Sun Hung Kai’s site above the West Kowloon rail station is the biggest ever sold in Hong Kong

Less than two months after purchasing a West Kowloon project for HK$42.23 ($5.4 billion) Sun Hung Kai Properties is reported to have found a partner to join in building the largest commercial tower on the peninsula.

Ping An Real Estate plans to buy one of three office buildings to be built on the 59,746 square metre (643,100 square foot site), according to sources close to Sun Hung Kai and Ping An who spoke with Mingtiandi on condition of anonymity.

The reported deal, which has yet to be announced by the parties involved, provides Sun Hung Kai with the backing of an insurance group which had more than RMB 300 billion ($43.74 billion) in assets under management in 2017 as it builds the 294,000 square metre project above the West Kowloon high speed rail terminus.

Taking One-Third of Kowloon’s Largest Office Project

While plans have yet to be submitted for the combined retail, office and hotel project, the three towers planned for the development are expected to have a total of 261,600 square metres of office space, account for around 89 percent of the complex’ gross floor area.

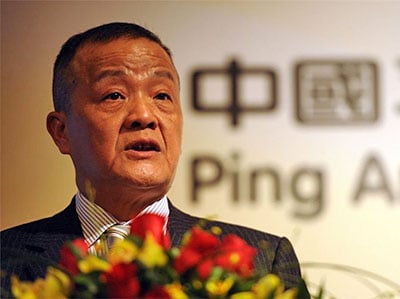

Ping An Group chairman Ma Mingzhe is expanding his relationship with SHK

Sun Hung Kai had won the rights to the largest plot of land ever sold in Hong Kong at a government land auction on 27 November, scooping up the prime commercial site at around 58 percent less than analysts had projected seven months earlier, after tighter lending conditions on the mainland and social unrest in the Asian economic hub had cooled the city’s property market.

Discussions regarding the details of the cooperation, including the amount of equity to be invested and the nature of the assets included in the sale are understood to be ongoing.

By the time of publication, neither Sun Hung Kai, nor Ping An Real Estate had replied to inquiries from Mingtiandi regarding the planned cooperation, which was first reported by Hong Kong’s Apple Daily.

Family Comes First at Sun Hung Kai

At the time that it won the tender for the West Kowloon site, Sun Hung Kai declared that, “The Group intends to invite other long term strategic investors to participate in the development to pool additional and diversified resources and concepts for the project.”

In mid-December Hong Kong’s most valuable listed developer, revealed the first of these strategic investors with an announcement that an investment firm owned by the Kwok family, which holds a controlling stake in the company, had purchased a 25 percent stake in the office portion of the West Kowloon project for HK$9.4 billion.

The retail portion of the project will continue to be wholly owned by Sun Hung Kai.

In the announcing the stake sale to the Kwok family, the developer noted that, “SHKP will continue to seek other suitable long-term strategic investment partners to pool additional resources to add value to the project.”

Sun Hung Kai, which cooperated with Henderson Land Development to build the 437,000 square metre IFC complex in Central district, was the sole developer of Kowloon’s 274,064 square metre ICC, which will connect to the new West Kowloon project underground.

Growing a Relationship with a Top Insurer

The decision by Ping An, which is among China’s five largest insurers, to invest in Sun Hung Kai’s Kowloon prize comes around six months after the developer had formed a mainland joint venture with the insurance giant to win a mixed-use project in Hangzhou.

The two partners paid a land premium of RMB 13.26 billion for the right to develop 857,700 square metres of commercial and residential space in the city’s Jianggan district, according to a notice by the Bureau of Planning and Natural Resources in the capital of Zhejiang province at the time.

Ping An chairman Ma Mingzhe is reported to have a close relationship with Wu Xiangdong, the former head of Shenzhen-based China Resources Land who this year became the first mainlander to join the board of Sun Hung Kai when the company appointed him as an independent non-executive director on 28 August.

Ma, whose company, now holds over 25 percent of Beijing-based China Fortune Land Development, is said to have been influential in persuading Wu to join the developer in March this year, where he now serves as co-chairman.

The rich get richer, no good will come of it