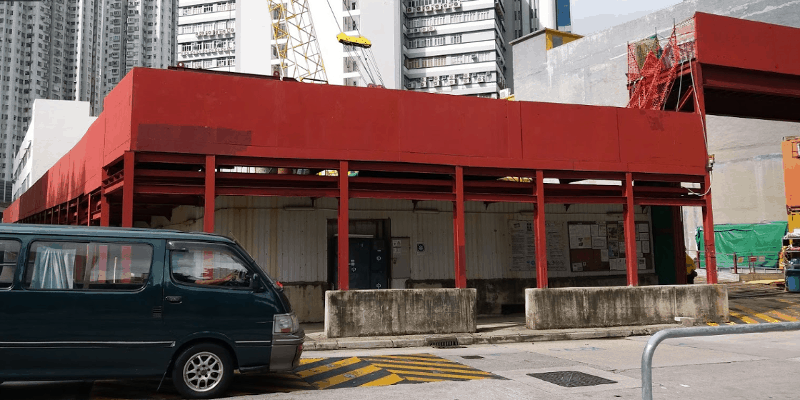

First Group Holdings plans to build a HK$1.6 billion office project on this site in Tsuen Wan

Hong Kong’s once-frenzied commercial property market is flagging as months of political turbulence take a mounting toll on the city’s economy. But a pair of recent sales in the New Territories and Kowloon totaling more than HK$1 billion show that some investors are braving the uncertainty to make significant bets on office and retail opportunities.

Hong Kong developer First Group Holdings recently acquired a site in the Tsuen Wan area of the New Territories for HK$980 million ($126 million), according to records filed last week, where the company plans to develop a grade A office building at an estimated cost of HK$1.6 billion ($305 million). The project is anticipated to be completed by 2023.

Just over seven miles to the southeast, a buyer reported to affiliated with the chairman of a Hong Kong-listed logistics operator and developer snapped up a pair of retail units in the Sham Shui Po area of Kowloon for HK$48.8 million ($6.3 million).

New Office Project in the New Territories

The Tsuen Wan site, formerly home to an old industrial building, is located at 11-15 Chai Wan Kok Street, near the intersection of Tuen Mun Road and Tsuen Wan Road. The Tseun Wan and Tsuen Wan West subway stations are located within walking distance to the southeast and east of the site, respectively.

First Group director Wei Shenyi

The parcel measures about 16,312 square feet with a plot ratio of 9.5, allowing for the development of a total gross floor area of up to 155,000 square feet. At the transaction price, First Group is paying the equivalent of roughly HK$6,300 per square foot of floor area for its Tsuen Wan prize.

First Group director Wei Shenyi revealed that the company has paid the land premium to convert the industrial site for commercial use and plans to redevelop the property into a grade A office building, according to an account on local news site Mingpao.

The seller, Star Properties Group, announced the deal to the Hong Kong Stock Exchange on December 31. Star Properties, which originally acquired the property in January 2014 for HK$173 million, expects to book a gain of roughly HK$380 million from the transaction, according to the statement.

The deal marks First Group’s third acquisition of a commercial project in Tsuen Wan over the past two years. In 2018, the company acquired two sites at 18 Tai Chung Road and 73 Chai Wan Kok Street, which it will redevelop into grade A office buildings and new industrial facilities, according to Mingpao.

Betting on Retail with Redevelopment Potential

In a separate retail deal in Kowloon, units C and D on the ground floor of the Wing Shing Building at 23-31 Castle Peak Road changed hands at HK$8 million below their initial asking price of HK$56.8 million, according to a report in Apple Daily.

The pair of shops in a residential building on Castle Peak Road recently changed hands

The price equates to about HK$13,500 per square foot for the units totalling 3,600 square feet. Located in an eight-storey residential building constructed in 1975, the retail space is currently leased to a stuffed toy shop at the rate of HK$128,000 per month, generating a return of around 3.1 percent based on the recent purchase price. The seller had acquired the asset in July 2010 for HK$27.8 million, achieving a HK$21 million increase in value over nine years.

The most recent buyer is understood to be Cheng Chi Fung (鄭智豐), who is associated with Shenzhen-based logistics operator and trade centre developer China South City Holdings. Cheng also co-owns retail units D and E on the ground floor of the adjacent Wah Shing Building at 17 Castle Peak Road, allowing for a possible joint development on both sites.

Cheng owns the neighbouring retail units together with Cheng Chi Fan and Cheng Tai Po, a non-executive director of China South City and elder brother of China South City’s chairman Ricky Cheng Chung Hing. In June of last year, the trio purchased Tak Yue Mansion, the former site of a well-known Chinese restaurant in Yau Ma Tei for HK$202 million. The Chengs have also been active property buyers in the Sham Shui Po and Cheung Sha Wan areas of Kowloon, where they hold at least a dozen assets.

Shenzhen-based China South City announced last month it was partnering with mall builder Wanda Group to develop a 305,000 square metre tourism, sports and retail centre in its home city.

Big Deals Buck Declining Trend

Transactions worth more than HK$500 million are increasingly rare in Hong Kong’s commercial market as the city witnesses its highest office vacancy rates and lowest levels of office property investment in roughly a decade, according to a recent report by JLL.

The agency found that the city’s longest bull run in history came to an end in the second half of 2019, with net take-up of grade A office space plunging 62 percent during the year to just under 1.1 million square feet, and overall grade A office rents dropping 4.3 percent.

Investment volumes for commercial properties priced over HK$20 million shrank to HK$13.6 billion in the second half of 2019, which JLL notes is the lowest half-yearly result in 11 years, amid economic and social woes as well as a pullback by mainland investors. Capital values for office and high street retail assets are expected to drop 15 to 20 percent in 2020, the agency forecasts.

Leave a Reply