CR Land’s Wei Shaofan submitted the only mainland bid

Hong Kong developers dominated the bidding for a residential site in the city’s Wong Chuk Hang area that is expected to sell for up to HK$10 billion (US$1.28 billion).

The tender for the 600-home site adjacent to the Wong Chuk Hang MTR station on the south side of Hong Kong Island closed last Friday after attracting 10 bids, with Shenzhen-based property giant China Resources Land the only mainland firm to enter the fray.

The city’s mass transit operator invited bids for the site in early November, after selling the first phase of the same housing development this past February to a joint venture between China’s Ping An Real Estate Capital and Hong Kong’s Road King Infrastructure for an estimated HK$8 billion to HK$9.8 billion.

MTR Site Could Sell for $1.28B

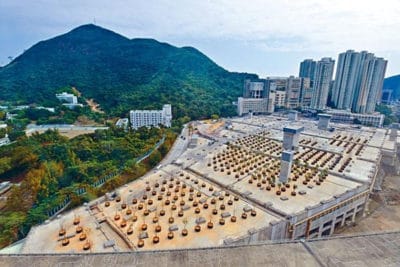

The parcel, Wong Chuk Hang Station Package Two, is earmarked for a development spanning up to 492,990 square feet (45,800 square metres), and forms part of a larger residential scheme adjoining the metro station, which opened with the rest of the South Island Line last December.

A piece of the Wong Chuk Hang development site (at the upper right corner) collected 10 bids

The overall development at Wong Chuk Hang is envisaged by MTR Corporation to provide a total of about 4,700 flats across 14 towers with a gross floor area of 357,000 square metres.

Package Two has a land premium of HK$5.2 billion ($666 million), equating to HK$10,576 ($1,355) per square foot – 30 percent higher than that of the adjacent Package One – and is expected to fetch a total of HK$9.86 billion, according to news portal Sina. The project is due for completion by 2023.

The Hong Kong-listed infrastructure firm plans to tender out a third housing site at Wong Chuk Hang by March of next year. The first parcel, which is planned to yield as many as 800 apartments totalling 576,950 square feet, was picked up in February for an undisclosed price estimated to range from HK$8 billion to HK$9.8 billion ($1.26 billion) – or up to HK$17,000 per square foot for the land.

Mainland Builders (Mostly) Stay Away

Nine Hong Kong developers bid on this latest parcel, including Li Ka-shing’s CK Asset Holdings, Chinachem Group, Great Eagle Holdings, Henderson Land Development, New World Development, Sun Hung Kai Properties, Wheelock and Company, and a joint venture between Sino Land and Kerry Properties.

The sole mainland contender, China Resources Land (CR Land), notched a major win further north on Hong Kong Island this year, when the state-run firm shouldered aside the Gaw family to pick up a residential site in Central for HK$1.1 billion ($140.9 million) in July.

A victory by one of CR Land’s Hong Kong rivals would buck a 2017 trend whereby deep-pocketed mainland groups have snapped up the vast majority of residential sites on offer in the city. Non-local developers accounted for 96 percent of the land value of residential site transactions in Hong Kong this year, according to a report by international brokerage Colliers late last month.

However, Hong Kong’s Sino Land already countered that trend in July by outbidding dozens of rivals to buy a waterfront residential site in Ma On Shan for $1.38 billion ($176.7 million). The same developer later joined with local rivals Wheelock, K Wah International and SEA Holdings, as well as mainland developer Shimao Property, to win a waterfront housing site in Cheung Sha Wan for HK$17.28 billion ($2.21 billion) at a government auction last month.

Leave a Reply