555 Fulton in San Francisco has been linked to the charges against Zhang Li

Still under arrest in London while fighting extradition to the US on corruption charges, Guangzhou R&F Properties co-chairman Zhang Li is selling off some of his California properties, including a ranch in Santa Clara and a commercial building in San Francisco.

Public records in Santa Clara show that Z&L Properties, a US entity controlled by Zhang, has reached a preliminary deal to sell the Richmond Ranch, a 3,654 acre (1,479 hectare) property southeast of San Jose for an undisclosed sum.

According to local news reports, the company has also agreed to sell 555 Fulton Street in San Francisco, a commercial project which is reported to be at the centre of charges that Zhang bribed local officials in order to secure approvals for the property which Z&L had acquired in August 2015.

Zhang who co-founded Guangzhou R&F with Hong Kong businessman Li Sze-Lim and built it into one of China’s largest developers, before defaulting $4.2 billion in debt, is currently free on $18 million in bail, after being arrested in the UK in December on bribery charges said to be linked to the San Francisco project.

Projects Stall

With the denizens of San Francisco hungry to see Z&L’s property in the city’s Hayes Valley area move forward after nearly a decade of delays, the developer reassured the public that a grocery story would soon be anchoring a new property on the site.

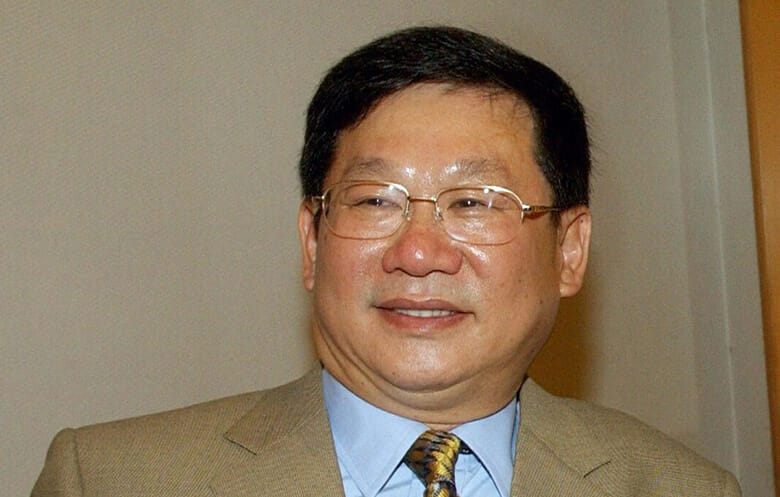

Zhang Li is selling off his California dreams (Getty Images)

“Z&L Properties is now in contract to sell the 555 Fulton Street property to a buyer who, once the deal is finalized, will assume the obligations of the lease and has assured us that they are eager to take the necessary steps to bring in Trader Joe’s as soon as possible,” Z&L was reported as saying in a press release cited by local news site Sfist.com earlier this month. The company estimated that due diligence on the sale would require around one more month, according to the media account.

Zhang’s arrest in January of this year has been linked in media reporting to an investigation of former San Francisco Department of Works director Mohammed Nuru, who is said to have enjoyed luxury trips to China and other benefits at Zhang’s expense in return for pushing forward the Fulton Street project.

With Z&L having reached an agreement to sell Richmond Ranch to San Jose real estate firm Terrascape Ventures, the mainland investor is liquidating more of its ill-fated California portfolio. Z&L Properties paid $25 million for the ranch in 2017.

After buying up a series of California properties for development projects from 2014 through 2017, Z&L has partially completed just one development, a 640-unit condo project near San Pedro Square in San Jose.

In 2019, the company saw another San Jose project taken away by city authorities, after acquiring the site in 2017 and failing to make progress. Z&L is also said to currently have up for sale a project at 70 South Almaden Avenue in San Jose which has never broken ground.

Trouble at Home

While Zhang Li struggles to avoid a trial in the US and moves to sell his California assets, Guangzhou R&F has been facing its own troubles back in China.

In announcing its audited financial results for 2022 at the end of last month, R&F said it had suffered a loss attributable to owners of the company of RMB 15.7 billion ($2.3 billion) last year, after losing RMB 16.5 billion a year earlier.

In a statement this week, Fitch Ratings affirmed Guangzhou R&F’s corporate rating at ‘RD’ for restricted default and withdrew its senior unsecured rating for the company.

The credit agency noted that, “Based on the auditor’s report in the company’s 2022 financial statements, RMB 29 billion of Guangzhou R&F’s bank and other borrowings were deemed to be in default or cross-default as of end-March 2023.”

With the company facing RMB 5 billion in capital market debt maturities by the end of 2024, Fitch also pointed called R&F’s capital structure unsustainable in light of its weak sales and the limited liquidity offered by its land bank.

Leave a Reply