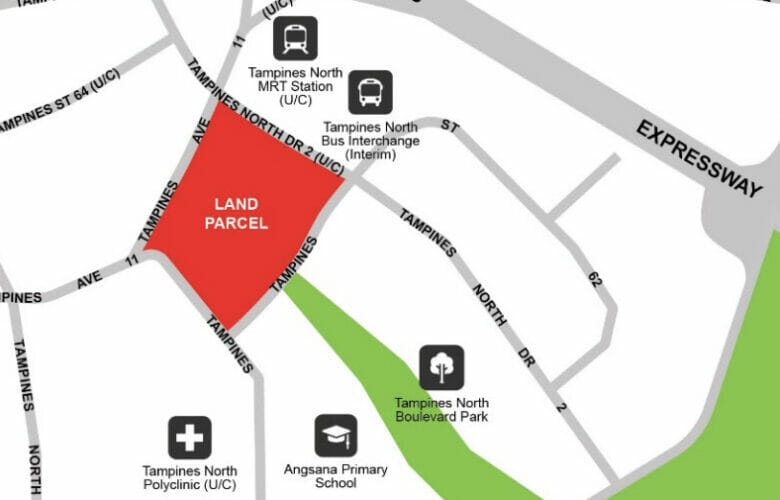

The Tampines Avenue 11 site can yield an estimated 1,190 housing units (Image: HDB)

CapitaLand has teamed up with UOL and its Singapore Land unit to win a mixed-use plot in northeastern Singapore’s Tampines area with a winning bid of S$1.2 billion ($900 million), the Housing and Development Board announced Tuesday.

The 50:50 JV is held equally by Temasek-controlled CapitaLand Development and the UOL consortium, which in turn is held on a 60:40 basis by the Wee family’s UOL Group and Singapore Land, according to a filing with the Singapore Exchange.

The partnership has secured the right to develop a commercial-residential project with a maximum gross floor area of 126,700 square metres (1,363,787 square feet) on the 50,680 square metre land parcel at Tampines Avenue 11. The development, to be integrated with a bus interchange, community club and hawker centre, is estimated to yield 1,190 housing units.

“The development project is in the ordinary course of the company’s business and would enable the company to replenish its land bank for residential developments in Singapore,” SingLand said, adding that the deal enables it to mitigate risks and take on more projects to diversify its portfolio.

Bid Meets Views

Tampines Avenue 11 is situated near Pasir Ris MRT station on the East West Line and the future Tampines North MRT station on the under-development Cross Island Line. Retail landmarks in the area include Our Tampines Hub, Tampines Mall, Century Square and Tampines 1.

Wee Cho Yaw, chairman of UOL Group and chairman emeritus of SingLand

At the time the tender was launched last December, analysts had expected the site to attract two or three bids and fetch anywhere from S$1.2 billion to S$1.3 billion. Bidding at the lower end of that range, the winning JV picked up the plot for roughly S$885 ($661) per square foot or S$9,522 per square metre.

The runner-up bid of S$1.06 billion was placed by Robert Kuok’s Allgreen Properties, while a JV of two Sim Lian Group subsidiaries made the only other offer at S$909.1 million.

The land is on a 99-year leasehold and is expected to take 84 months to develop into a 64 metre (210 foot) high building with a minimum GFA of 76,020 square metres for residential and a maximum 13,600 square metres for commercial space. The minimum GFA is 5,750 square metres for the bus interchange, 3,500 square metres for the Hawker Center and 2,000 square metres for the community club.

Kingsford Takes Marina South Plot

Also Tuesday, a consortium led by Chinese builder Kingsford was awarded the Urban Redevelopment Authority’s mixed-use site in the southernmost portion of the Marina Bay financial district after entering a winning bid of S$1.03 billion ($770 million), besting three other tenderers.

The 12,245 square metre site at Marina Gardens Lane can yield a maximum GFA of 68,573 square metres next to the upcoming Marina South MRT station, with the Kingsford team set to pay S$15,086 per square metre for the right to build a 790-unit residential tower with commercial space on the first floor.

To boost private home supply and tame a red-hot housing market, Singapore last month unveiled plans to put up for sale eight residential sites in the second half of 2023. The URA is set to auction off projects that can be developed into up to 5,160 new private homes, including 560 subsidised condos.

Leave a Reply