China Resources Land vice chairman Tang Yong

The Hong Kong buying binge by mainland developers continues unabated as China Resources Land (CR Land) beat out the Gaw family to pick up a residential site in the city’s Central district for HK$1.1 billion ($140.9 million), it was reported last week.

The 5,223 square foot (485 square metre) site at No. 1-4 Chancery Lane where two apartment buildings currently stand is zoned for residential space. The Shenzhen-based state-owned property giant, plans to redevelop the site into a property of up to 47,007 square feet (4,367 square metres), with a maximum plot ratio of about nine times. The price the developer paid equates to HK$210,607 ($26,972) per square foot for the site, or HK$23,401 ($2,997) per buildable square foot.

China Resources Land bought up the property after it was put up for sale in an auction which ended on May 25. Pioneer Global Group, the listed firm controlled by Hong Kong’s Gaw family, also bid for the redevelopment project, according to an announcement by the company.

Shenzhen Builder Lands in a Swanky Hong Kong Neighbourhood

The pair of Chancery lane plots are located near Hong Kong’s SOHO district, a cultural and entertainment zone south of Hollywood Road known for its upscale art galleries and eclectic restaurants, and a short walk away from the Lan Kwai Fong nightlife street.

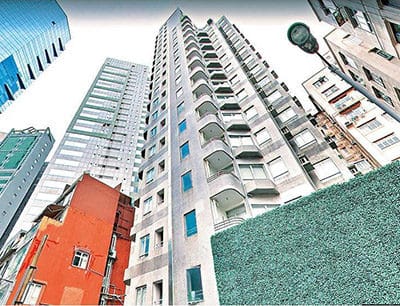

No. 1-2 Chancery Lane is a circa 1970 mid-rise building combining residential and commercial uses, with a virtual car racing club on the ground floor. Standing adjacent at No. 3-4 Chancery Lane is a 34-units serviced apartment block which was built in 1988.

Mainland Developers Bingeing on Land South of the Border

The pair of apartment buildings at No. 1-4 Chancery Lane near Hong Kong’s SOHO area will be redeveloped

The move by China Resources Land, which is the real estate development wing of one of the mainland’s biggest conglomerates, comes after deep-pocketed developers from the mainland spent over HK$43 billion this year buying up all the residential land sites auctioned in Hong Kong since January 1st. The successful tender by CR Land comes after after the state-run firm was outbid by mainland rivals in two other government auctions earlier this year.

In late February, a joint venture of two mainland builders – Shenzhen’s Logan Property Holdings and Guangzhou’s KWG Property Holdings – muscled aside competitors including CR Land to pay HK$16.86 billion ($2.17 billion) or HK$22,118 per square foot for a residential plot at Ap Lei Chau, the island off the south of Hong Kong Island.

Then in March, the Shenzhen-based developers was among 14 also-rans that lost out to Hainan-based conglomerate HNA Group on a residential land parcel in the city’s Kai Tak area. The sale marked the fourth adjoining parcel that HNA scooped up in succession for a total price of HK$27 billion ($3.5 billion), or HK$13,400 per square foot.

Hong Kong-listed CR Land, which was China’s 10th biggest developer by sales last year, made its first major foray overseas in May by buying a trophy office building in the City of London in concert with a European REIT for £300 million ($384.6 million).

Leave a Reply