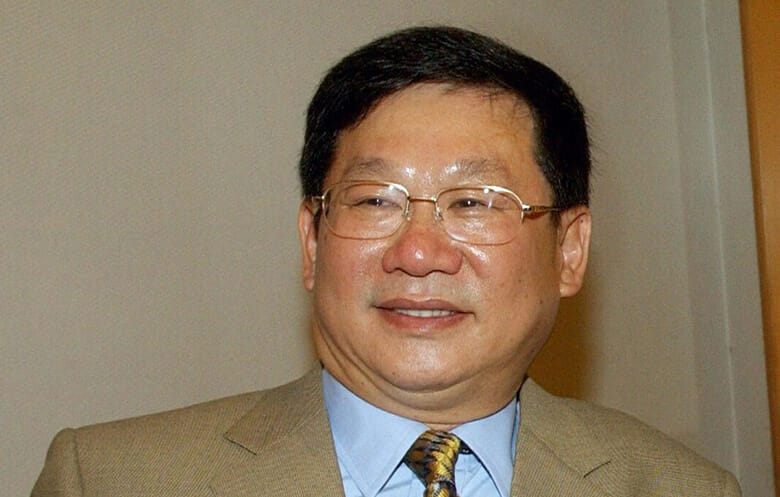

Zhang Li is said to be back in China after his legal adventures (Getty Images)

Guangzhou R&F Properties co-chairman Zhang Li has avoided jail time and will not see criminal charges after admitting to bribing a local official in order to secure approvals for a San Francisco mixed-use project.

Under the deal reached with US prosecutors, Zhang’s local Z&L Properties entity will pay a $1 million fine and Zhang himself will fork over $50,000, according to an account by the San Francisco Standard. The case will be dismissed entirely within three years if all conditions of the agreement are met, Bloomberg reported Thursday. Zhang could have faced 20 years in prison if convicted.

Zhang was arrested in London in January after an investigation of former San Francisco Department of Works director Mohammed Nuru, who was said to have enjoyed luxury trips to China and other benefits at Zhang’s expense in return for pushing forward 555 Fulton Street in San Francisco’s Fillmore district. Zhang was extradited to the US six months later.

“We are pleased that Mr Zhang has returned to China and the charges against him will be dismissed pursuant to an agreement with the US government,” Bloomberg quoted his lawyer, Hartley MK West, as saying.

Unloading Assets

During Zhang’s incarceration in London, the tycoon took the opportunity to sell some California properties, including a ranch in Silicon Valley’s Santa Clara and 555 Fulton Street.

555 Fulton Street in San Francisco

Public records in Santa Clara revealed that Z&L Properties reached a preliminary deal to sell the Richmond Ranch, a 3,654 acre (1,479 hectare) property southeast of San Jose, for an undisclosed sum. According to local news reports, the company also agreed to sell 555 Fulton Street, a five-storey mixed-use building with a planned 139 homes and 29,000 square feet (2,694 square metres) of ground-floor retail.

After buying up a series of California properties for development projects from 2014 through 2017, Z&L has partially completed just one development, a 640-unit condo project near San Pedro Square in San Jose.

In 2019, the company saw another San Jose project taken away by city authorities, after acquiring the site in 2017 and failing to make progress. Z&L is also said to currently have up for sale a project at 70 South Almaden Avenue in San Jose that has never broken ground.

Trouble Back Home

In announcing its audited financial results for 2022 in March, Guangzhou R&F said it had suffered a loss attributable to owners of the company of RMB 15.7 billion ($2.3 billion) last year, after losing RMB 16.5 billion a year earlier.

In April, Fitch Ratings affirmed R&F’s corporate rating at RD for restricted default and withdrew its senior unsecured rating for the company.

With the company facing RMB 5 billion in capital market debt maturities by the end of 2024, Fitch called R&F’s capital structure unsustainable in light of its weak sales and the limited liquidity offered by its land bank.

Yicai Global reported last week that R&F said it had not received any court documents related to two creditors allegedly seeking the developer’s bankruptcy restructuring.

Leave a Reply