S. Iswaran (left) and Ong Beng Seng (right) with F1 Group CEO Stefano Domenicali (Source: S Iswaran Facebook)

Ong Beng Seng, co-founder and controlling shareholder of SGX-listed Hotel Properties Ltd (HPL), has been arrested and was requested by Singapore’s anti-graft agency to provide details regarding his interactions with Transport Minister S. Iswaran, who has been put on leave and asked to stay in the country as part of a corruption investigation.

Ong is fully cooperating with the Corrupt Practices Investigation Bureau (CPIB) and has already provided the agency with requested information, according to a disclosure by HPL to the local bourse Friday. No further details were shared regarding the arrest, but HPL said that the 77-year-old tycoon is already out on bail of S$100,000 ($75,735) and no charges were filed against him.

The company, which owns 38 hotels and resorts across 15 countries, said its nominating committee deemed Ong as “suitable to carry out his duties and responsibilities” as its managing director, although shares in the company sank by as much as 6.7 percent following news of his arrest.

Prior to the legal tangle, HPL has been busy recalibrating its portfolio in Singapore with the sale of its seven shop units in Ming Arcade in a collective sale last December and a potential mega-redevelopment project involving a trio of properties along Orchard Road.

Unhappy Investors

Ong, who held 60.47 percent of HPL’s shares as of June, was scheduled to travel Friday and will be surrendering his passport to the CPIB upon his return to Singapore, the company said.

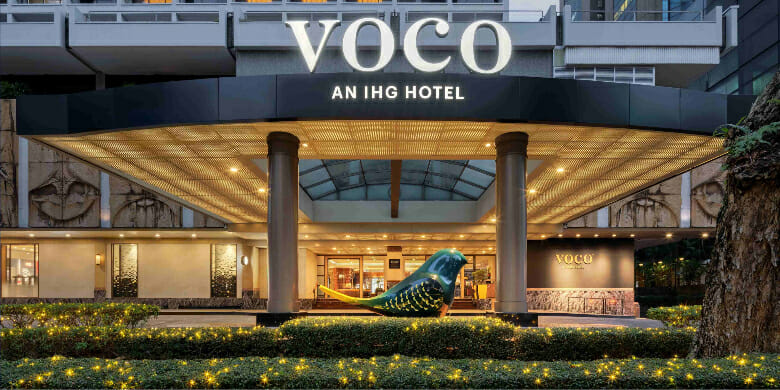

HPL’s 38-asset portfolio includes Voco Orchard Singapore Hotel. (Source: HPL)

“The board and the nominating committee will continue to monitor the progress of the matter and the nominating committee will continue to re-assess the suitability of the continued appointment of Mr Ong,” it added.

In an announcement on Wednesday, the CPIB said S. Iswaran is assisting the bureau with an investigation into a case, although no further details were disclosed. Prime Minister Lee Hsien Loong later that day asked the Transport Minister to take a leave of absence until the investigations are completed.

The CPIB stressed that Singapore has a strict zero-tolerance policy on corruption and the bureau will “not hesitate to take action against any parties involved in corrupt activities.” The city-state was ranked as the fifth-least corrupt country in the world and the only Asian nation to be included in the top 10 of the latest Transparency International Corruption Perceptions Index.

Ong’s involvement sent HPL’s stock price down to S$3.60 per share at the start of the trading session on Friday from its S$3.86 close on Thursday. The company’s shares recovered slightly and ended the week at S$3.75 apiece, still down 4 percent from a week earlier.

Ong’s involvement in the political scandal comes two decades after HPL was reportedly found to have given the late Singapore leader Lee Kuan Yew and his son unsolicited discounts of 5 to 12 percent discounts on their purchase of two pairs of luxury condos in the Nassim Jade condominium project in District 10 and the Scotts 28 complex in District 9.

The company was called out by stock exchange regulators for withholding details of the discounts, the sum of which were later on donated to charity according to an account by the Straits Times.

Orchard Road Project on Way

HPL’s core business is a 38-asset hospitality portfolio spread across the Asian destinations of Bhutan, Indonesia, Maldives, Seychelles and Thailand, as well as in Italy, South Africa, Tanzania, the United Kingdom and Vanuatu in addition to its home city.

The hotels are operated under brands including COMO Hotels & Resorts, Four Seasons Hotels & Resorts, InterContinental Hotel Group and Marriott International.

In May 2022, HPL teamed with a consortium dominated Temasek Holdings-backed Mapletree Investments and CapitaLand in a S$3.9 billion takeover of the real estate business of Singapore Press Holdings after a bidding war with Keppel Corporation.

Last month the company was reported to have proposed redeveloping its three adjacent properties at Orchard Road and Cuscaden Road in Singapore.

After filing a request to rezone the site of it Voco Orchard hotel to allow commercial use early last month, property analysts have speculated that the group will redevelop the three adjacent properties into a large-scale luxury development project.

The 423-key hotel, together with the Forum mall and HPL House, have an estimated existing gross floor area of 150,000 square feet (13,900 square metres) in total, with the combined site having the for redevelopment as a mixed-use project of up to 700,000 square feet, according to a note by DBS Group Research.

Leave a Reply