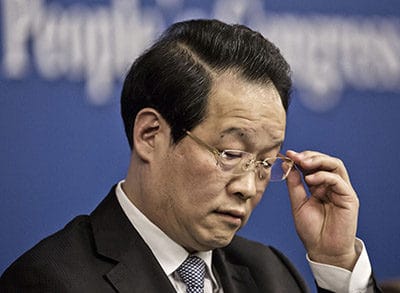

In his latest appearance, Anbang boss may be addressing a less welcoming audience

Following months of rumours about his fate, Anbang Insurance chairman and CEO Wu Xiaohui has been detained by Chinese authorities, according to reports in mainland state-owned media.

The controversial insurance executive was taken away by “relevant departments” on Friday, according to an account published today in influential Chinese business publication Caijing. Wu’s detainment was followed on Saturday by a meeting between leaders of the China Insurance Regulatory Commission (CIRC) and Anbang executives, where the regulatory officials confirmed that Wu was in custody, without providing specific reasons, Caijing said.

The detainment report, in addition to being published on Caijing, has been widely redistributed on official mainland media outlets including Sohu.com and Sina. Close associates of the entrepreneur are said to have been unable to contact Wu since last week. Inquiries by Mingtiandi to Anbang officials went unanswered at the time of publication.

Note: since the time of publication accounts of Wu’s detention have been censored in mainland media.

Anbang Boss Has Another Date with the CIRC

Wu’s detainment could be related to the corruption charges against CIRC chairman Xiang Junbo

The reported government move follows multiple accounts of run-ins between Wu and insurance industry regulators after a series of high profile acquisitions by the 50-year-old one-time Zhejiang car insurer, including Anbang’s $1.95 billion purchase of New York’s Waldorf Astoria hotel in 2014.

The CIRC reportedly began looking into Anbang and its controversial boss as early as March 2016 when the company made a $14 billion bid to buy out Starwood Hotels and Resorts. After Anbang unexpectedly pulled that deal off the table, the CIRC was said to be checking into the insurer’s capital structure.

Reports in the New York Times have detailed financial ties between Wu, who married Deng Xiaoping’s grand-daughter Zhuo Ran after divorcing his second wife in 2004, and the extended family of the former Chinese premier leader. Anbang is also said to have received investment from other relatives of former top politicians.

June Detainment Story Follows May Disciplinary Decision

Wouldn’t Wu have been better off just buying some warehouses?

In the past year those connections seem to have been less effective at paving a path for Anbang and Wu.

In May 2016 the CIRC was said to launch a full-scale investigation into Anbang’s practices and at the beginning of last month the industry regulator banned Anbang from applying for sales of new products. In a May statement the CIRC cited the privately held insurer for “disrupting market order” by selling short-term high-yield universal life insurance policies. Such policies, which guaranteed short-term returns to finance purchase of illiquid assets such as the Waldorf, have been criticised as adding risk to China’s financial markets.

That ban from the regulator came just days after Wu granted a rare press interview to deny reports of his detention which circulated in late April, although those reports never made it into the mainland press.

Those earlier detention accounts came at the same time that mainland business portal Caixin published an account highlighting Anbang’s murky financial structure, which Wu countered with a lawsuit against Caixin and its editor Hu Shuli.

Anbang’s Deal-Making Could Be at an End

Although Anbang was able to announce the $392 million acquisition of a hotel from Blackstone in late May, days later the Financial Times was reporting that Wu was no longer allowed to leave the country.

By Friday, the entrepreneur who led one of 2016’s biggest real estate transactions when he engineered the $5.5 billion acquisition of Strategic Hotels and Resorts from Blackstone was likely locked into a new set of negotiations. Only now Wu may be sitting across the table from people who drive an even harder bargain than a Manhattan fund manager.

Leave a Reply