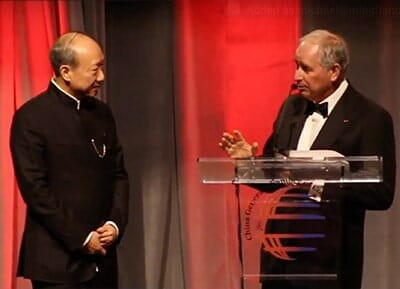

Blackstone’s Stephen Schwarzman on stage in New York with HNA’s Chen Feng last week

Chinese conglomerate HNA has faced a barrage of bad news lately, as four of its mainland-listed companies halted trading and the once super-buyer has now turned high-interest borrower.

There was at least a ray of sunshine for the airlines to apartments conglomerate last week, however, as Blackstone boss Stephen Schwarzman presented HNA chairman Chen Feng with an award in New York, and it wasn’t for being the person most likely to sell him a trophy asset at a steep discount.

HNA as Brand of the Year

According to a statement from HNA, which last week offered investment returns of up to 39 percent to any of its employees that would lend the company at least $15,000, the group was given the “Brand of the Year Award” at the China General Chamber of Commerce’s Chinese Lunar New Year party in Manhattan.

The award, which was presented to chairman Chen by Schwarzman, was given “in recognition of the company’s actively expanding industrial footprint and rising global brand equity,” according to the statement.

HNA Hails US Ties as CFIUS Halts Deals

“HNA Group had a year of incredible growth in expanding the brand’s influence around the globe,” HNA Chairman Chen Feng said. “This award not only recognizes our expanding global footprint, but marks our progress in bringing the world closer together through deepened U.S. market ties.”

HNA’s award was announced just one day before Reuters reported that the Committee on Foreign Investment in the US (CFIUS), the US government agency which regulates foreign investments in the United States, had declared a halt on further acquisitions by HNA until the company clarifies the nature of its ownership.

Praising HNA’s Generosity

HNA bought the Reuters headquarters on Canary Wharf in 2015. The news agency is now relocating

At the NYC event Schwarzman had a chance to praise HNA, and not just for paying Blackstone $6.5 billion for a 25 percent stake the Chinese firm bought in Blackstone-controlled Hilton Hotels in 2016.

“I could go on for a long time about HNA’s generosity, from providing wells in Hainan Province, to free cataracts operations in many countries across the world. This is really somewhat unusual, especially in a Chinese context, and they’ve also generously supported the Schwarzman Scholars, providing a library for the programme,” Schwarzman said.

And HNA’s generosity looks set to grow this year, as it struggles to reverse its $40 billion buying spree. Earlier this month the company showed its commitment to giving back to the community in the UK, where it is said to be offering to sell a pair of London office buildings that it bought in 2015 and 2016 for a combined 366 million pounds ($496 million). Principal tenants of both buildings have now said they will leave within the next two years and plan to lease space elsewhere in London.

Buy High, Sell Low, But Win an Award

As the company scrambles to service a mountain of debt it piled up while acquiring a mix of real estate, logistics and transportation assets globally, HNA’s CEO Adam Tan said in November that the company will sell property assets in New York and Sydney. The mainland group is also in talks with Hong Kong developer SHK to borrow against its HK$27.2 billion ($3.5 billion) in projects in Hong Kong’s Kai Tak area.

Whether investors were failing to reciprocate HNA’s generosity, or word had simply not travelled regarding the company’s brand equity, bond holders were dumping HNA’s notes last week after some of the group’s units reportedly missed payments due to Chinese banks since December.

Leave a Reply