Liping Zhang is to become Blackstone’s Greater China Chairman

Blackstone today named Liping Zhang as its new Chairman for Greater China, filling a role which had been vacant for more than a year, as China continues to lead the world in merger and acquisition activity.

Zhang, who previously served as co-CEO for Greater China at Credit Suisse, will also be a senior managing director for Blackstone, which has long been active in the region’s real estate sector.

The 30 year veteran of Asia’s financial industry will be based in Hong Kong, and oversee the company’s operations in Hong Kong, Taiwan and on the mainland.

Mainlander to Lead Greater China for US Private Equity Firm

Zhang takes over from Hong Kong-native and former SAR official Antony Leung, who announced in 2013 that he was leaving Blackstone to head up privately held Hong Kong real estate developer Nan Fung.

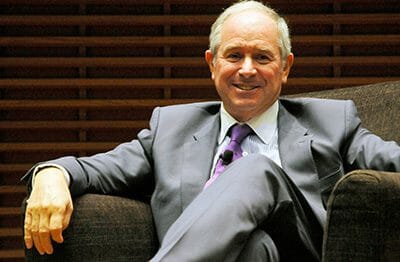

Blackstone chief Stephen Schwarzman has made ties with China a priority for the private equity firm

“Liping Zhang is one of the preeminent figures in finance in China, and his appointment underscores the strategic importance of Greater China to Blackstone,” said Stephen A. Schwarzman, Chairman, CEO and Co-Founder of Blackstone. “With his public and private sector experience across the region, Liping possesses a unique perspective and deep knowledge of the market that will serve us well as we seek to build further upon our leading presence and relationships in the region.”

In addition to his duties as co-CEO, Zhang had also served as vice-chairman of global investment banking at Credit Suisse, and had been with the firm since 2004. The graduate of Beijing University’s School of International Business & Economics, also received a Master’s degree in International Affairs and International Law from St. John’s University in the US, and attended NYU’s Stern School of Business.

With Zhang’s departure from Credit Suisse, Neil Harvey, who had formerly shared the co-CEO, will now become the bank’s sole chief executive for Greater China, according to a report in Reuters.

Global Private Equity Continues to Focus on China

Despite an overall slowdown that sees China’s economy headed for an expected 7.0 percent GDP growth this year, down from double-digit rates just a few years ago, Blackstone and other private equity players remain active on the mainland.

Commenting on his new role at the firm, Zhang said, “Blackstone has established a leading platform in China and has a comprehensive understanding of the region, which my own experience in the market will complement. I look forward to partnering with management and the investment professionals to help further grow the business.”

The New York-based investment manager is said to have purchased a Shanghai commercial complex in May for RMB5.3 billion ($854 million), although Blackstone has yet to comment on the deal publicly. The private equity firm has also invested in shopping malls and logistics facilities in China.

Leave a Reply