purchasing sites at government auctions, over the course of 2019, Shimao has picked up several sites from cash-strapped Tahoe Group as well as buying stakes in some of the rival developer’s residential and resort developments. Seven months ago, Shimao bought a 49 percent stake in a mixed-use project in Hangzhou, the capital of China’s Zhejiang province, from Tahoe for RMB 928 million.

During the period from January through September, the builder recorded contracted sales of RMB 173.99 billion, which represents an increase of 44 percent compared to its performance over the same period in 2018.

Leave a Reply